Diligence in your investment processes is imperative to safeguard your financial future and maximize returns. Engaging in thorough due diligence enables you to assess potential risks and rewards associated with an investment opportunity. By conducting detailed research and analysis, you can make informed decisions and avoid costly mistakes. This practice is not merely a step; it’s a mindset that empowers you to navigate the complex landscape of investing with confidence, ultimately leading to smarter choices and enhanced portfolio performance.

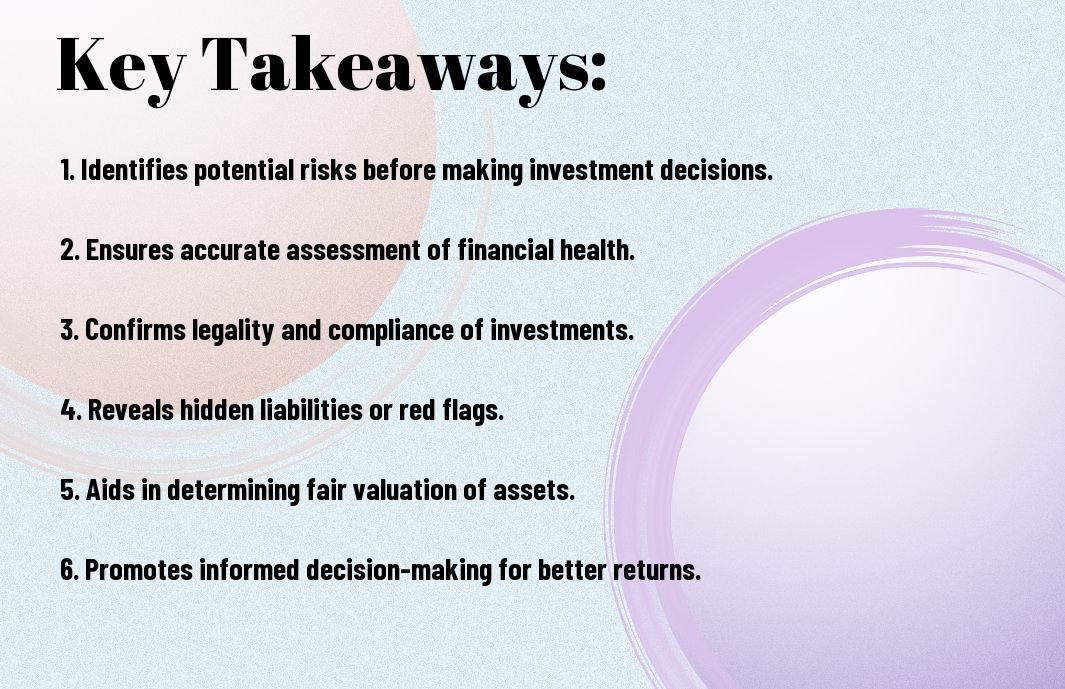

Key Takeaways:

- Risk Mitigation: Conducting due diligence helps identify potential risks associated with an investment, allowing investors to make informed decisions.

- Financial Health: Investigating a company’s financial statements and performance can reveal its stability and profitability, which are vital for investment success.

- Market Analysis: Understanding the market conditions and competitive landscape aids in assessing an investment’s viability and future growth potential.

- Regulatory Compliance: Ensuring an investment meets legal and regulatory requirements protects investors from associated legal risks.

- Informed Decision-Making: A thorough due diligence process equips investors with necessary knowledge, enabling them to navigate complexities and make sound investment choices.

Understanding Due Diligence

Your investment journey begins with understanding due diligence, a comprehensive analysis process that ensures you gather all critical information before making decisions. This involves evaluating potential investments to minimize risks and maximize returns, allowing you to make informed choices based on thorough research and insight.

Definition of Due Diligence

One key aspect of successful investing is understanding the definition of due diligence. It refers to the detailed investigation and evaluation of a business or investment opportunity to confirm all relevant facts and assess risks before proceeding with a transaction.

Types of Due Diligence

Diligence comes in various forms, each serving a different purpose in the investment process. Here are the common types you should be aware of:

| Type | Description |

| Financial Due Diligence | Focuses on the financial history and projections of a target company. |

| Legal Due Diligence | Assesses the legal aspects, including contracts, regulations, and compliance. |

| Operational Due Diligence | Evaluates the operational efficiency and processes of a business. |

| Commercial Due Diligence | Examines market conditions, competition, and customer dynamics. |

| Environmental Due Diligence | Reviews compliance with environmental laws and potential liabilities. |

Plus, these types of due diligence empower you to view investments from multiple dimensions, ensuring you have a well-rounded perspective. Here are some advantages of engaging in comprehensive due diligence:

- Identifies potential red flags in investments.

- Provides insight into market trends and dynamics.

- Enhances negotiation positions through informed facts.

- Improves your understanding of the risks involved.

- Bolsters your confidence in investment decisions.

Any thorough analysis will reveal the intricacies of investment opportunities, helping you make choice decisions grounded in careful examination.

The Role of Due Diligence in Investment Decisions

There’s no question that due diligence is vital in informing your investment decisions. By thoroughly investigating an opportunity, you can better understand its potential and the risks involved. When you take the time to assess all aspects of an investment, you empower yourself to make informed choices, ultimately leading to improved financial outcomes.

Risk Assessment

Around every investment lies a spectrum of risks, which can vary significantly depending on market conditions and the nature of the asset. Effective due diligence allows you to identify, analyze, and quantify these risks, enabling you to weigh potential returns against the uncertainties. By being proactive in your risk assessment, you can develop strategies to mitigate exposure and better safeguard your investment portfolio.

Financial Evaluation

Investment decisions should always be grounded in a thorough financial evaluation of the opportunity at hand. This involves reviewing financial statements, cash flow projections, and other relevant metrics to assess the asset’s current and future performance. You can identify potential red flags and opportunities for growth by performing a comprehensive analysis.

Considering the financial aspects of your investment aids you in understanding its viability and sustainability in the long run. You’ll want to scrutinize profit margins, debt-to-equity ratios, and overall financial health to gauge whether the investment aligns with your goals. A well-rounded financial evaluation allows you to base your decisions not only on potential returns but also on the stability and soundness of the investment, ultimately increasing your chances of success.

Key Components of Due Diligence

Unlike a casual investment decision, thorough due diligence involves a comprehensive analysis of multiple key components. You should examine financial records, management backgrounds, market conditions, and competitor landscapes to gain a complete understanding of the investment. This multifaceted approach allows you to mitigate risks and make informed choices that align with your investment goals.

Legal Considerations

An important aspect of due diligence is understanding the legal framework surrounding an investment. You need to review contracts, compliance reports, and any pending litigation to safeguard against potential legal pitfalls. This will help ensure that your investment adheres to relevant laws and regulations, protecting your interests in the long run.

Operational Review

One of the vital components of due diligence is conducting an operational review. This involves assessing the efficiency and effectiveness of a company’s operations. You must look into processes, systems, and workforce capabilities to identify any operational risks or inefficiencies that could affect the business’s overall performance.

Further, examining the operational aspects can give you insight into whether the company can sustain its growth and weather challenges. You should analyze metrics like production efficiency, supply chain viability, and quality control measures. By understanding these elements, you can better evaluate the organization’s potential for success and ensure that your investment will yield the returns you expect.

Benefits of Conducting Thorough Due Diligence

Keep in mind that conducting thorough due diligence provides you with a clearer understanding of potential investments. This process allows you to assess the risks and rewards associated with each opportunity, enabling you to make informed decisions that align with your financial goals. Ultimately, this diligence can serve as a safeguard for your investments and can lead to more successful outcomes.

Protecting Investment Capital

Any investor understands the importance of safeguarding their capital. By performing comprehensive due diligence, you can identify potential red flags in an investment, such as operational inefficiencies or legal issues, that could result in losses. This proactive approach allows you to minimize risk, ensuring that your hard-earned money remains protected.

Enhancing Investment Returns

After conducting thorough due diligence, you are well-positioned to enhance your investment returns. By gaining deeper insights into market trends and the financial health of companies, you can identify opportunities that others might overlook. This informed perspective enables you to make strategic investments that are likely to yield higher returns over time.

Indeed, when you enhance your investment returns through diligent research, you not only maximize profitability but also gain a competitive edge in the market. Your ability to analyze key performance indicators, industry developments, and management credibility allows you to select investments with strong growth potential. By taking the time to understand the nuances of each opportunity, you set yourself up for more favorable outcomes and long-term financial success.

Common Pitfalls in the Due Diligence Process

Now that you understand the importance of due diligence, it’s vital to be aware of common pitfalls that can undermine your investment decisions. Many investors overlook critical aspects, leading to potential losses. Familiarizing yourself with these traps will strengthen your approach. For more insights on Due Diligence, you can dive deeper into best practices and strategies.

Incomplete Research

With thorough due diligence, it’s vital to avoid incomplete research that can skew your understanding of an investment. Many investors may focus on surface-level information while neglecting deeper insights, such as financial statements, market conditions, and competitive analysis. To make informed decisions, ensure you explore all pertinent areas of the investment.

Overconfidence Bias

At times, your confidence in your investment judgment can lead to overconfidence bias, causing you to underestimate risks and overlook vital facts. This mindset can skewer your investment strategy, making you complacent and leading to poor financial decisions.

This tendency often stems from previous successes, making it easy to assume future investments will follow suit. It’s crucial to challenge your assumptions and rigorously evaluate each opportunity. By balancing your confidence with cautious analysis, you can minimize the chances of falling victim to overconfidence and bolster your investment success.

Best Practices for Effective Due Diligence

Despite the apparent complexity of due diligence, adopting best practices can streamline the process. You should start by educating yourself on the fundamentals outlined in resources like the Due Diligence in 10 Easy Steps. These steps will help you systematically assess potential investments and significantly reduce risk.

Developing a Due Diligence Checklist

Below, create a detailed checklist tailored to your investment goals. Include important factors such as financial health, market position, and legal compliance. This tool ensures you evaluate all critical elements before making a commitment, helping you to make informed decisions.

Engaging Professional Advisors

The importance of engaging professional advisors cannot be overstated. These experts can provide invaluable insights and analysis that you may overlook during your due diligence process. Their specialized skills enhance your understanding of complex industries and financial metrics.

Consequently, leveraging the expertise of financial analysts or legal counsel can help you navigate potential pitfalls. These professionals offer a fresh perspective and thorough evaluations, ultimately enriching your decision-making process. By utilizing their skills, you can approach your investment decisions with greater confidence and clarity.

Summing up

Presently, understanding the importance of due diligence in investing empowers you to make informed decisions that can significantly affect your financial future. By thoroughly researching and analyzing potential investments, you safeguard your capital against unnecessary risks and increase your chances of achieving favorable returns. It is crucial for you to approach each investment opportunity with careful scrutiny, as this disciplined strategy not only enhances your decision-making but also instills confidence in your investment portfolio. Ultimately, due diligence serves as a foundation for sustainable investment success.

FAQ

Q: What is due diligence in the context of investing?

A: Due diligence refers to the comprehensive process of researching and evaluating investment opportunities before committing funds. This involves examining financial statements, market conditions, management capabilities, and potential risks associated with the investment. Investors perform due diligence to gain a clear understanding of the potential returns and the stability of the investment, ensuring that they make informed decisions. It can also include verifying factual information and assessing the legal and compliance framework of the investment.

Q: How does due diligence mitigate investment risks?

A: Conducting thorough due diligence helps investors identify and assess potential risks involved with an investment. By investigating various factors such as the company’s financial health, industry trends, or operational efficiency, investors can pinpoint potential pitfalls and challenges. This proactive approach enables investors to make strategic decisions about whether to proceed, modify, or abandon an investment opportunity. By highlighting red flags, due diligence minimizes the chances of losses and enhances the likelihood of favorable investment outcomes.

Q: What are some key components of a due diligence process?

A: The due diligence process typically includes several key components: financial analysis, operational review, legal assessment, and market evaluation. Financial analysis involves scrutinizing income statements, balance sheets, and cash flow statements to ascertain the economic viability of the investment. An operational review examines the efficiency of company processes and resources. Legal assessment focuses on regulatory compliance, contracts, and potential liabilities. Finally, market evaluation looks at industry competition, market trends, and customer demographics. Together, these components provide a comprehensive view of the investment opportunity.