Embarking on a successful trading journey requires a well-crafted strategy, and market trading simulators can be a powerful tool in your arsenal. By immersing yourself in simulated trading environments, you can test various approaches, fine-tune your tactics, and gain valuable experience without real financial risk. These virtual platforms serve as your training ground, allowing you to experiment, learn from mistakes, and ultimately refine your trading strategy to achieve greater success in the real market. Embrace the power of market trading simulators as a critical element in developing your trading strategy.

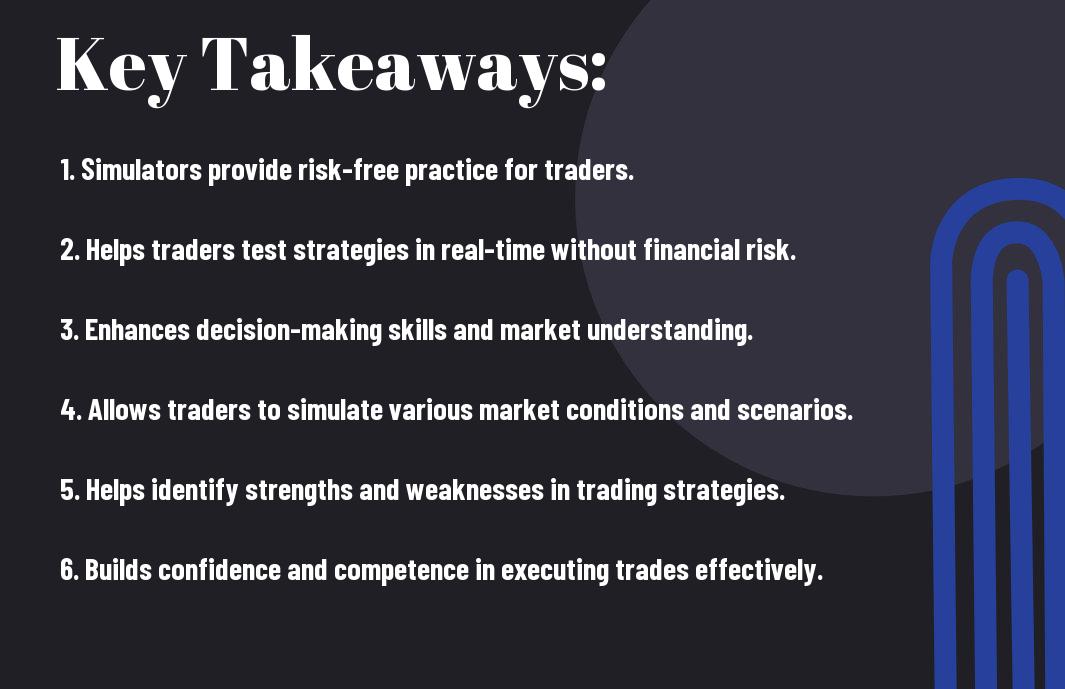

Key Takeaways:

- Realistic Practice: Market trading simulators provide a realistic environment for traders to practice and refine their trading strategies without risking real money.

- Strategy Testing: Traders can use simulators to test new strategies, analyze market trends, and understand the potential outcomes of different trading decisions.

- Skill Improvement: By using trading simulators, traders can improve their trading skills, gain experience, and develop the discipline needed for successful trading in the real market.

The Importance of Strategy Development

Why Traders Need a Solid Strategy

While engaging in market trading, having a well-defined strategy is crucial for your success. A solid strategy acts as a roadmap that guides your decision-making process, helping you navigate through the unpredictable nature of the financial markets. Without a clear plan in place, you may find yourself making impulsive decisions based on emotions rather than logic.

The Consequences of Impulsive Trading

Strategy development is necessary because it helps you avoid the damaging effects of impulsive trading. When you make decisions without a strategic approach, you are more likely to fall prey to emotional biases such as fear and greed. These emotions can cloud your judgment and lead to hasty actions that may result in significant financial losses.

A disciplined approach to trading, based on a well-thought-out strategy, can help you stay focused on your long-term goals and prevent you from making rash decisions during volatile market conditions. By following a predefined set of rules and guidelines, you are better equipped to manage risk and maintain consistency in your trading performance.

The Role of Market Trading Simulators

What are Market Trading Simulators?

With the advancement of technology, market trading simulators have become invaluable tools for aspiring traders looking to develop their strategies. These simulators are software programs that mimic real-market conditions, allowing you to practice trading without the risk of losing real money. They provide a safe environment for you to experiment with different trading techniques, assess market trends, and refine your skills.

How Simulators Mimic Real-Market Conditions

With market trading simulators, you can experience the ups and downs of trading in a virtual setting that closely resembles the real financial markets. These platforms mirror market volatility, price fluctuations, and order execution processes, providing you with a realistic trading experience. By using historical data and real-time market information, simulators offer an authentic trading environment where you can test your strategies and decision-making abilities.

The ability of simulators to replicate real-market conditions is crucial for your development as a trader. It allows you to gain practical experience and build confidence in your trading skills before risking your capital in the actual market. By immersing yourself in simulated trading scenarios, you can learn how to navigate complex market dynamics, manage risks effectively, and make informed trading decisions.

Identifying Trading Goals and Objectives

All traders, whether novice or experienced, begin their journey by setting trading goals and objectives. When using market trading simulators, you have the opportunity to experiment with different strategies and approaches to understand what works best for you. By utilizing these tools, you can explore various trading styles and determine the most suitable methods that align with your financial objectives. If you are unsure about how a stock trading simulator works, you can learn more about it here.

Defining Risk Tolerance and Profit Targets

With market trading simulators, you can assess your risk tolerance and establish profit targets by simulating various trading scenarios. This process allows you to determine the level of risk you are comfortable with and set realistic profit goals based on your trading strategy. By practicing in a simulated environment, you can refine your risk management techniques and fine-tune your profit-taking strategies to achieve consistent results in the real market.

Setting Realistic Expectations

ToleranceSetting realistic expectations is crucial in trading, and market trading simulators can help you do just that. These tools enable you to test different trading approaches and understand the potential outcomes of your decisions without risking actual capital. By using simulators to set realistic expectations, you can avoid unrealistic goals and develop a more pragmatic outlook on your trading performance. It’s necessary to remember that trading is a journey of continuous learning and improvement, and market simulators serve as a valuable resource in guiding you towards making informed decisions.

Developing a Trading Plan

Creating a Framework for Decision-Making

Keep in mind that trading in the financial markets requires a structured approach. Your trading plan should serve as a roadmap that guides you through the decision-making process. By creating a framework for decision-making, you establish a set of rules and guidelines that help you stay disciplined and focused on your trading goals.

Backtesting Strategies with Simulators

Trading with market simulators provides you with a valuable tool for testing and refining your trading strategies. By backtesting your strategies using historical data, you can evaluate their performance and effectiveness in different market conditions. This process allows you to identify strengths and weaknesses in your approach and make necessary adjustments to improve your overall trading performance.

It is necessary to remember that backtesting is not a guarantee of future success in the markets. However, it can help you gain valuable insights into how your strategies might perform and give you the confidence to execute them with discipline and precision when trading with real capital.

Refining Trading Skills

Unlike live trading with real money, market trading simulators allow you to practice and refine your trading skills without the risk of losing your hard-earned capital. This is a valuable tool for traders at any level of experience looking to improve their strategies and techniques.

Practicing Risk Management Techniques

Practicing risk management techniques on a market trading simulator can help you develop the discipline needed to protect your trading account in real-life scenarios. By testing different risk management strategies in a simulated environment, you can see firsthand how they impact your overall profitability and adjust accordingly.

Improving Market Analysis and Forecasting

Any successful trader will tell you that market analysis and forecasting are important skills for making informed trading decisions. Market trading simulators provide a safe space for you to practice analyzing market trends, interpreting indicators, and making accurate predictions about price movements.

For instance, you can use a trading simulator to test different technical analysis tools and study how they perform in various market conditions. This hands-on experience can help you sharpen your analytical skills and build confidence in your trading strategies before risking real money.

Overcoming Psychological Barriers

Now, when it comes to developing your trading strategy, market trading simulators can be invaluable tools. They allow you to practice trading in a risk-free environment, helping you gain experience and confidence without putting your capital at risk. If you want to explore deeper into the world of trading simulators, you can refer to Trading simulators: a comprehensive guide for more information.

Managing Fear and Greed

Barriers like fear and greed often hinder traders from making rational decisions. By using trading simulators, you can confront these emotions head-on in a simulated environment. You can practice controlling your emotions and sticking to your trading plan, which is necessary for long-term success in trading.

Building Confidence and Discipline

For traders, confidence and discipline are key factors for success. Trading simulators help you build these attributes by allowing you to execute your trading strategy repeatedly. The more you practice and see positive results, the more confident you become in your abilities. Consistent practice also helps you develop the discipline to stick to your trading plan even in the face of market volatility.

Managing your psychological barriers is crucial in trading. By using trading simulators to simulate real trading conditions, you can develop the mental fortitude needed to navigate the ups and downs of the market successfully. Bear in mind, honing your emotional intelligence is just as important as mastering the technical aspects of trading.

Conclusion

To wrap up, market trading simulators are a valuable tool in your strategy development as a trader. By utilizing these simulators, you can practice trading strategies in a risk-free environment, learn how different market conditions impact your investments, and gain confidence in your decision-making abilities. Additionally, market trading simulators allow you to experiment with new trading techniques, refine your skills, and ultimately improve your chances of success in the real trading world. So, make sure to incorporate market trading simulators into your trading routine to enhance your strategy development and increase your overall proficiency as a trader.

Q: What is a market trading simulator?

A: A market trading simulator is a tool or software that allows traders to practice trading strategies in a simulated environment that mimics real market conditions without risking real money.

Q: How can market trading simulators help in a trader’s strategy development?

A: Market trading simulators provide a risk-free environment for traders to test and refine their trading strategies, experiment with different approaches, and learn from their mistakes without incurring any financial losses.

Q: Are market trading simulators suitable for both beginner and experienced traders?

A: Yes, market trading simulators are beneficial for traders of all levels. Beginners can use them to gain hands-on experience and build confidence before entering the real market, while experienced traders can test new strategies or fine-tune existing ones without any financial consequences.