Stocks that pay dividends can be a valuable addition to your investment portfolio, offering you a steady income stream alongside potential price appreciation. To effectively choose the best dividend-paying stocks, you need to evaluate key factors such as the company’s dividend yield, payout ratio, and overall financial health. By understanding these elements, you can identify companies that not only distribute regular dividends but are also positioned for long-term growth. This guide will walk you through vital strategies for selecting the most rewarding dividend stocks tailored to your investment goals.

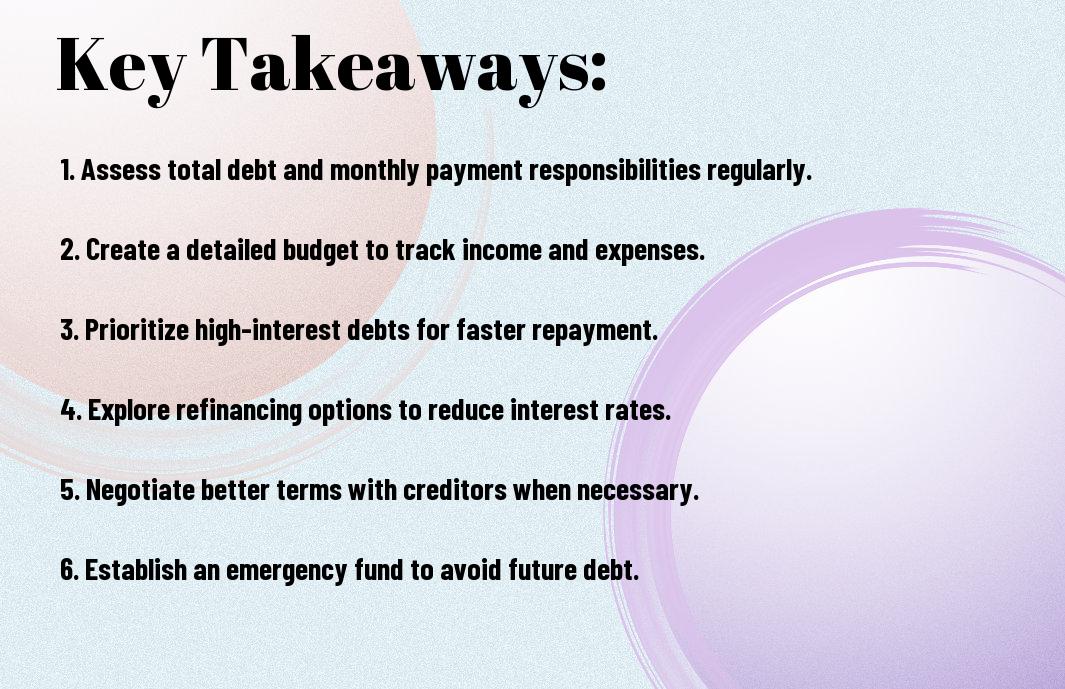

Key Takeaways:

- Dividend Yield: Look for stocks with a high dividend yield, which indicates a good return on investment relative to the stock price.

- Dividend History: Analyze the company’s dividend history to ensure it has a track record of consistent and increasing dividend payouts.

- Financial Health: Assess the financial health of the company by reviewing metrics such as earnings, revenue growth, and debt levels to ensure sustainability of dividends.

Understanding Dividends

The concept of dividends is fundamental when investing in stocks, as they represent a portion of a company’s earnings distributed to shareholders. Understanding how dividends work can help you make informed choices and potentially increase your return on investment. As you explore dividend stocks, it’s crucial to grasp the underlying mechanics and benefits of dividend payments for your financial strategy.

What Are Dividends?

Dividends are cash payments made by a corporation to its shareholders, usually on a regular basis, to share profits generated by the company. These payments can be an attractive source of income, particularly for those looking to supplement their earnings or build wealth over time. When you invest in dividend-paying stocks, you can receive these periodic payments directly to your account, providing both income and potential capital appreciation.

Importance of Dividend Stocks

Between the potential for capital gains and regular income, dividend stocks can offer a unique advantage to your investment portfolio. By focusing on companies that pay dividends, you can create a more reliable income stream, which can be especially appealing during market downturns. Additionally, these stocks often indicate a company’s financial health, as only stable firms typically distribute profits consistently to shareholders.

Consequently, investing in dividend stocks can provide you with financial stability and a buffer during volatile market conditions. The consistent cash flow from dividends allows you to reinvest, build wealth, or provide for your expenses, thus enhancing your overall investment strategy. Furthermore, companies that regularly pay dividends often have more predictable earnings, making them less risky compared to non-dividend-paying stocks. By understanding the importance of dividend stocks, you can make more informed decisions that align with your financial goals.

Key Factors in Selecting Dividend Stocks

It is vital to consider multiple factors when selecting dividend stocks to ensure you make informed investment decisions. Key elements to evaluate include:

- Dividend yield

- Dividend growth rate

- Payout ratio

- Company financial health

- Market position and competitive advantages

This multi-faceted approach will help you identify stocks that align with your investment goals.

Dividend Yield

One important measure of a stock’s attractiveness as a dividend investment is its dividend yield, which indicates how much a company pays in dividends each year relative to its stock price. A higher yield can be appealing, but it’s vital to assess the sustainability of those dividends as well.

Dividend Growth Rate

Below the dividend growth rate reflects how quickly a company’s dividends have increased over time, serving as an indicator of its financial health and future potential. A consistent growth rate often signals a reliable income source for your portfolio.

At the same time, you should consider that a stable or increasing dividend growth rate suggests effective management and strong cash flow. Companies that regularly raise their dividends often have a competitive edge and a positive outlook, making them attractive options for your dividend investment strategy. Analyzing dividend growth alongside other financial metrics will provide you with a comprehensive understanding of a stock’s long-term viability as a source of income.

Evaluating Financial Health

Your approach to evaluating a company’s financial health is important for selecting the best dividend stocks. Focus on key indicators such as revenue growth, profitability, and debt levels. Understanding a company’s balance sheet, cash flow statements, and income statements will help you gauge its ability to sustain and grow dividends over time. Look for companies that exhibit strong financial fundamentals and a stable track record of dividend payments.

Analyzing Earnings Reports

Among the most important documents to assess are earnings reports, which provide insights into a company’s profitability and operational efficiency. Pay attention to revenue trends and net income, as these figures can indicate the firm’s capacity to generate consistent returns. A thorough review of these reports can help you identify whether a company is on solid footing to maintain and potentially increase its dividend payouts.

Understanding Payout Ratios

Reports on payout ratios provide vital information about the portion of earnings a company distributes as dividends. A lower payout ratio suggests the company retains earnings for growth and stability, while a higher ratio could indicate potential risks if earnings decline.

Analyzing payout ratios can give you insight into a company’s dividend sustainability. A ratio between 30% to 60% is often considered healthy, allowing firms to balance between rewarding shareholders and reinvesting in growth. However, it’s important to contextually compare this ratio with industry peers, as different sectors may have varying standards for what constitutes a suitable payout level.

Industry Considerations

For investors seeking to maximize returns through dividends, it’s vital to examine the industry in which a company operates. Different sectors exhibit varying levels of volatility and growth potential, impacting their ability to provide consistent dividends. Some industries, such as utilities and consumer staples, typically offer stable dividend payouts, while others, like technology, may reinvest profits instead. Understanding these dynamics helps you align your investments with your financial goals.

Sector Stability

About sector stability, it’s vital to assess how consistently a sector performs over economic cycles. Stable sectors tend to weather market downturns better, leading to reliable dividend payments. Look for industries with a history of solid financial performance and resilience during economic fluctuations, as this can significantly enhance your dividend strategy.

Economic Conditions

Stability in economic conditions plays a significant role in the performance of dividend-paying stocks. A robust economy generally fosters company growth and profitability, which can lead to increased dividend payouts. Conversely, in a downturn, companies may cut or suspend dividends, impacting your investment returns. Therefore, staying informed about current and projected economic trends is vital for making savvy dividend stock selections.

Economic indicators such as GDP growth, unemployment rates, and consumer spending provide valuable insights into the overall health of the economy. By analyzing these factors, you can gauge whether a company is likely to maintain or increase its dividends based on its market environment. Additionally, consider the impact of inflation on purchasing power and corporate profits, as this can also influence dividend sustainability. A thorough understanding of economic conditions allows you to make informed decisions and select stocks that will likely deliver consistent dividend income.

Risks Associated with Dividend Stocks

Now that you understand the appeal of dividend stocks, it’s crucial to recognize the risks involved. Dividend investing isn’t without its challenges; market fluctuations and company-specific issues can impact your returns. Ensuring you’re aware of these potential pitfalls will help you make more informed decisions and safeguard your investments.

Market Volatility

Above all, market volatility can significantly affect the performance of dividend stocks. Economic downturns often lead to stock price declines and, in some cases, a reduction or elimination of dividend payouts. Staying informed about market conditions will allow you to adapt your investment strategy accordingly.

Company-Specific Risks

Market factors aside, individual company risks can also pose a threat to your dividend investments. Factors such as management changes, industry competition, or financial missteps can directly impact a company’s ability to sustain its dividend payouts. This is why thorough research into a company’s fundamentals is vital before you invest.

In fact, you should regularly review the company’s financial health, dividend history, and overall market position. Evaluating these areas will help you discern the sustainability of their dividends and alert you to any potential red flags. By staying proactive in your assessment, you can minimize the risks associated with company-specific challenges and make more confident investment choices.

Strategies for Building a Dividend Portfolio

After considering various factors, you can implement effective strategies for building your dividend portfolio. Focus on selecting reliable companies with a history of consistent and growing dividend payments. To further refine your approach, check out this guide on How to Pick the Best Dividend Stocks. By combining sound research with market knowledge, you can craft a robust portfolio that meets your financial goals.

Diversification

Strategies for diversification are important to mitigate risk in your dividend portfolio. Spreading investments across various sectors and industries can help safeguard against market volatility, ensuring that a downturn in one area doesn’t significantly impact your overall returns. Consider balancing your holdings among large-cap, mid-cap, and small-cap companies to achieve a well-rounded portfolio.

Reinvestment Strategies

Portfolio reinvestment strategies can enhance the power of compound interest. By opting into dividend reinvestment plans (DRIPs), you can automatically reinvest your dividends to purchase additional shares, accelerating growth over time. This approach allows your investment to benefit from both dividend payments and capital appreciation, leading to increased wealth accumulation.

But, it’s important to evaluate the underlying companies’ fundamentals before reinvesting dividends. This ensures you’re investing in businesses with strong growth potential and sustainability. While reinvesting can turbocharge your returns, selective investment in high-quality dividend stocks is key to reaping long-term benefits. Stay informed about market conditions and adjust your reinvestment strategy accordingly to maximize your investment’s potential.

Summing up

So, when choosing the best stocks for dividends, focus on companies with a strong history of consistent dividend payments, a healthy payout ratio, and robust financial performance. Diversify your portfolio to mitigate risk, and consider the industry trends that might affect dividend sustainability. By taking these factors into account and conducting thorough research, you can make well-informed decisions that align with your investment goals and enhance your income through dividends.

Q: What key factors should I consider when selecting dividend stocks?

A: When choosing dividend stocks, it is important to evaluate several factors. Firstly, examine the company’s dividend yield, which is the annual dividend payment divided by the stock price. A higher yield can be attractive, but it’s necessary to ensure that the yield is sustainable. Secondly, look at the company’s payout ratio, which indicates the portion of earnings paid out as dividends. A lower payout ratio suggests that the company retains enough earnings for growth. Additionally, consider the company’s historical dividend growth rate; consistent increases over time can signal a reliable dividend policy. Finally, assess the company’s overall financial health through metrics such as earnings stability and debt levels to ensure they can maintain dividend payments during economic downturns.

Q: How important is the history of dividend payments when evaluating stocks?

A: The history of dividend payments is a significant indicator when evaluating stocks for dividends. Companies that have a long track record of paying dividends are typically more reliable in maintaining and increasing payouts. This historical performance can reflect management’s commitment to returning value to shareholders, as well as the company’s financial stability. Look for companies categorized as “Dividend Aristocrats,” which have consistently increased their dividends over 25 years. An established dividend history can provide a level of assurance for investors seeking income through dividends, as it suggests a strong business model and operational resilience.

Q: What role do economic conditions play in choosing dividend-paying stocks?

A: Economic conditions can heavily influence the performance of dividend-paying stocks. During economic booms, companies may experience increased sales and profitability, allowing them to maintain or enhance dividend payments. However, during downturns or recessions, some firms may be forced to cut or eliminate dividends to conserve cash. It’s important to consider the sector in which a company operates; industries like utilities or consumer staples often show resilience during slower economic periods and tend to have steady dividend payment histories. Keeping an eye on macroeconomic indicators such as interest rates, inflation, and economic growth is vital, as these factors can affect both stock prices and dividend sustainability.