Cash flow is the lifeblood of your business, determining its sustainability and growth potential. Understanding the intricacies of cash flow management allows you to make informed financial decisions that can enhance profitability and minimize risks. By monitoring your cash inflows and outflows, you empower yourself to navigate challenges, invest in opportunities, and ensure that your operations run smoothly. Effectively managing cash flow not only contributes to your business’s stability but also positions you for long-term success in a competitive marketplace.

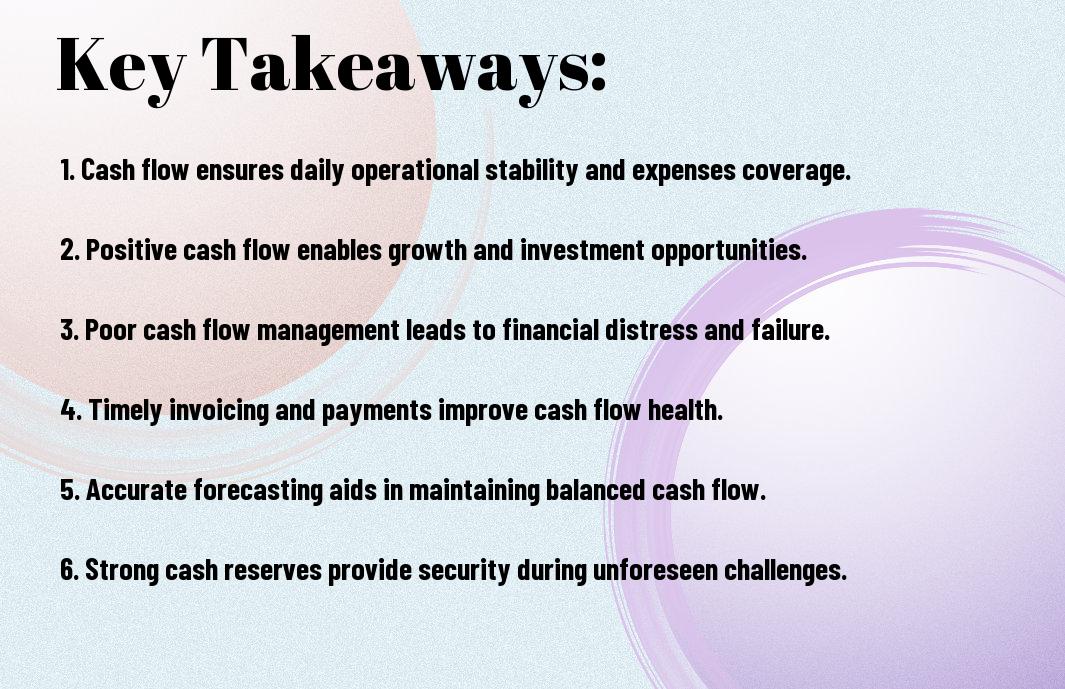

Key Takeaways:

- Cash Flow Management: Effective cash flow management ensures that a business can meet its obligations, pay employees, and reinvest in operations.

- Operational Sustainability: Positive cash flow contributes to the operational sustainability of a business, enabling it to navigate challenges and market fluctuations.

- Growth Opportunities: A healthy cash flow position allows businesses to seize growth opportunities, such as expanding product lines or entering new markets.

- Financial Planning: Accurate cash flow forecasting aids in financial planning, allowing businesses to anticipate expenses and align resources accordingly.

- Investor Confidence: Demonstrating strong cash flow can boost investor confidence, making it easier to secure funding and support for future initiatives.

Understanding Cash Flow

While many entrepreneurs focus on sales and profit margins, a solid understanding of cash flow is important for maintaining your business’s sustainability. Cash flow is the lifeblood of any organization; it represents the money moving in and out of your business. By grasping the intricacies of cash flow, you can assure that your company remains solvent and can seize new opportunities for growth.

Definition and Components

One key aspect to grasp about cash flow is its definition and the components that comprise it. Cash flow refers to the total amount of money entering and exiting your business over a specific period. The primary components are cash inflows from sales, loans, investments, and cash outflows for operating expenses, payroll, and debt repayments. Understanding these elements can help you manage your finances effectively.

Cash Flow vs. Profit

Around the world of business finance, cash flow and profit are often mistaken for one another, but they represent different concepts. Profit is the revenue remaining after all expenses have been deducted, while cash flow focuses on the actual cash available at any given moment. This distinction is vital for making informed decisions about your company’s strategies and day-to-day operations.

Another important consideration is that a business can be profitable while still experiencing negative cash flow. For instance, if you sell products on credit, your profit might be intact, but you may struggle to pay your immediate expenses if customers delay payments. This emphasizes the importance of managing cash flow, as it ensures you have the necessary liquidity to operate smoothly and pursue growth opportunities without compromising your financial stability.

The Role of Cash Flow in Business Operations

Any business relies on effective cash flow management to maintain both functionality and growth. Smooth cash flow allows you to pay your employees, settle supplier bills, and invest in new opportunities. Without a solid understanding of your cash flow situation, you could struggle with daily operations, threatening the overall success of your business.

Daily Operations and Expenses

Role of cash flow management extends into your daily operations, where timely payments and predictable income are necessary to meet expenses. Your ability to monitor and forecast cash flow helps you ensure that you can cover costs such as rent, utilities, and employee wages without interruption.

Cash Flow Management Techniques

Expenses can escalate quickly if not tracked properly, making it imperative to have effective cash flow management techniques in place. By implementing budgeting practices, creating cash flow forecasts, and utilizing accounting software, you can ensure a healthy financial environment for your business.

But having the right techniques in place requires diligence. Regularly reviewing your cash flow statement, setting aside emergency funds, and scheduling consistent financial check-ins will allow you to anticipate potential cash shortages. Staying proactive in your cash flow management will help you avoid disruptions and better position your business for long-term success.

Cash Flow Forecasting

Despite its importance, many business owners overlook cash flow forecasting, which can significantly impact your company’s financial health. By predicting future cash inflows and outflows, you can identify possible shortfalls and plan accordingly, ensuring your business remains on solid footing. A well-prepared forecast allows you to make informed decisions, allocate resources effectively, and avoid unwanted surprises.

Importance of Forecasting

Besides being a key component of your financial strategy, forecasting helps you understand your business’s cash requirements over time. By anticipating changes in cash flow, you gain the ability to adapt to fluctuations and maintain operational stability. This foresight ultimately supports your overall business growth and sustainability.

Tools and Methods for Forecasting

Importance lies in choosing the right tools and methods to create an effective cash flow forecast. Various techniques, such as using spreadsheets, accounting software, or specialized forecasting tools, can provide clarity and streamline the process. The right approach will depend on your business model and specific needs, enabling you to make data-driven decisions.

Understanding the various tools and methods available for cash flow forecasting is imperative in creating a reliable financial strategy. Software like QuickBooks or Microsoft Excel can help you build tailored forecasts that align with your business goals. Additionally, you may consider implementing rolling forecasts, which allow you to update your projections regularly based on actual performance. By selecting the most suitable tools and methods, you can enhance your forecasting accuracy and maintain better control over your cash flow.

Common Cash Flow Challenges

Now, understanding the common cash flow challenges can help you better prepare and manage your business finances. Issues such as seasonal fluctuations and client payment delays can create significant strain on your cash flow. To learn more about how these factors can impact your business, check out The Crucial Role Cash Flow Plays In Business Success.

Seasonal Fluctuations

Against a backdrop of changing consumer demand, seasonal fluctuations can lead to unpredictable cash flow issues. Businesses that rely heavily on specific seasons for revenue must manage expenses tightly during off-peak times to maintain a balanced cash flow throughout the year.

Client Payment Delays

Across various industries, client payment delays can significantly hinder your cash flow. When clients take longer to pay invoices, it can lead to cash shortages, making it challenging to cover operating expenses and invest in growth opportunities.

Payment delays are a common issue that can disrupt your cash flow strategy. To mitigate this, establish clear payment terms with your clients and consider implementing a system for follow-up reminders. Offering discounts for early payments or setting up payment plans can also encourage timely payments, ensuring that your cash flow remains healthy and consistent.

Strategies for Improving Cash Flow

To enhance your cash flow, consider implementing a variety of targeted strategies. Focus on optimizing your accounts receivable, controlling your inventory costs, and negotiating better payment terms with suppliers. Each of these steps can offer significant boosts to your financial health, allowing you to maintain a steady cash flow and ensure that your business thrives.

Optimizing Accounts Receivable

After you streamline your invoicing process, ensure quicker payments by offering incentives for early payments or implementing strict payment deadlines. You can also regularly review your accounts receivable aging reports to identify overdue accounts and take prompt action to collect outstanding payments. This will not only improve your cash flow but also help maintain healthier relationships with your clients.

Controlling Inventory Costs

Beside optimizing accounts receivable, managing your inventory costs effectively can be a game changer for your cash flow. Regularly evaluate your inventory levels and consider adopting a just-in-time inventory approach, eliminating excess stock that ties up cash. Monitor market demand closely to adjust your purchasing and avoid overstocking while ensuring you have enough products available to meet customer needs.

Consequently, actively managing your inventory can lead to reduced holding costs and improved cash flow. By analyzing trends and customer preferences, you can make informed decisions on inventory purchases. This not only conserves cash but also minimizes the risk of obsolete stock, enabling your business to operate more efficiently and stay agile in the marketplace.

The Impact of Cash Flow on Business Growth

Keep in mind that healthy cash flow is integral to scaling your business. Without sufficient cash flow, you may find yourself unable to seize new opportunities or react swiftly to market changes. Consistent positive cash flow supports business operations, allowing you to expand your product offerings, hire new staff, and enter new markets—all vital components for sustainable growth.

Funding Opportunities

At times, having a solid cash flow can open doors to various funding opportunities. Investors and lenders are more inclined to support businesses that demonstrate effective cash management. When you can showcase consistent cash inflows, it builds trust and encourages financial institutions and investors to provide the necessary capital for your growth initiatives.

Investment in Innovation

Flow of cash enables you to invest in innovation, which is vital for staying competitive in today’s fast-paced market. With adequate funding, you can explore new technologies, develop better products, or enhance services, thereby improving your operational efficiency and customer satisfaction.

Opportunities arise when you prioritize cash flow management, allowing your business to allocate resources effectively toward innovative projects. These investments not only help differentiate your brand, but they also drive long-term profitability. By embracing innovation fueled by consistent cash flow, you can pave the way for sustained success and market leadership.

Final Words

Hence, understanding the importance of cash flow in your business success cannot be overstated. Effective cash flow management ensures that you not only meet your immediate financial obligations but also invest in growth opportunities as they arise. By keeping a close eye on your inflows and outflows, you empower your business to remain agile and resilient in the face of challenges. Prioritizing cash flow enables you to make informed decisions, gain confidence in your operations, and ultimately secure the long-term success you aspire to achieve.

FAQ

Q: Why is cash flow important for business operations?

A: Cash flow is imperative for the smooth operation of a business. It represents the money coming in and going out, enabling a company to meet its short-term obligations such as salaries, rent, and inventory purchases. Without proper cash flow management, even profitable businesses can face challenges, as they may not have enough liquid assets to cover immediate expenses, potentially leading to operational disruptions.

Q: How can businesses improve their cash flow management?

A: Businesses can enhance their cash flow management by implementing several strategies. Firstly, monitoring cash flow regularly helps identify patterns and potential cash shortages. Secondly, optimizing inventory levels can free up cash that might otherwise be tied up in unsold goods. Additionally, setting clear payment terms with customers and encouraging prompt payments can help improve inflow. Finally, considering financing options, such as lines of credit, can provide a buffer during slow periods.

Q: What are the consequences of poor cash flow in a business?

A: Poor cash flow can lead to several unfavorable outcomes for a business. It can result in late payments to suppliers, which can damage relationships and lead to lost discounts. Additionally, insufficient cash can hinder a company’s ability to invest in new opportunities or growth initiatives. In severe cases, ongoing cash flow issues may lead to bankruptcy or the dissolution of the business. Maintaining positive cash flow is, therefore, imperative for long-term sustainability and success.