Investing in dividend stocks can offer you a steady income stream while potentially benefiting from capital appreciation. However, it’s necessary to weigh the advantages and disadvantages before diving in. This informative post will guide you through the key pros and cons, helping you to make an informed decision. To further explore this topic, check out The Pros and Cons of a Dividend Focused Investing Strategy. Gain insights into whether this approach aligns with your financial goals.

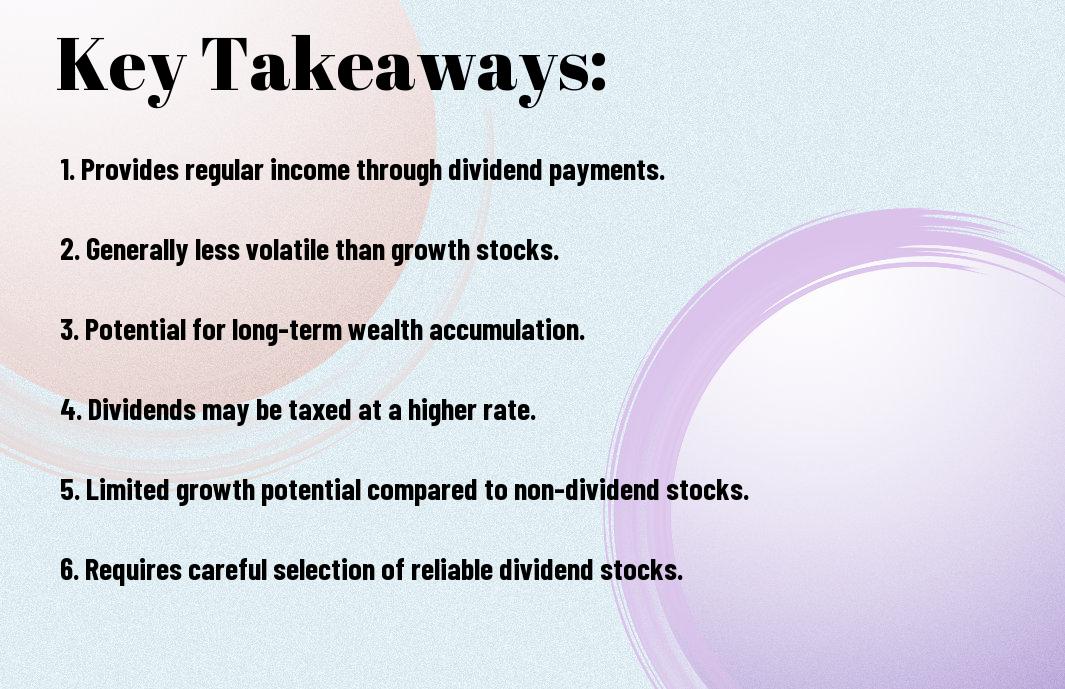

Key Takeaways:

- Stable Income: Dividend investing provides a consistent income stream through regular payments from companies.

- Reinvestment Opportunities: Investors can reinvest dividends to purchase more shares, potentially increasing future earnings.

- Market Volatility Mitigation: Dividend stocks can offer a buffer against market fluctuations, often performing better in downturns.

- Tax Considerations: Depending on the jurisdiction, dividends may be taxed differently than capital gains, influencing net returns.

- Business Risk: Companies can cut or eliminate dividends during financial difficulties, affecting expected income for investors.

Understanding Dividend Investing

The world of dividend investing revolves around acquiring shares in companies that distribute a portion of their earnings to shareholders in the form of dividends. This strategy can provide a steady income stream while also allowing for potential capital appreciation. As you explore dividend investing, you will find that it requires a balanced approach to select companies with strong financial health and a history of dividend payouts.

What is Dividend Investing?

Above all, dividend investing is a strategy that focuses on purchasing stocks of companies that regularly pay dividends. It allows you to capture a portion of the company’s earnings while participating in its growth potential. This approach can be particularly attractive for those seeking both income and long-term wealth accumulation.

Types of Dividend Stocks

To effectively diversify your portfolio, it’s necessary to understand the different types of dividend stocks available:

| Type | Description |

| Blue-Chip Stocks | Established companies with a history of reliable dividends. |

| REITs | Real Estate Investment Trusts that pay significant dividends. |

| Dividend Growth Stocks | Companies with a track record of increasing dividends over time. |

| Utility Stocks | Firms in the utility sector that offer steady dividends. |

| High-Yield Stocks | Stocks that offer a higher-than-average dividend yield. |

After reviewing these categories, you can tailor your investment strategy to meet your financial goals, ensuring diversification and income stability.

At the core of dividend investing, understanding the types of dividend stocks can enhance your investment selection process. The following types are often highlighted:

| Type | Characteristics |

| Dividend Aristocrats | Companies with 25+ years of consecutive dividend increases. |

| Monthly Dividend Stocks | Companies that pay dividends on a monthly basis. |

| Foreign Dividend Stocks | International companies that offer dividends to U.S. investors. |

| Tech Dividend Stocks | Technology companies that have begun offering dividends. |

| Small-Cap Dividend Stocks | Smaller companies that pay dividends and have growth potential. |

After assessing these various types, you can make informed decisions about which dividend stocks align with your financial objectives and risk tolerance.

Advantages of Dividend Investing

If you’re looking for a reliable way to generate returns from your investments, dividend investing offers a range of benefits. By focusing on companies that regularly distribute dividends, you can tap into a passive income stream while also enjoying the potential for long-term growth. This strategy not only enhances your portfolio’s stability but also aligns with a more conservative investing approach, allowing you to reap rewards without relying solely on market fluctuations.

Passive Income Generation

Income from dividends can significantly enhance your financial situation, providing you with regular cash flow. This passive income can help cover living expenses or be reinvested to compound your investment growth. Additionally, knowing that you receive payments consistently could allow you to enjoy greater financial peace of mind, as it adds an extra layer of security to your overall investment strategy.

Potential for Capital Appreciation

Advantages of investing in dividend-paying stocks include not just the income from dividends but also the potential for capital appreciation. Companies that consistently pay dividends often have strong fundamentals and a track record of performance, which can lead to rising stock prices over time. By holding onto these stocks, you don’t just benefit from dividend payments; you also gain value as the share price increases.

Due to the nature of dividend stocks, they tend to attract investors, which can further drive up their stock prices. As market confidence grows in companies that consistently deliver dividends, you stand to gain both income and capital appreciation, creating a well-rounded investment opportunity. This approach can help you build wealth over the long term, particularly if you reinvest your dividends for compounding returns.

Inflation Hedge

After considering the threat that inflation poses to your purchasing power, dividend investing can serve as a hedge against rising costs. Many dividend-paying companies increase their payouts over time, which can help you maintain your standard of living, even when prices rise. This characteristic makes dividend stocks an attractive option for those concerned about inflation eroding their savings.

Even during periods of economic uncertainty, companies that regularly raise dividends often demonstrate financial resilience. By investing in stocks with a history of increasing payouts, you position yourself to benefit from higher income streams, even as inflation pressures mount. This strategy not only helps protect your investments but can also contribute to your long-term financial stability.

Disadvantages of Dividend Investing

Not all investments are free of drawbacks, and dividend investing is no exception. While dividend stocks can provide a regular income stream, there are significant disadvantages, such as tax implications and potential risks that may impact your overall investment strategy. Understanding these cons can better equip you to make informed decisions about your portfolio.

Tax Implications

Below the surface, dividend income is subject to taxation, which can erode your overall returns. Depending on your tax bracket, these earnings may be taxed at a higher rate than long-term capital gains, diminishing the attractive nature of this income stream.

Risk of Dividend Cuts

Between the allure of reliable income and market fluctuations lies the risk of dividend cuts. Companies may reduce or eliminate their dividend payouts during financial downturns or when facing economic challenges, which can significantly impact your investment strategy and expected returns.

Risk remains a factor you cannot overlook in dividend investing. Although many companies pride themselves on their long-standing dividend history, circumstances can change swiftly. A downturn in earnings or a strategic shift could lead to unexpected cuts, leaving your portfolio vulnerable and your plans in disarray.

Limited Growth Potential

Dividend investing often focuses on established companies that pay consistent dividends, but this can limit your overall growth potential. While these stocks may provide income, they may not offer the same capital appreciation opportunities as growth-oriented investments, possibly stunting your portfolio’s expansion.

Growth can be particularly constrained in dividend-focused investments, as companies that prioritize dividend payments often reinvest less of their profits back into growth initiatives. This conservative approach could hinder innovation and expansion efforts, making it imperative for you to balance your portfolio with growth stocks to pursue long-term wealth accumulation.

Strategies for Successful Dividend Investing

After identifying your investment goals, consider implementing strategies that maximize your dividend returns. Consistent evaluation of your portfolio, diversifying across industries, and focusing on dividend growth stocks can enhance your overall returns. Additionally, maintaining a long-term perspective is vital, as dividend investing often requires patience to appreciate the benefits. By staying informed about market conditions and industry trends, you can make well-rounded decisions to optimize your investment strategy.

Dividend Reinvestment Plans (DRIPs)

At the core of effective dividend investing is the use of Dividend Reinvestment Plans (DRIPs). These plans allow you to reinvest your dividends automatically to purchase additional shares of the stock, often without incurring any commissions. This compounding effect can significantly increase your share ownership over time, potentially leading to higher future dividends and enhanced capital growth. By choosing DRIPs, you can harness the power of compounding and steadily build wealth in your dividend portfolio.

Evaluating Dividend Safety

About ensuring the sustainability of your dividend income is the evaluation of dividend safety. It involves analyzing key financial metrics, such as the payout ratio and free cash flow, to gauge whether a company can maintain its dividend payments during challenging economic periods. A low payout ratio often indicates that a company retains sufficient earnings for growth while still rewarding shareholders. This assessment helps you make informed decisions, protecting your portfolio from potential yield loss in case of dividend cuts.

Understanding the factors that contribute to dividend safety is paramount for protecting your investments. Pay attention to the company’s historical performance, balance sheet strength, and industry position. Look for firms with consistent earnings growth and a solid track record of paying dividends, especially during economic downturns. By analyzing these aspects, you will be better equipped to assess whether the dividend is sustainable, helping you minimize risks and maximize your returns over time.

Case Studies in Dividend Investing

Now, let’s explore some enlightening case studies that showcase the potential and pitfalls of dividend investing:

- Procter & Gamble (PG): A consistent dividend payer with a 65+ year history of increases, showcasing stability and reliability.

- Coca-Cola (KO): Maintained a dividend growth streak for over 50 years and provided an average annual return of 9.4% over the last decade.

- General Electric (GE): Once a strong dividend stock, it cut its dividend by 50% in 2018, reflecting how quickly things can change.

- 3M (MMM): A high performer over 60 years, but faced challenges leading to a stagnant dividend in recent years, illuminating the need for vigilance.

Successful Dividend Aristocrats

Against the backdrop of dividend investing, several companies stand out as Dividend Aristocrats, truly exemplifying financial health and consistency. Companies like Johnson & Johnson and 3M have consistently raised their dividends for over 25 years, making them enticing options for those seeking reliable income streams. They demonstrate how solid business models and prudent management can yield long-term success. However, just because a company fits this profile does not guarantee future performance, so you must conduct thorough research.

Lessons from Dividend Failures

Across dividend investing, there are also noteworthy instances of failures that can serve as valuable lessons. The downfall of companies such as GE illustrates how quickly a blue-chip stock can falter, shattering investor expectations. Understanding these failures provides insights into the importance of assessing business fundamentals, not just yield percentages.

Another important aspect of learning from these failures involves recognizing the signs of potential trouble before it impacts your portfolio. Look for warning signals like declining revenues or significant debt levels, as these can lead companies to cut or suspend their dividends. By staying informed and vigilant, you can avoid some of the pitfalls that beset dividend investors in the past, allowing you to make more strategic investment decisions.

To wrap up

Following this exploration of dividend investing, you should weigh both the benefits and drawbacks to determine if it aligns with your financial goals. While dividend stocks can provide a steady income stream and offer potential growth, they also come with risks, such as market fluctuations and potential for reduced payouts. For a deeper understanding, consider checking out Dividend Investing: Pros, Cons and Rules to Follow. Ultimately, informed choices will guide your investment journey effectively.

Q: What are the primary benefits of dividend investing?

A: Dividend investing offers several advantages, including a steady income stream, potential capital appreciation, and the power of compounding. Investors receive regular dividend payments, which can provide a reliable source of cash flow, particularly during market downturns. Additionally, many dividend-paying stocks tend to be from established companies with stable earnings, which can contribute to long-term growth. Reinvesting dividends can further enhance returns over time, creating a compounding effect that can significantly boost the overall investment portfolio.

Q: What are the potential drawbacks of dividend investing?

A: One of the drawbacks of dividend investing is the risk of dividend cuts or omissions, particularly during economic downturns when companies may want to conserve cash. This can lead to reduced income for investors who rely on dividends. Furthermore, dividend stocks may not offer the high growth potential of non-dividend-paying stocks, which could limit overall capital appreciation. Additionally, investors may find themselves overly concentrated in certain sectors, such as utilities and consumer staples, which can lead to a lack of diversification in their portfolios.

Q: How can an investor decide if dividend investing is suitable for their financial goals?

A: To determine if dividend investing aligns with their financial goals, investors should evaluate their income needs, risk tolerance, and investment timeline. If an investor seeks regular income and appreciates lower volatility, dividend investing may be a good fit. Conversely, younger investors or those with higher risk tolerance may prefer growth stocks that reinvest profits rather than paying dividends. It’s also important for investors to consider how dividends fit within their broader investment strategy and ensure they diversify their portfolio to manage risk effectively.