There’s a powerful tool at your fingertips that can enhance your investment strategy: options trading. Utilizing options can provide you with an opportunity to diversify your portfolio beyond traditional stocks and bonds, allowing for greater flexibility and potential risk management. In this post, you’ll discover effective techniques to incorporate options into your investment strategy, enhance profits, and mitigate losses. For more insights on the best strategies, check out this guide on Best way of diversification when trading options?

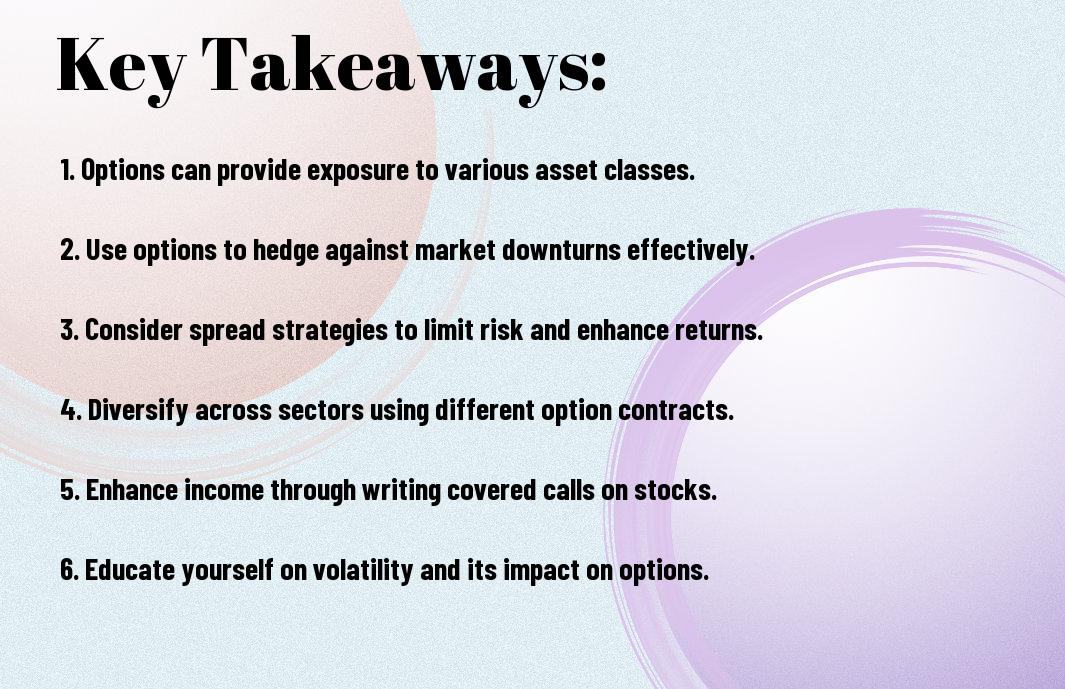

Key Takeaways:

- Understand Risk Management: Options can help manage and limit risk in your investment portfolio by providing a way to hedge against potential losses.

- Diversification Strategies: Incorporating options can enhance diversification by offering exposure to different asset classes and market segments without needing to invest heavily in each one.

- Leverage Potential: Use options to control larger positions with a smaller capital investment, allowing you to leverage your investments while diversifying your holdings.

- Flexibility: Options can be tailored for various strategies, including long-term investments through LEAPS or short-term trades, offering flexibility in how you diversify.

- Income Generation: Selling options can generate additional income through premiums, which can be reinvested into other assets, further diversifying your portfolio.

Understanding Options Trading

Options trading is a strategic way to enhance your investment portfolio, providing unique opportunities and leverage. By grasping the fundamentals of this financial instrument, you can better navigate the complexities of the market and refine your investment strategies to suit your goals.

What Are Options?

At its core, an option is a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified expiration date. This flexibility allows you to take advantage of market movements without having to directly own the underlying asset.

Types of Options: Calls and Puts

On the surface, options primarily fall into two categories: calls and puts. A call option gives you the right to buy an asset, while a put option provides the right to sell. Both types can be utilized for various strategies in your trading endeavors.

- Call options are used when you expect the asset price to increase.

- Put options are used when you anticipate a decline in the asset price.

- You can employ both to hedge against losses or speculate on price movements.

- Options come with expiration dates that influence their value.

- Understanding the difference is important for effective options trading.

| Option Type | Description |

| Call | Right to buy an underlying asset |

| Put | Right to sell an underlying asset |

| Expiration Date | Last date options can be exercised |

| Strike Price | Price at which the option can be exercised |

| Premium | Cost of purchasing the option |

As you explore options trading, you’ll find that each type serves distinct purposes in your overall strategy. Calls are primarily used for bullish positions, while puts allow you to safeguard against declines or take advantage of downward trends.

- Assess your market outlook to choose the appropriate option type.

- Combined strategies can yield diversified outcomes.

- Options can enhance your portfolio’s responsiveness to market conditions.

- Practice risk management to limit potential losses.

- Understanding both types will refine your trading techniques.

| Trading Strategy | Use Cases |

| Buying Calls | Confidence in price increase |

| Selling Puts | Expecting price stability or increase |

| Spreads | Limiting risk while maintaining profit potential |

| Straddles | Profiting from volatility in either direction |

| Protective Puts | Securing current profits amid market uncertainty |

As you probe deeper into options, it’s important to remember that the right strategy can optimize your investment outcomes. Carefully evaluate market trends and potential risks, allowing you to strategically use calls and puts to your advantage.

The Benefits of Using Options for Diversification

Clearly, incorporating options into your portfolio can offer a range of benefits that help mitigate risk and enhance potential returns. Options can serve as a valuable tool for diversifying your investments beyond conventional assets, allowing you to adapt to market fluctuations and seize opportunities across different sectors. By using options strategically, you can better manage your overall portfolio performance and align it with your financial goals.

Reducing Portfolio Risk

Among the various strategies to lower your investment risk, options provide unique opportunities to hedge against market volatility. By utilizing puts and calls appropriately, you can protect your existing assets from sudden downturns. This insurance effect allows you to preserve capital while still participating in market movements, enhancing your overall portfolio stability even in uncertain times.

Enhancing Return Potential

Above all, options not only serve as a risk management tool but also open up avenues for increased returns. They allow you to leverage your investment capital, enabling you to control larger positions without needing to commit substantial funds upfront. This leverage means that even small movements in the underlying asset can lead to significant profit opportunities, allowing you to optimize your returns.

Understanding the potential of options trading can further empower you to enhance your overall investment strategy. By executing strategies such as selling covered calls or employing spreads, you can generate additional income streams. This can significantly boost your return profile while maintaining a balanced approach to risk. With a clear grasp of how to use options effectively, you truly position yourself to take full advantage of market opportunities while optimizing your portfolio diversification.

Strategies for Incorporating Options

Despite the inherent risks involved, employing options trading can significantly enhance your portfolio’s diversification. By utilizing various strategies, you can mitigate potential losses while capitalizing on market movements. Understanding the different options strategies will empower you to tailor your investments according to your risk tolerance and financial goals.

Covered Calls

Along with generating income, covered calls allow you to leverage the stocks you already own. By selling call options against your existing stock holdings, you can collect premiums while still retaining ownership of your shares, providing a buffer against potential downturns.

Protective Puts

With protective puts, you can safeguard your investments against unexpected declines. By purchasing put options for stocks you own, you can protect your downside risk while giving yourself additional peace of mind during turbulent market conditions.

In fact, protective puts act as insurance for your portfolio. The put option will increase in value if the underlying stock declines, allowing you to offset some of your losses. This strategy is particularly effective during economic downturns or increased market volatility, enabling you to hold on to your investments without fear of significant losses.

Spreads and Straddles

Calls when you implement spreads or straddles, you can strategically capitalize on market movements while limiting your risk. Spreads involve buying and selling options of the same class but with different strike prices or expiration dates, while straddles allow you to profit from significant price movements, regardless of direction.

A well-executed spread can minimize your upfront investment and reduce exposure to large market swings, while straddles can be advantageous in anticipation of major events, such as earnings reports, that could lead to substantial price changes. Both strategies can add depth and flexibility to your options trading approach, enhancing your portfolio’s overall resilience.

Evaluating Market Conditions

All successful options trading begins with a solid understanding of market conditions. Before executing any trades, you must analyze the current economic landscape, which includes the overall market trend, volatility, and potential catalysts that could influence asset prices. By staying aware of these factors, you can make more informed decisions that align with your portfolio diversification goals.

Timing Your Trades

Your success in options trading hinges greatly on your timing. Identifying the right moments to enter and exit positions can maximize your returns and reduce potential risks. Keep an eye on market trends, news events, and earnings reports, as these can significantly impact price movements. Equip yourself with a disciplined trading strategy to optimize your timing for better outcomes.

Market Indicators to Consider

Market indicators play a vital role in assessing the right environment for options trading. These metrics offer insights into market momentum, volatility, and trends that can influence your decision-making process.

In addition to basic metrics, pay attention to key indicators such as the VIX (Volatility Index), moving averages, and volume trends. The VIX provides a gauge of market sentiment and anticipated volatility, while moving averages help identify trend directions. High trading volumes can signal strong interest in an asset, indicating potential price movements. Monitoring these indicators will empower you to make educated choices about your options trades and enhance the diversification of your portfolio.

Risks and Considerations in Options Trading

Your foray into options trading can be rewarding, but it’s vital to navigate the associated risks. Options are inherently leveraged instruments, meaning that while you can multiply your investment returns, you also amplify your potential losses. It’s important for you to thoroughly understand your risk tolerance, the mechanics of options, and the impact of market volatility on your trades before getting started.

Understanding Leverage

Above all, leverage in options trading allows you to control a larger position with a relatively small amount of capital. This characteristic can magnify your profits, but it can just as easily increase your losses. By using leverage, you are vitally borrowing funds to invest, making it imperative for you to be cautious. Ensure you have a strategy in place to manage these risks effectively.

Potential Losses

Options can be a double-edged sword, leading to substantial gains or significant losses. Options trading involves a degree of risk, and if the market moves against your position, you could lose your entire investment. It’s vital to understand that with some strategies, such as writing uncovered calls, your potential losses can be unlimited. Hence, careful planning and risk management are paramount to protecting your portfolio.

Potential losses in options trading can be severe, especially if you do not fully comprehend the complexities of your chosen strategies. The downside of buying options is that they can expire worthless, resulting in a total loss of your premium. Moreover, when trading strategies such as selling naked calls or puts, you may face unlimited losses if the stock moves unfavorably. Always evaluate your financial situation and set clear boundaries to mitigate risks effectively.

Tools and Resources for Options Traders

To successfully navigate the options trading landscape, you need the right tools and resources. A great starting point is to explore 5 Tips for Diversifying Your Portfolio, which provide valuable insights into effective strategies. Additionally, leverage analytical tools, trading platforms, and software that can enhance your decision-making process and help you manage trades smoothly.

Trading Platforms and Software

Options trading requires the use of reliable trading platforms and software. These tools help you execute trades efficiently and provide access to important market data. Look for features like real-time analytics, user-friendly interfaces, and educational support to facilitate your trading journey.

Educational Resources and Communities

Communities centered around options trading can be incredibly beneficial. Engaging with fellow traders allows you to share insights and strategies while learning from each other’s experiences. Online forums, webinars, and social media platforms host a wealth of information tailored to options traders at all levels.

Hence, being a part of educational communities enhances your understanding of options trading principles. You can find mentors, participate in discussions, and access a variety of resources such as tutorials and e-books, all designed to improve your skills and boost your confidence in diversifying your investment portfolio.

Conclusion

Presently, incorporating options trading into your investment strategy can significantly enhance your portfolio’s diversification. By leveraging various options strategies such as buying calls or puts, or employing spreads, you can manage risk while opening up opportunities for profit. Understanding the underlying assets and market conditions will empower you to make informed decisions that align with your financial goals. By thoughtfully integrating options into your investment mix, you can better navigate market volatility and potentially improve your overall returns.

FAQ

Q: What are options, and how can they be used to diversify my investment portfolio?

A: Options are financial derivatives that give investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. They can be used for diversification by allowing investors to hedge against potential losses in their stock investments or to speculate on market movements with less capital than traditional stock purchases. For example, buying put options can provide a safety net during market downturns, while call options can increase exposure to stocks without having to buy them outright. This flexibility can reduce overall portfolio risk.

Q: What strategies can I implement with options to achieve better portfolio diversification?

A: There are several strategies you can utilize with options to enhance diversification. For instance, you can employ a protective put strategy, where you hold a stock and purchase a put option on it to guard against a decline in the stock’s price. Another approach is the covered call strategy, where you sell call options on stocks you own, generating additional income while potentially capping your upside. Lastly, you can consider using spread strategies, such as vertical spreads, which allow you to limit potential losses while still participating in market movements. Each of these strategies can help balance your portfolio risk against market volatility.

Q: Are there any risks associated with using options for diversification that I should be aware of?

A: Yes, while options can be a powerful tool for diversification, they also come with certain risks. Options are time-sensitive, meaning they can expire worthless if the expected move in the underlying asset does not occur within the specified time frame. This can result in a complete loss of the premium paid for the option. Additionally, the complexity of some options strategies may lead to unanticipated outcomes if not properly understood. It’s imperative to have a clear strategy, understand the market environment, and possibly consult with a financial advisor before incorporating options into your investment approach to ensure that you are comfortable with the associated risks.