Many aspiring entrepreneurs often feel overwhelmed at the thought of starting their own business. However, you can navigate this exciting journey with confidence by following imperative tips that pave the way for success. This guide will provide you with ten valuable insights that can significantly enhance your entrepreneurial journey. For additional strategies, check out these 10 Ways To Succeed As A First-Time Entrepreneur. Equip yourself with the knowledge to make informed decisions and build a thriving business.

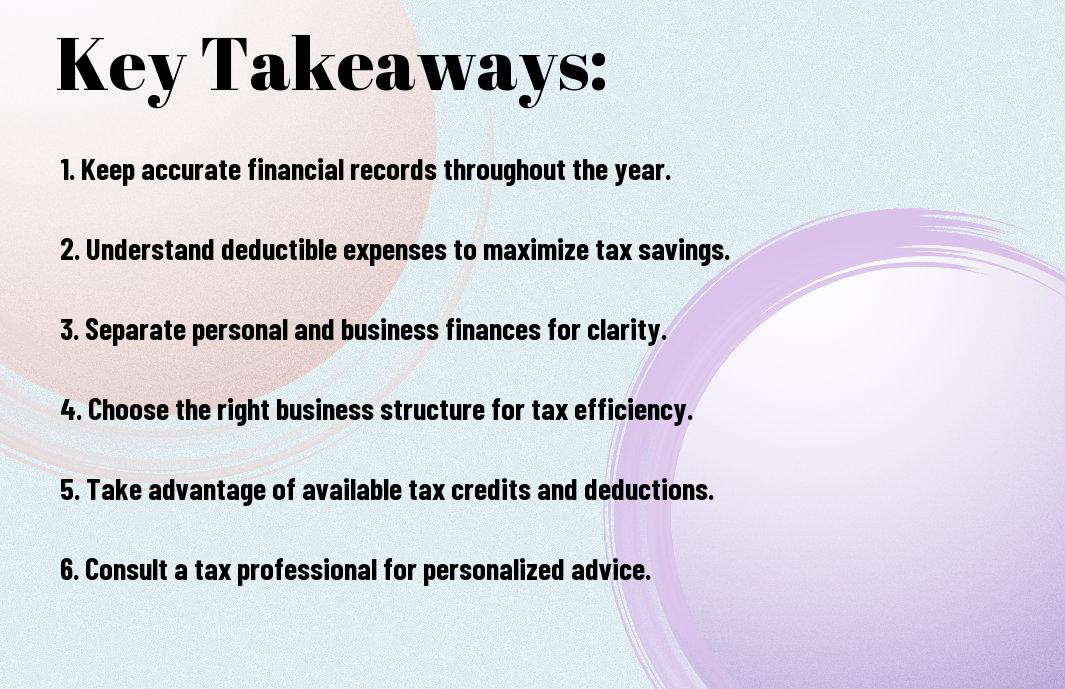

Key Takeaways:

- Business Plan: Develop a comprehensive business plan that outlines your goals, target market, and financial projections.

- Networking: Build a strong network of contacts, mentors, and fellow entrepreneurs to gain support and insight.

- Market Research: Conduct thorough market research to understand industry trends, customer needs, and competition.

- Financial Management: Keep a close eye on your finances to ensure proper budgeting and cash flow management.

- Adaptability: Stay open to feedback and be prepared to adapt your strategies as your business grows and changes.

Understanding Your Market

The foundation of a successful business lies in understanding your market. By grasping the needs, preferences, and behaviors of your target customers, you can tailor your products or services to meet their demands effectively. Conducting in-depth market analysis enables you to identify trends, gaps, and opportunities that could give your venture a competitive edge. Ultimately, a comprehensive understanding of your market will inform your strategic decisions, marketing efforts, and growth initiatives.

Researching Target Audiences

With a clear understanding of your market, you can focus on researching your target audiences. Identifying who your ideal customers are will help you define their demographics, interests, and pain points. Utilize surveys, interviews, and online analytics to gather valuable insights that shape your business offerings and marketing strategies. This knowledge empowers you to create targeted messaging that resonates with your audience, ultimately driving engagement and sales.

Analyzing Competitors

An necessary part of understanding your market involves analyzing your competitors. By studying their strengths, weaknesses, and strategies, you can identify areas where you can differentiate your business and exploit gaps in the market. Look at their product lines, pricing structures, marketing tactics, and customer feedback to gather intelligence. This competitive analysis allows you to adapt your approach, improving your chances of thriving in a crowded marketplace.

Also, competitor analysis is not just about observing their successes but also learning from their failures. Take note of what customers are saying about your competitors through reviews and social media. Understanding areas where they fall short can offer you valuable insights into what your potential customers are seeking. By implementing these lessons, you can refine your own offerings and position your business as the preferred choice in your industry.

Defining Your Business Model

You need to establish a solid business model that outlines how your enterprise will create, deliver, and capture value. This not only includes identifying your target market and understanding customer needs but also establishing how you plan to generate revenue. By defining your business model, you can streamline your operations and focus your resources effectively, leading you toward long-term success.

Choosing the Right Structure

Behind every successful business is a well-thought-out structure that defines your company’s type, tax obligations, and legal protections. Evaluate the various options, such as sole proprietorship, partnership, LLP, or corporation, to determine which aligns best with your goals, financial situation, and growth plans. Make sure to consult legal and financial advisors to ensure you choose a structure that supports your future ambitions.

Crafting a Value Proposition

Behind effective marketing is a strong value proposition that clearly communicates why your product or service is the best choice for customers. This statement should articulate the unique benefits and features that distinguish you from competitors. A well-defined value proposition not only attracts customers but also clarifies your mission and helps guide your branding and messaging efforts.

Indeed, crafting a value proposition involves thoroughly understanding your audience and their pain points. You should consider what unique benefits you offer and how they align with customer needs. By focusing on the specific solutions you provide, you create a compelling narrative that resonates with potential customers, ultimately driving engagement and sales. Your value proposition acts as a foundation for your marketing strategies and can significantly influence your business’s overall success.

Creating a Business Plan

All successful entrepreneurs begin with a well-structured business plan. This document serves as your roadmap, outlining your business goals, strategies, and financial projections. Whether you’re seeking investors or simply aiming to focus your ideas, a comprehensive business plan can guide your decision-making and help you stay on track as you navigate the challenges of entrepreneurship.

Essential Components

Across the landscape of business plans, several key components stand out. You’ll need to include an executive summary, market analysis, organizational structure, product or service description, marketing strategy, and financial projections. Each section should clearly convey your vision and demonstrate the viability of your business idea to potential investors or partners.

Setting Realistic Goals

An effective business plan must include realistic goals that are both achievable and measurable. By setting specific milestones, you can track your progress and adjust your strategies accordingly, ensuring your business remains on the path to success.

Aiming for overly ambitious goals can lead to frustration or burnout. Instead, break down your larger objectives into smaller, manageable tasks that allow for incremental progress. Setting timelines for each goal not only keeps you accountable but also helps to ensure you stay motivated. Regularly reassess your goals to adapt to changing circumstances, and celebrate your achievements, no matter how small, as you move forward in your entrepreneurial journey.

Financial Planning

To succeed as an entrepreneur, robust financial planning is key. Developing a well-rounded financial strategy enables you to allocate resources efficiently and anticipate potential pitfalls. For insightful guidance, check out the 10 Essential Tips for Every First-Time Startup Founder to streamline your planning efforts.

Budgeting Basics

At the core of your financial strategy lies proper budgeting. This involves estimating your income and expenses to create a realistic plan that keeps your startup afloat. Make sure to categorize your spending to identify areas where you can minimize costs and maximize profits.

Securing Funding

Behind every successful startup is a strong funding strategy. To launch your business, identify the right investors or funding sources that align with your vision. This might include venture capital, angel investors, or crowdfunding, depending on your unique circumstances.

Plus, be prepared to showcase your business plan convincingly to potential investors. Your financial projections, market analysis, and clear path to profitability will be important in building their confidence. Take the time to research your funding options thoroughly to find the best fit for your long-term goals.

Building Your Brand

Once again, your brand is more than just a logo or business name; it represents your values, vision, and mission. It’s vital to create a strong identity that resonates with your target audience and sets you apart from competitors. Consider reading these 15 Tips For First-Time Entrepreneurs for more insights on effective branding strategies.

Establishing an Online Presence

The digital landscape is where most of your potential customers are, making it vital to establish a strong online presence. Build a user-friendly website and engage actively on social media platforms, ensuring that your branding is consistent across all channels. This not only builds trust but also serves as a foundation for your marketing efforts.

Effective Marketing Strategies

At the core of successful entrepreneurship lies the ability to market your products or services effectively. You’ll need to identify your target audience and leverage various marketing channels to reach them. Use a mix of social media, email marketing, content marketing, and paid advertising to create a comprehensive strategy that drives awareness and engagement.

Brand awareness is fundamental to your marketing strategy. Consider utilizing content marketing, such as blogging or video creation, to share valuable information related to your industry while subtly promoting your products or services. Additionally, collaborations with influencers or other businesses can increase your reach and credibility. By tracking your efforts and adjusting your strategies based on data, you can refine your approach and maximize your impact.

Networking and Support

Keep in mind that building a strong network and seeking support from others are fundamental to your success as an entrepreneur. Surrounding yourself with like-minded individuals can provide you with valuable insights and encouragement. Engaging in networking events, conferences, and social media groups will help you establish connections that may open doors to new opportunities. Don’t hesitate to reach out; sharing your journey can lead to collaboration and partnerships that benefit everyone involved.

Finding Mentors

Above all, finding a mentor can significantly accelerate your growth as an entrepreneur. Look for someone who has navigated the challenges you face and can offer guidance based on their experiences. A good mentor can provide you with honest feedback, valuable advice, and a different perspective that can help you make informed decisions. Establishing a mentor-mentee relationship requires effort, so be proactive in seeking out opportunities to connect with potential mentors in your network.

Joining Entrepreneurial Communities

Across various platforms, you will find entrepreneurial communities that foster collaboration and support among members. Engaging with these groups can be highly beneficial for sharing knowledge, resources, and experiences. Whether online or offline, communities provide a sense of belonging and can be a source of inspiration. Networking with fellow entrepreneurs allows you to exchange ideas, brainstorm solutions, and celebrate milestones together, ultimately strengthening your resolve to succeed.

Entrepreneurial communities serve as invaluable resources for your personal and professional growth. By participating in workshops, forums, or local meetups, you can gain insights from diverse perspectives and tap into a wealth of knowledge. These connections can lead to potential partnerships, collaborations, and even lifelong friendships. As you contribute to the community, you’ll not only enhance your skills but also build a reputation that can open new doors for your entrepreneurial journey.

Navigating Challenges

Despite the excitement of launching your business, you’ll encounter various challenges that test your resilience. Embracing obstacles as opportunities for growth is vital. These hurdles can range from financial setbacks to enduring market fluctuations. Your ability to adapt, learn, and pivot will define your entrepreneurial journey. Keep an open mind and stay focused on your vision, using each challenge as a stepping stone to greater understanding and strength.

Adapting to Change

The business landscape is ever-evolving, and your success hinges on your ability to adapt. Flexibility allows you to respond effectively to changes in market trends, customer preferences, and emerging technologies. Stay informed and be willing to reassess your strategies. This proactive mindset will empower you to innovate and stay ahead of competitors while aligning your offerings with evolving demands.

Managing Risks

Against common misconceptions, risk is an inherent part of entrepreneurship. Being aware of potential risks allows you to develop effective strategies to mitigate them and safeguard your business. Engage in thorough research to analyze market conditions, legal considerations, and financial implications before making major decisions.

Risks can stem from various aspects of your business, including financial investments, operational failures, and market volatility. It’s crucial to conduct a comprehensive risk assessment to identify potential challenges early on. Exploring different scenarios and developing contingency plans will help you respond quickly when issues arise. Moreover, maintaining a strong support network and seeking guidance from experienced mentors can provide valuable insights, enabling you to navigate risks more effectively.

Q: What are the key characteristics that first-time entrepreneurs should develop?

A: First-time entrepreneurs should focus on developing resilience, adaptability, and a strong work ethic. Resilience helps them bounce back from setbacks, while adaptability allows them to pivot their business strategies as needed. A strong work ethic ensures they remain committed and motivated, especially during challenging times. Cultivating these traits can significantly increase their chances of business success.

Q: How important is networking for a new entrepreneur, and how can one get started?

A: Networking is vital for new entrepreneurs as it facilitates access to valuable resources, guidance, and potential partnerships. To get started, they can attend industry events, join local business organizations, or participate in online forums. Building relationships with fellow entrepreneurs, mentors, and professionals can offer insights and opportunities that can help grow their business.

Q: What financial strategies should first-time entrepreneurs consider?

A: First-time entrepreneurs should prioritize creating a detailed budget to track expenses and revenues. They should consider setting aside a reserve fund to cover unexpected costs and explore various funding options, such as small business loans or crowdfunding. Additionally, they need to monitor cash flow closely to ensure they can manage operational costs efficiently and make informed financial decisions as their business grows.