Unlock the extraordinary potential of branding to elevate your small business. As a small business owner, you have the unique opportunity to create a strong brand identity that sets you apart from competition, connects with your target audience, and fosters customer loyalty. Effective branding not only conveys your values and mission but also resonates emotionally with your customers, increasing their likelihood to engage and spend. In this post, you’ll discover practical strategies that will empower you to harness the full potential of your brand, driving sustainable growth and success.

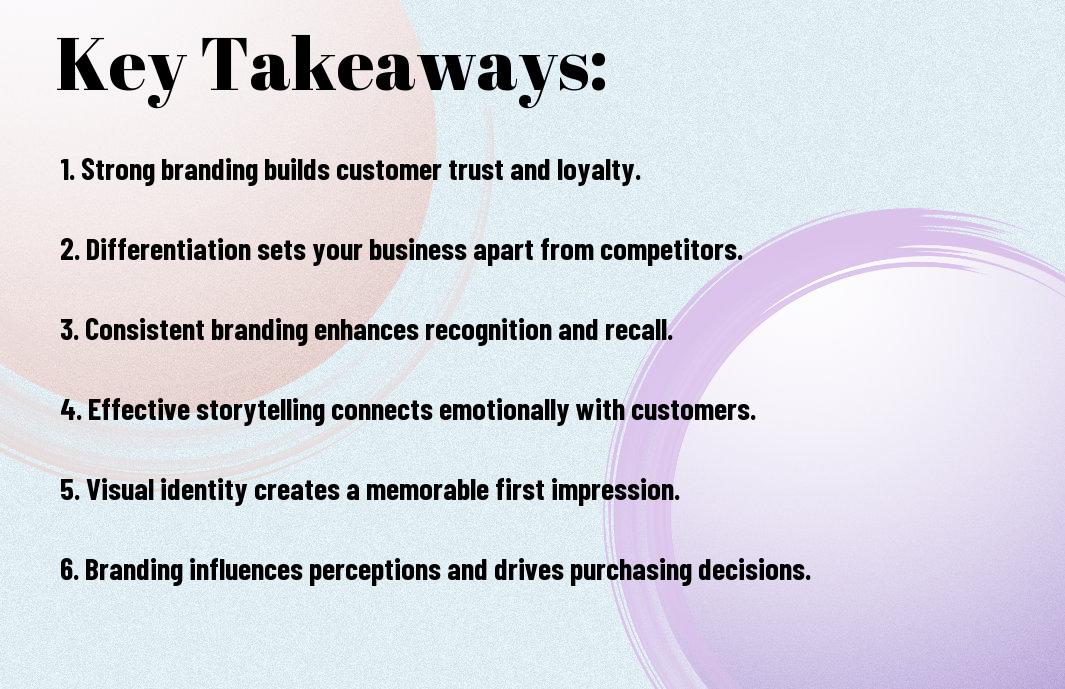

Key Takeaways:

- Establishing Identity: A strong brand provides small businesses with a unique identity that differentiates them from competitors in the market.

- Building Trust: Effective branding fosters trust with customers, leading to increased loyalty and repeat business.

- Enhancing Recognition: Consistent branding elements, such as logos and color schemes, enhance brand recognition, making it easier for customers to identify and remember the business.

- Effective Marketing: A well-defined brand strategy streamlines marketing efforts, allowing small businesses to convey their message clearly and attract their target audience more effectively.

- Emotional Connection: Strong branding creates an emotional connection with consumers, leading to deeper engagement and a stronger overall customer relationship.

Understanding Branding

To comprehend the true essence of branding, it’s important to appreciate its impact on your small business. A well-crafted brand communicates your values, builds trust, and distinguishes you from competitors. You can deepen your understanding by exploring The Power of Branding and Design for Small Businesses, which offers valuable insights on creating an effective brand identity.

Definition of Branding

Around you, branding encompasses the visual elements, messaging, and perceptions that define your company in the marketplace. It is not just a logo or color scheme; branding encapsulates the overall experience and promise you deliver to your customers.

Importance for Small Businesses

Definition of branding is important for small businesses, as it creates recognition and fosters customer loyalty. A strong brand identity helps you forge a connection with your target audience, encouraging repeat business and word-of-mouth referrals.

Further, a well-defined brand can position your small business uniquely in the minds of consumers. This differentiation can lead to increased market share, as customers are more likely to choose a brand they recognize and trust over an unfamiliar option. By honing your branding strategy, you can effectively attract and retain customers, ultimately driving growth and success for your venture.

Elements of Effective Branding

Any small business looking to establish its presence in the market should focus on the imperative elements of effective branding. From a striking logo to a consistent brand voice, these components work together to create a memorable identity. Discover more about The Power of Strong Branding for Small Businesses and how you can leverage them to set yourself apart from the competition.

Logo and Visual Identity

About your logo and visual identity, these elements serve as the first impression of your brand. A well-designed logo captures the essence of your business while creating a memorable image that resonates with your audience. Pair it with a cohesive color palette and typography to enhance brand recognition.

Brand Voice and Messaging

Visual identity conveys your brand’s personality, but brand voice and messaging are equally vital for connecting with your audience. Establishing a consistent tone in your communications fosters familiarity and trust. Understanding your target demographic allows you to tailor your messaging effectively, ensuring your brand speaks directly to their needs and requirements.

Voice plays an integral role in the overall perception of your brand. It not only reflects your business’s personality but also influences how customers engage with you. Clear, relatable, and consistent messaging can strengthen relationships and encourage loyalty, making it important to invest the time to develop a distinctive voice that resonates with your audience.

The Benefits of Strong Branding

Keep in mind that strong branding can significantly elevate your small business, giving you a competitive edge. It not only enhances your recognition in the marketplace but also establishes trust and credibility with your audience. A well-executed brand strategy cultivates emotional connections, making customers more likely to choose your products or services over the competition. Strong branding can also facilitate higher prices and increase your business’s value over time.

Building Customer Loyalty

Across various industries, building customer loyalty relies heavily on brand perception. When customers resonate with your brand values and mission, they are more likely to return and recommend your business to others. By establishing a consistent and memorable brand experience, you inspire trust and encourage repeat purchases, turning one-time buyers into lifelong advocates.

Differentiation in the Market

Against a backdrop of many competitors, effective branding sets you apart. A distinct brand identity helps you carve out your unique space in consumers’ minds, influencing their choices. When potential customers can easily identify what makes your business different, they are more inclined to explore and engage with your offerings.

With a strong brand, you communicate your unique value proposition, illustrating exactly why customers should choose you over your competition. Whether it’s through visual design, messaging, or customer experience, differentiation allows you to highlight the specific benefits that your products or services provide. This clarity not only attracts the right audience but also cultivates a sense of familiarity and loyalty, necessary for long-term success in the marketplace.

Strategies for Developing Your Brand

Despite the challenges small businesses face, developing a strong brand strategy can significantly enhance your market presence. Begin by defining your brand values, mission, and unique selling points. Utilize effective visual elements like logos and color schemes that resonate with your identity. Leveraging social media, building a website, and creating engaging content will help you connect with your audience and establish your brand. Always seek feedback to refine your approach and ensure your brand evolves alongside your business.

Market Research and Audience Targeting

Strategies for understanding your target audience involve thorough market research. Utilize surveys, focus groups, and competitor analysis to identify the preferences and needs of your ideal customers. Analyze demographics, interests, and behaviors to tailor your messaging effectively. By understanding your audience, you can create brands that truly resonate with them, leading to a more meaningful connection and increased brand loyalty.

Consistency Across Platforms

Across all channels, maintaining brand consistency is necessary for building trust and recognition. Your logo, color palette, messaging, and overall design should be uniform, whether on social media, your website, or printed materials. This helps customers easily identify your brand and promotes a cohesive image in their minds. It’s about creating a reliable experience that fosters familiarity and comfort, making it easier for customers to connect with your business. Every touchpoint should echo your brand values to reinforce your message and deepen your relationship with your audience.

The importance of consistency cannot be overstated, as it lays the foundation for your brand’s identity. When customers encounter a unified brand experience, they’re more likely to remember you and trust your offerings. To achieve this, establish brand guidelines that outline how your brand should be presented in various mediums. Regularly review your online and offline presence to ensure everything aligns with your core message. By committing to this consistency, you enhance brand recognition, making your business more memorable in a competitive market.

Leveraging Social Media for Brand Growth

Unlike traditional advertising methods, social media offers small businesses the unique ability to connect directly with their audience. By creating engaging and authentic content, you can build a loyal community around your brand, driving awareness and contributing to your growth. Using targeted strategies, you can reach potential customers, while providing them with insights into your brand’s values and offerings.

Choosing the Right Platforms

Growth begins with selecting social media platforms that align with your target audience. Consider where your customers are most active, whether it’s Facebook, Instagram, LinkedIn, or TikTok. Prioritize platforms that resonate with your brand identity and the preferences of your audience. This strategic approach will maximize your engagement and enhance your online visibility.

Engaging with Your Audience

Media engagement is key to fostering relationships and building brand loyalty. You must interact with your audience by responding to comments, initiating conversations, and sharing user-generated content. This two-way communication helps to humanize your brand and showcases that you value their input and feedback.

Leveraging authentic interactions on social media not only strengthens your connection with your audience but also encourages them to become advocates for your brand. By asking questions, hosting live sessions, and sharing behind-the-scenes content, you invite your followers into your world. This approach cultivates trust and encourages repeat interactions, which can significantly boost your brand’s visibility and growth potential.

Measuring Brand Success

Your brand’s success is not just about recognition; it’s about understanding how well your branding efforts resonate with your target audience. By effectively measuring your brand’s performance, you can identify strengths and weaknesses, enabling you to make informed decisions that drive growth. Utilizing various metrics will allow you to gain valuable insights into the perceptions and behaviors of your customers, ultimately leading to a stronger brand presence in the market.

Key Performance Indicators

Among the crucial metrics to measure your brand’s success are customer awareness, engagement rates, and conversion statistics. By tracking these key performance indicators, you can gauge how effectively your branding strategies are reaching your audience and driving them to take action. This data not only reflects current performance but also highlights areas that may require refinement, allowing you to stay aligned with your business objectives.

Feedback and Adaptation

Adaptation is vital for maintaining a successful brand. Gathering and analyzing customer feedback can provide you with insights into how your audience perceives your brand and its offerings. This information is instrumental in shaping a more responsive branding strategy that meets the evolving preferences and expectations of your target market.

Performance metrics paired with customer feedback can create a robust framework for ongoing brand improvement. By actively seeking out opinions through surveys, reviews, or social media interactions, you can uncover valuable insights that inform your adjustments. This commitment to listening and adapting fosters a more authentic connection with your audience, ensuring that your brand not only survives but thrives in an ever-changing marketplace.

Summing up

Drawing together the elements of branding for your small business, it’s clear that a strong brand identity can significantly influence your success. By defining your unique value proposition, creating a consistent visual style, and engaging with your target audience, you can enhance recognition and loyalty. Effective branding not only sets you apart from competitors but also builds trust, encouraging customers to choose you time and again. Embrace the power of branding to transform your business and foster long-lasting relationships with your clientele.

FAQ

Q: How can a strong brand identity benefit my small business?

A: A strong brand identity helps your small business stand out in a competitive marketplace. It creates an emotional connection with your target audience, fostering loyalty and trust. By differentiating your offerings, a recognizable brand can attract new customers and encourage repeat business. Additionally, a well-defined brand identity can facilitate marketing efforts, making it easier to communicate your value proposition and mission.

Q: What are some effective ways to develop a brand for my small business?

A: To develop a brand for your small business, start by clearly defining your mission and values. This foundation will guide your branding efforts. Next, create a unique visual identity, including a logo, color scheme, and typography that reflects your brand personality. Consistency is key; use these elements across all platforms, including your website and social media. Engage with your audience through storytelling, showcasing your product or service’s benefits and creating a community around your brand.

Q: How can I measure the impact of my branding efforts?

A: Measuring the impact of your branding efforts can be achieved through various metrics. Track changes in brand awareness by utilizing surveys or social media engagement analytics. Additionally, monitor customer feedback and online reviews to gauge public perception. Another effective approach is to analyze sales data before and after branding initiatives; growth in sales could indicate successful branding efforts. Finally, consider using tools to assess website traffic and conversion rates related to specific campaigns for a comprehensive view of branding effectiveness.