There’s a vital connection between financial planning and the resilience of your business. With the right financial strategies in place, you can better withstand unforeseen challenges and economic fluctuations. By understanding your financial position and preparing for various scenarios, you enhance your ability to adapt and thrive in a dynamic market. This post will explore into the key aspects of financial planning that contribute to building and maintaining business resilience, empowering you to make informed decisions and secure your business’s future.

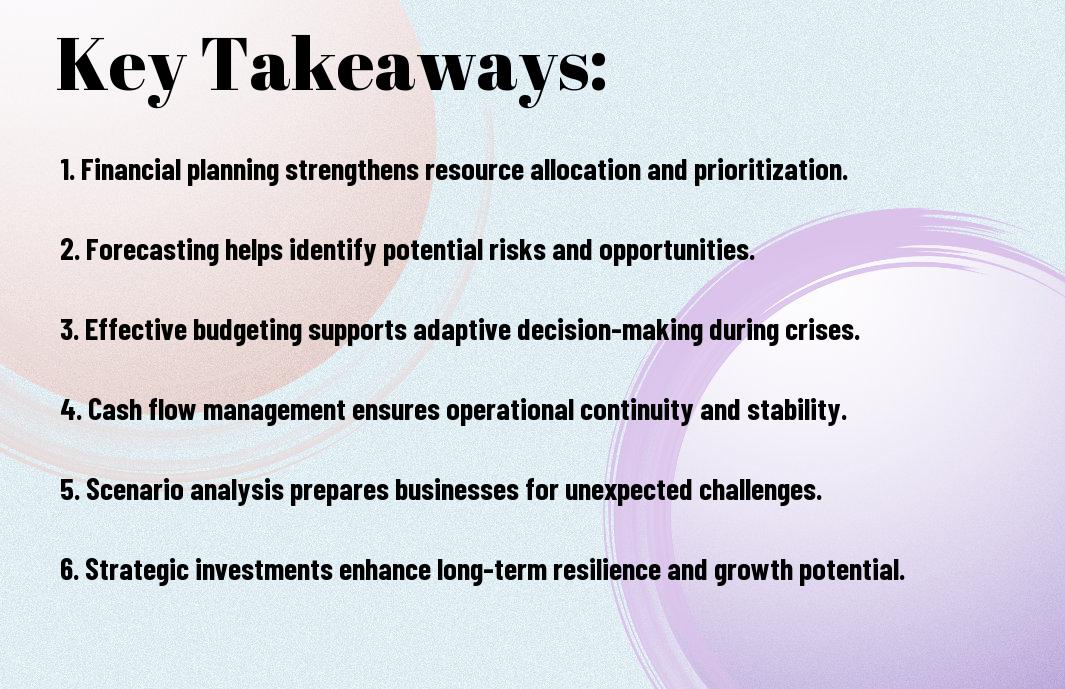

Key Takeaways:

- Strategic Forecasting: Financial planning aids in preparing for potential market fluctuations and helps businesses adjust strategies accordingly.

- Resource Allocation: Effective financial planning ensures optimal usage of resources, allowing businesses to maintain operations during unforeseen challenges.

- Risk Management: Incorporating financial planning facilitates the identification and mitigation of risks, thereby enhancing overall business resilience.

Understanding Financial Planning

While financial planning is often seen as a complex and daunting task, it serves as a roadmap that guides your business towards sustainable growth and stability. By anticipating future financial challenges and opportunities, you can make informed decisions that enhance your operational efficiency and safeguard your enterprise against unforeseen risks.

Definition and Importance

An effective financial planning process involves setting financial goals and creating a strategy to achieve them. This process is vital because it enables you to allocate resources wisely, maintain cash flow, and ultimately strengthen your business’s ability to withstand market volatility.

Key Components of Effective Financial Planning

An effective financial plan comprises several key components, including budgeting, forecasting, risk management, and investment strategies. Each element plays a vital role in ensuring that you not only meet your immediate needs but also position your business for long-term success.

Planning involves careful consideration of several factors that contribute to a robust financial framework. This includes establishing a realistic budget that tracks income and expenditures, projecting future cash flow needs, assessing potential risks, and determining appropriate investment opportunities. By focusing on these components, you can create a comprehensive financial plan that adapts to challenges and drives your business forward.

Assessing Business Risks

One of the fundamental steps in financial planning is assessing business risks. Understanding the types of risks your business faces—be it market fluctuations, operational challenges, or regulatory changes—allows you to proactively prepare and build resilience. Regularly evaluating these risks enables you to safeguard your financial health and ensures your business can adapt to unforeseen challenges, ultimately fostering long-term sustainability.

Identifying Financial Risks

Below, you will find that identifying financial risks involves analyzing your business’s exposure to various financial threats. This includes cash flow issues, debt levels, investment volatility, and credit risks. By pinpointing these vulnerabilities, you can make informed decisions that directly impact your financial health.

Risk Mitigation Strategies

At this point, implementing risk mitigation strategies becomes important. These strategies may include diversifying income streams, establishing emergency funds, and investing in adequate insurance coverage. By creating a robust plan to address identified risks, you strengthen your business’s ability to withstand financial shocks.

In fact, a proactive approach to risk mitigation can enhance your business’s stability. Consider conducting regular financial audits to evaluate your current strategies and adapt them as necessary. Engaging professionals or consultants may provide insights that are critical for refining your plans. By continuously monitoring the market and your financial metrics, you’ll be better prepared to navigate challenges and capitalize on opportunities swiftly.

The Role of Budgeting in Resilience

Not every business has the luxury of predictable income and expenses; effective budgeting is your safeguard. A resilient business is prepared to navigate uncertainties through well-structured budgets that reflect both your goals and potential challenges. By prioritizing your financial resources, you enhance your ability to withstand unexpected disruptions and adapt quickly to changing environments.

Creating Flexible Budgets

Behind every successful budget lies flexibility. As you create your budget, ensure it accommodates various scenarios, allowing for rapid adjustments in response to unforeseen events. This adaptability will give you the leverage needed to pivot your strategy without compromising your financial standing.

Monitoring and Adjusting Budgets

About the importance of staying vigilant, constant monitoring of your budget is crucial. You should regularly review your financial performance against your budget to identify variances and opportunities for adjustment. By keeping a close eye on spending and income, you can make informed decisions that help align your financial activities with your business objectives.

Considering the ever-changing nature of the business landscape, ongoing monitoring and adjusting of your budget should be a standard practice. By tracking your financial performance and proactively addressing discrepancies, you can protect your business from adverse impacts and maintain alignment with your strategic goals. This continuous feedback loop not only equips you to respond swiftly but also fosters a culture of financial awareness across your organization, enhancing overall resilience.

Forecasting and Scenario Planning

Keep in mind that effective forecasting and scenario planning are crucial for navigating uncertainties in the business landscape. By accurately predicting future trends, you position your business to adapt swiftly to changes, ensuring sustained operational effectiveness even in challenging times. Recognizing various potential outcomes allows for informed decision-making, ultimately contributing to your company’s resilience and growth.

Importance of Accurate Forecasting

One of the key components of successful financial planning is accurate forecasting. This practice helps you set realistic objectives and allocate resources optimally, enabling you to anticipate market fluctuations. By analyzing data trends and integrating market insights, you can enhance your ability to make informed decisions that drive your business forward.

Scenario Analysis for Strategic Decisions

With scenario analysis, you can evaluate multiple potential futures and develop strategies tailored to different circumstances. This approach empowers you to assess risks and opportunities, providing a framework for effective decision-making. By weighing various scenarios, you can proactively create contingency plans that bolster your business’s adaptability.

But successful scenario analysis goes beyond mere speculation. It requires a thorough understanding of your operational environment and the various factors influencing your industry. By engaging in detailed discussions and workshops with your team, you can explore both optimistic and pessimistic scenarios. This exercise not only enhances your strategic awareness but also fosters a culture of resilience within your organization, ensuring you are better prepared for whatever the future holds.

Cash Flow Management

Your ability to effectively manage cash flow can significantly impact your business’s resilience. Through diligent cash flow management, you ensure that your operations run smoothly, enabling you to meet obligations and seize growth opportunities as they arise. By understanding the fundamentals and employing sound techniques, you can safeguard your business against unexpected financial challenges.

Understanding Cash Flow Basics

Basics of cash flow revolve around the movement of money in and out of your business. It encompasses your revenues and expenses, highlighting how well you can generate cash and manage outgoing costs. Understanding these elements enables you to forecast future cash needs and avoid potential shortfalls that could hinder your operations.

Techniques for Optimizing Cash Flow

One effective way to optimize cash flow is by streamlining invoicing processes and implementing strict payment terms. This encourages timely payments from your customers and minimizes delays in cash inflows. Additionally, consider closely monitoring your expenses and identifying areas where you can cut costs or negotiate better terms with suppliers.

In addition to these techniques, maintaining a cash reserve can provide a buffer against unexpected expenses and fluctuations in revenue. Regularly reviewing your financial statements helps you stay informed about your cash position and guides your decision-making. Implementing technology solutions for tracking cash flow can enhance your visibility and allow you to make proactive adjustments as needed.

Investment Strategies for Stability

Unlike short-term gains driven by market fluctuations, investment strategies aimed at stability focus on building a resilient financial foundation for your business. These strategies ensure that your company can withstand economic uncertainties and continue to thrive in fluctuating markets. By emphasizing conservative investments and maintaining a diversified portfolio, you secure a path to long-term sustainability.

Long-term vs. Short-term Investments

Strategies for investment should consider both long-term and short-term approaches. Long-term investments often yield greater returns but require patience and a solid commitment. In contrast, short-term investments may provide immediate cash flow but come with enhanced volatility. Balancing these types can provide the security and growth necessary to support your business stability.

Balancing Risk and Reward

With any investment strategy, it’s crucial to balance risk and reward effectively. By assessing your risk tolerance and aligning it with your business objectives, you can plan investments that match your financial goals while protecting against potential losses. This balance allows you to seize opportunities while staying resilient during economic downturns.

For instance, if you choose to invest heavily in a promising start-up to maximize returns, you should also allocate a portion of your resources to more stable assets like bonds or established stocks. This diversification helps mitigate the risk of significant losses, as safer investments can buffer your portfolio during volatile market conditions. Monitoring your investments regularly and adjusting your strategy based on performance will further enhance your capacity to balance risk and reward effectively.

Final Words

Drawing together the insights on financial planning and business resilience, you can better navigate uncertainties by integrating effective financial strategies into your operations. This proactive approach not only safeguards your business but also positions you to seize opportunities as they arise. To enhance your understanding of maintaining stability in challenging times, explore resources like Business Continuity Planning for Financial Institutions, which outlines important strategies for resilience. Your financial foresight is key to building a sustainable future.

FAQ

Q: How does financial planning enhance business resilience during economic downturns?

A: Financial planning plays a significant role in helping businesses navigate economic downturns. By anticipating potential financial impacts, organizations can develop strategies to reduce costs, optimize cash flow, and allocate resources effectively. This proactive approach allows businesses to maintain operations, invest in critical areas, and withstand market fluctuations without facing severe disruptions. Moreover, having a well-structured financial plan enables businesses to identify alternative revenue streams and explore new opportunities, thus strengthening their ability to adapt to changing economic conditions.

Q: In what ways can financial planning contribute to long-term business sustainability?

A: Financial planning supports long-term sustainability by establishing a clear roadmap for resource allocation and investment decisions. By analyzing current financial health and forecasting future performance, businesses can prioritize initiatives that drive growth and innovation. This involves budgeting for critical improvements, such as technology upgrades and employee training, which can help maintain competitive advantages. Additionally, a robust financial plan allows for continuous monitoring and adjustment to strategies, ensuring that the business remains resilient and prepared for unforeseen challenges while aligning with its long-term goals.

Q: What financial management techniques can businesses implement to improve resilience?

A: Businesses can adopt several financial management techniques to bolster resilience, including cash flow forecasting, scenario analysis, and stress testing. Cash flow forecasting helps businesses predict inflows and outflows, enabling them to manage liquidity effectively and avoid cash shortfalls. Scenario analysis allows organizations to evaluate the effects of different potential market changes, helping them to prepare for various outcomes. Stress testing evaluates how financial plans hold up under extreme conditions, ensuring that the business has adequate contingency strategies in place. Collectively, these techniques empower organizations to navigate uncertainties with greater assurance and adaptability.