Many financial experts agree that having an emergency fund is imperative before you start investing. This safety net can protect your finances from unexpected expenses, allowing you to invest with confidence. Before exploring into the stock market or other investment avenues, it’s important to understand the significance of an emergency fund. For a deeper understanding, you can explore Emergency Fund: What it Is and Why it Matters. In this post, you’ll learn how to build an effective emergency fund tailored to your financial needs.

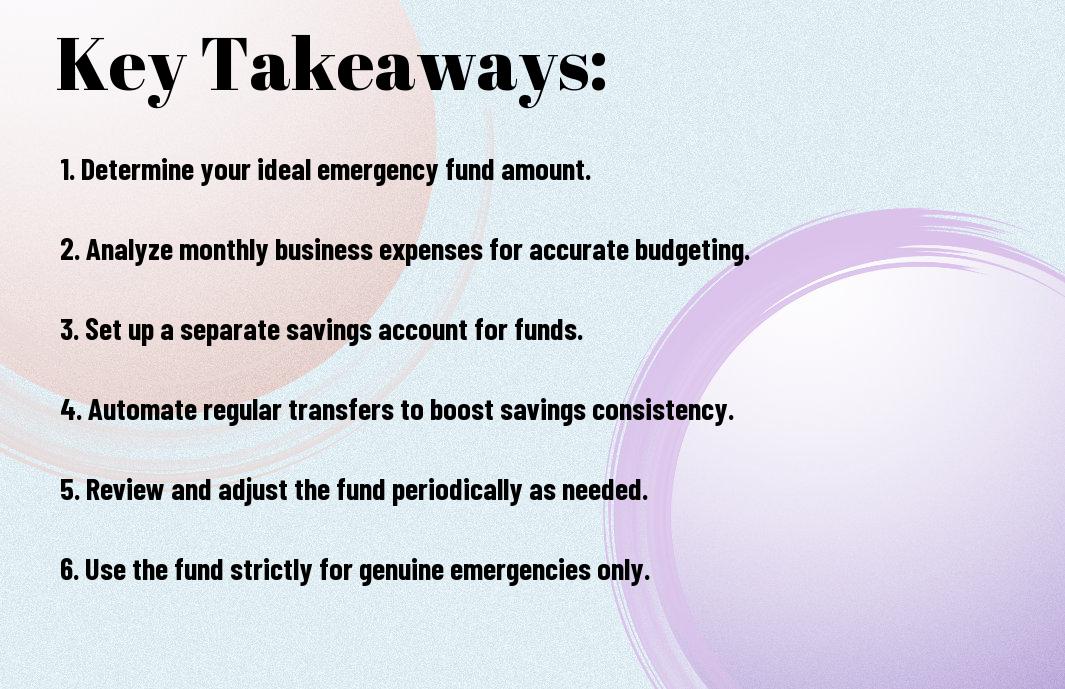

Key Takeaways:

- Determine your goal: Establish a target amount for your emergency fund, typically 3-6 months’ worth of living expenses.

- Start small: Begin by setting aside a manageable amount of money each month to gradually build your fund.

- Choose the right account: Opt for a high-yield savings account to keep your funds accessible while earning some interest.

- Prioritize expenses: Identify and reduce non-imperative spending to allocate more towards your emergency savings.

- Automate savings: Set up automatic transfers to your emergency fund to ensure consistent contributions without extra effort.

Understanding the Importance of an Emergency Fund

The significance of establishing an emergency fund cannot be overstated. It serves as your financial safety net, providing peace of mind in case of unexpected expenses, such as medical bills or car repairs. Having this buffer allows you to navigate life’s surprises without derailing your financial plans or resorting to debt. Before making any investments, prioritizing an emergency fund empowers you to invest with confidence and security.

What is an Emergency Fund?

Around 3 to 6 months’ worth of living expenses, an emergency fund is a designated amount of savings set aside to cover unexpected financial challenges. It is a separate account, distinct from your regular savings or investment accounts, ensuring easy access when needed. This fund gives you the flexibility to address unforeseen circumstances without negatively impacting your financial health.

Why You Need One Before Investing

On your journey toward financial stability, having an emergency fund is imperative prior to investing. You must prioritize this fund to ensure you can handle sudden expenses without disrupting your investment strategy.

Due to market fluctuations and the inherent risks of investing, you may encounter periods where your investments do not perform as expected. In these instances, having an emergency fund can cushion any financial blow, allowing you to stay the course with your investment strategy without panic-selling or incurring debt. Your emergency fund creates a stable foundation, enabling you to make informed and strategic investment decisions confidently.

Assessing Your Financial Situation

Assuming you want to build an emergency fund, it’s crucial to evaluate your current financial standing. Take a detailed look at your income, expenses, and any outstanding debts. Understanding where you stand financially will give you a clearer picture of how much you can allocate towards saving for emergencies before plunging into investments.

Evaluating Income and Expenses

Any assessment of your finances starts with a comprehensive evaluation of your income and expenses. Calculate all sources of income, followed by a thorough listing of your monthly expenses. By identifying fixed and variable costs, you can highlight areas where you may cut back, allowing you to set aside a portion of your income for your emergency fund.

Identifying Potential Risks

On the other hand, reviewing potential risks that could impact your financial stability is just as important. Consider factors such as job security, health issues, or unexpected expenses that could strain your finances. By pinpointing these risks, you can better prepare your emergency fund to withstand any financial shocks.

Indeed, understanding potential risks offers valuable insights for building a robust emergency fund. Life can be unpredictable, so it’s wise to anticipate challenges like sudden medical expenses or job loss. By recognizing these uncertainties, you can establish a goal for your emergency savings—typically covering three to six months’ worth of living expenses—ensuring you’re prepared for whatever life throws your way.

Setting a Savings Goal

Keep your financial future secure by setting a realistic savings goal for your emergency fund. This target will not only give you a clear idea of how much you need to save but also motivate you to prioritize your finances. Start by assessing your monthly expenses, such as rent, utilities, groceries, and debt payments, to determine an appropriate amount for your emergency fund.

Determining the Right Amount

Along with assessing your monthly expenses, consider factors like job stability and emergency scenarios you might face. A common recommendation is to save three to six months’ worth of living expenses. Tailor this target based on your personal circumstances to ensure you feel secure and prepared for the unexpected.

Creating a Timeline for Savings

One effective way to reach your savings goal is by establishing a timeline. Break down your total savings target into manageable monthly or weekly contributions, allowing you to track your progress and stay motivated. This structure will help you visualize where you stand and keep you committed to your goal.

Creating a timeline encourages discipline in your savings behavior. Decide on a specific end date for achieving your emergency fund goal, and reverse-engineer your savings plan. For example, if your goal is $6,000 in 12 months, you would need to save $500 each month. By regularly reviewing and adjusting your contributions as necessary, you can maintain focus and adapt to any changes in your financial situation. Consistency is key, and having a timeline creates a sense of urgency to reach your goal.

Choosing the Right Savings Account

Unlike regular savings accounts, an emergency fund requires a dedicated account that prioritizes accessibility and minimal fees. You want a place where your money can grow slightly while remaining easy to access when unexpected expenses arise. Consider your options carefully, as the right savings account can make all the difference in efficiently building your emergency fund.

Types of Accounts for Emergency Funds

An array of account types can serve your emergency fund needs:

- High-yield savings accounts

- Money market accounts

- Certificates of deposit (CDs)

- Online savings accounts

- Traditional savings accounts

This variety allows you to select one that best aligns with your goals and preferences.

| Account Type | Features |

| High-yield savings | Higher interest rates |

| Money market | Check-writing privileges |

| Certificates of deposit | Fixed interest but limited access |

| Online savings | Lower fees, higher rates |

| Traditional savings | Basic interest, easy access |

Factors to Consider When Choosing an Account

An effective emergency fund account is influenced by several factors:

- Interest rates

- Fees and minimum balance requirements

- Accessibility and withdrawal rules

- FDIC insurance coverage

- Banking options (online or local)

Knowing these attributes helps you make an informed decision that best suits your financial needs.

In addition to the basics, ensure you evaluate how each factor affects your overall savings strategy. Consider your financial habits and emergency fund goals. Your goal is to find the right balance between earning interest and having easy access to your funds.

- Evaluate your liquidity needs

- Analyze interest rate trends

- Research different financial institutions

- Consider any promotional offers

- Stay informed on account updates

Knowing these details will empower you to choose an account that serves your emergency fund effectively.

Strategies for Building Your Emergency Fund

Your journey to building a solid emergency fund begins with effective strategies that fit your lifestyle. Start by setting clear savings goals, creating a dedicated account for your fund, and prioritizing your savings just like you would any other monthly expense. By adopting these strategies, you can steadily grow your emergency fund and gain peace of mind, knowing you are financially prepared for unexpected events.

Automating Savings

Beside establishing a budget, automating your savings can significantly simplify your financial planning. Set up a direct deposit from your paycheck into a separate high-yield savings account dedicated to your emergency fund. By automating this process, you ensure that saving becomes a habit rather than a choice, making it easier for you to reach your goals without even thinking about it.

Cutting Expenses and Increasing Income

With a clearer understanding of your financial landscape, cutting unnecessary expenses and exploring ways to increase your income will enhance your ability to grow your emergency fund. Analyze your monthly spending habits and identify areas where you can reduce costs—like dining out or subscription services. Additionally, consider taking on a part-time job or freelance work to supplement your income and accelerate your savings.

To build your emergency fund effectively, combine both cutting costs and increasing your income. Create a list of non-crucial expenses you can temporarily eliminate, such as gym memberships or streaming services. Simultaneously, look for side gigs that match your skills or hobbies. Even small contributions from these efforts can add up significantly over time, enabling you to reach your emergency fund goal faster while maintaining financial stability.

Maintaining Your Emergency Fund

Despite the importance of your emergency fund, it’s easy to neglect its maintenance. Regularly review your savings to ensure that your fund remains adequate for potential emergencies. Inflation can impact your savings, so consider reassessing your fund periodically and adjust contributions as necessary to keep pace with rising costs. This proactive approach will help you feel secure and prepared regardless of unforeseen circumstances.

When to Reassess Your Fund

Emergency funds should not be static; they need to evolve as your financial situation changes. Key moments to reassess your fund include significant life events like a new job, marriage, or the birth of a child. Additionally, any changes in your expenses, such as moving to a more expensive area or taking on new debt, warrant a reassessment to ensure your emergency savings align with your current needs.

How to Avoid Using Your Emergency Fund

Emergency funds serve a specific purpose, so it’s vital to keep them untouched for actual emergencies. Establish clear boundaries by distinguishing between emergency situations and regular expenses. You can also create separate savings accounts for discretionary spending or non-urgent needs, preventing you from dipping into your emergency fund for everyday costs.

Reassess your spending habits and identify the triggers that may lead you to use your emergency fund for non-emergencies. By setting these clear boundaries and understanding your priorities, you can keep your emergency savings intact. Consider maintaining a budget that separates crucial expenses from discretionary spending. This practice will help ensure that your emergency fund remains a reliable safety net when you truly need it.

Conclusion

Now that you understand the importance of building an emergency fund before stepping into investments, you can take actionable steps to protect yourself financially. Start by setting a savings goal that covers at least three to six months’ worth of expenses. For guidance, check out these 6 Steps to Creating an Emergency Fund. By prioritizing this fund, you secure your financial future and set a strong foundation for your investment journey.

FAQ

Q: Why is it important to have an emergency fund before I start investing?

A: An emergency fund serves as a financial safety net that protects you from unforeseen expenses, such as medical emergencies, car repairs, or job loss. By having this fund in place, you can avoid dipping into your investments during a financial crisis, which can lead to potential losses. It’s about creating a stable foundation so you can invest confidently and focus on your long-term financial goals without the stress of immediate financial pressures.

Q: How much should I save for my emergency fund before I begin investing?

A: Financial experts generally recommend aiming for three to six months’ worth of living expenses in your emergency fund. This amount may vary based on personal circumstances, such as job stability and family size. It’s beneficial to evaluate your specific needs and consider factors like your income source and overall financial situation. Once you reach this target, you’ll have a better safety net in place, allowing you to shift your focus toward investing.

Q: What are some effective strategies to build my emergency fund quickly?

A: There are several strategies you can use to accelerate the growth of your emergency fund. First, create a dedicated savings account that earns interest and is separate from your everyday spending accounts. Next, set a monthly savings goal that aligns with your budget, and automate your savings to make it a regular habit. Additionally, you can consider cutting back on discretionary expenses, selling unused items, or taking on extra work to bolster your savings. The key is consistency and commitment to your goal.