Delayed by just a few seconds or streaming in real-time, the type of market data you have access to can significantly impact your trading decisions. Understanding the distinction between real-time and delayed market data is crucial for making informed choices in the fast-paced world of trading tools. Let’s look into the nuances of these two types of data and how they can influence your trading strategies.

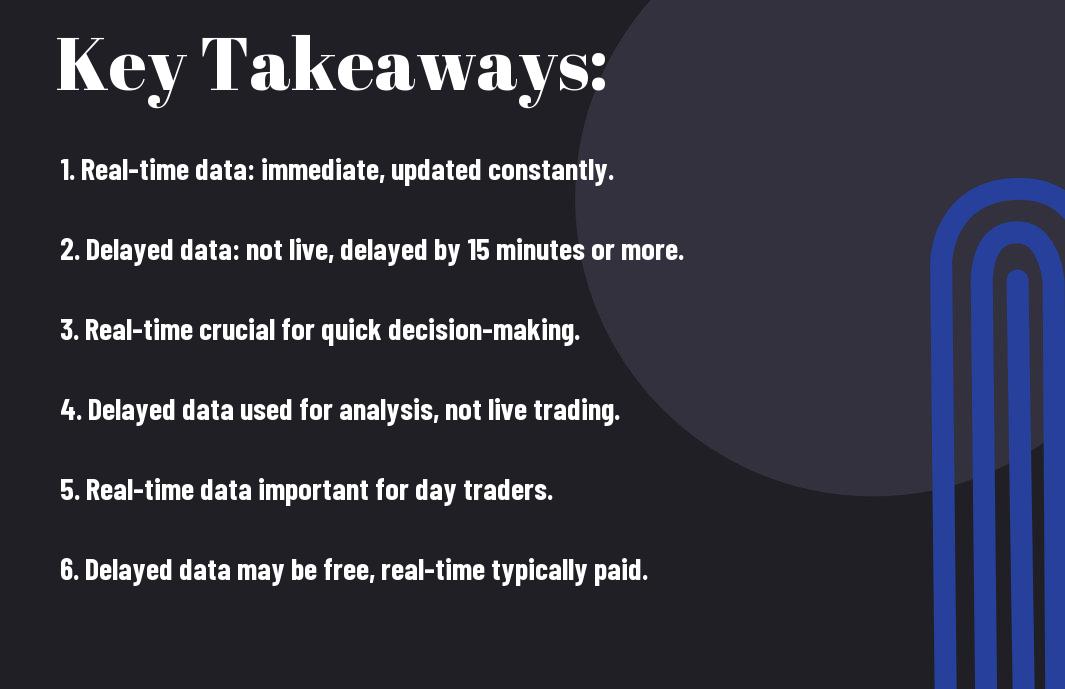

Key Takeaways:

- Real-time market data: Provides up-to-the-second information on stock prices, trades, and market movements.

- Delayed market data: Involves a slight time lag before the information is received, usually around 15 minutes.

- Impact on trading: Traders who rely on real-time data make quicker and more informed decisions, while those using delayed data may experience missed opportunities or inaccurate market readings.

Defining Market Data

Real-Time Market Data

The world of trading moves at lightning speed, and having access to real-time market data is crucial for making informed decisions. An necessary component of trading tools, real-time market data provides you with up-to-the-second information on stock prices, volume, and other market indicators. This instantaneous data allows you to react quickly to market movements and execute trades with precision.

Delayed Market Data

For some traders, delayed market data may be sufficient for their trading strategy. This type of data is slightly older, typically delayed by 15 minutes or more from real-time. While not as immediate as real-time data, delayed market data can still give you a sense of market trends and price movements over a short period. It can be a cost-effective option for traders who do not require instant data and are looking to save on subscription fees.

Another important aspect to consider with delayed market data is that in fast-paced markets or during times of high volatility, even a delay of a few minutes can mean missing out on crucial information that could impact your trading decisions. It’s necessary to evaluate your trading style and goals to determine whether real-time or delayed market data is the right fit for you.

Importance of Timeliness in Trading

Impact on Trading Decisions

One of the most critical aspects of successful trading is making timely decisions based on the most current market information available. Real-time data provides you with up-to-the-second insights into stock prices, trends, and trading volumes, allowing you to react swiftly to market fluctuations. In contrast, delayed market data can hinder your ability to make informed decisions, potentially causing you to miss out on profitable trading opportunities or avoid losses.

Benefits of Real-Time Data

An vital benefit of using real-time data in your trading activities is the ability to capitalize on instantaneous market movements. With real-time data, you can quickly identify emerging trends, detect price fluctuations, and execute trades at the most opportune moments. This immediacy empowers you to react promptly to changing market conditions, giving you a competitive edge over traders relying on delayed information.

Real-time data also enhances your risk management strategies by providing you with a more accurate picture of market dynamics. By staying informed in real-time, you can set stop-loss orders, adjust your trading positions, and implement effective risk mitigation tactics promptly, reducing the likelihood of substantial losses in volatile market conditions.

Characteristics of Real-Time Market Data

Instantaneous Updates

Unlike delayed market data, real-time market data provides you with instantaneous updates on price changes, volume, and other imperative market information. This means that you are receiving the most current data available, allowing you to make informed trading decisions based on up-to-the-second information.

Live Feeds

Characteristics of real-time market data include live feeds that deliver information directly from the exchanges. These live feeds offer you a constant stream of data without any delay, ensuring that you are always informed about the latest market developments.

Plus, real-time market data allows you to see the bid and ask prices in real-time, giving you a more comprehensive view of the market depth and potential price movements.

Accurate Reflection of Market Conditions

One key characteristic of real-time market data is its ability to provide an accurate reflection of current market conditions. With real-time data, you can see price changes as they happen, enabling you to react quickly to market dynamics and seize trading opportunities.

The immediacy of real-time market data gives you a competitive edge in fast-moving markets, where split-second decisions can make a significant difference in your trading results.

Characteristics of Delayed Market Data

All What is Real-Time Market Data & How to Use It – Intrinio trading tools have access to market data, but not all of it is real-time. Delayed market data, as the name suggests, is not updated instantly and comes with its own set of characteristics that you should be aware of.

Time Lag

Characteristics of delayed market data include a time lag between when an event occurs in the market and when the data reflecting that event is delivered to you. This time lag can range from a few seconds to several minutes, depending on the source of the data and the platform you are using. While this data may still be useful for some types of analysis and trading strategies, it is important to understand that you are not receiving real-time information.

Historical Data

Historical data is another key feature of delayed market data. This type of data provides you with information on past price movements, volume, and other market activities. While historical data can be valuable for backtesting strategies and analyzing trends, it is important to remember that this information is based on past market conditions and may not accurately reflect current market dynamics.

Data

Delayed market data can be a cost-effective option for traders who do not require up-to-the-second information or for those who are looking to supplement real-time data with historical insights. It can also be a useful tool for educational purposes, allowing you to learn about market movements and trends without the pressure of real-time decision-making.

Limited Use in Fast-Moving Markets

Characteristics of delayed market data mean that it has limited use in fast-moving markets where split-second decisions can make a significant impact on your trading outcomes. When markets are volatile or experiencing rapid price fluctuations, delayed data may not provide you with the timely information you need to react effectively. In such situations, having access to real-time data becomes crucial for making informed and timely trading decisions.

Plus, it is vital to consider the nature of your trading activities and the level of accuracy and timeliness required for your strategies when choosing between delayed and real-time market data. Understanding the characteristics of both types of data will help you make more informed decisions and maximize your trading potential.

Applications of Real-Time Market Data

High-Frequency Trading

With The Power of Delayed Market Data well understood, the use of real-time market data in high-frequency trading strategies becomes crucial. High-frequency trading involves executing a large number of trades at extremely fast speeds based on pre-programmed algorithms. Real-time market data is necessary for these strategies as even the slightest delay can result in missed opportunities or potential losses. Traders rely on up-to-the-millisecond pricing information to make split-second decisions and capitalize on market movements.

Algorithmic Trading

To take advantage of market inefficiencies, algorithmic trading requires real-time market data to automate trading decisions based on predefined criteria. Algorithms can analyze vast amounts of data at lightning speed, identify patterns, and execute trades accordingly. Real-time data allows these algorithms to react swiftly to changing market conditions, enabling traders to stay competitive in today’s fast-paced markets.

Algorithmic trading has gained popularity due to its ability to remove emotions from trading, minimize human errors, and execute trades with precision and speed. By leveraging real-time market data, algorithmic trading strategies can adapt to market fluctuations and adjust trading positions accordingly to optimize trading outcomes.

Informed Investment Decisions

Trading with the latest real-time market data empowers you to make informed investment decisions based on the most up-to-date information available. Whether you are a day trader looking to capitalize on short-term price movements or a long-term investor assessing market trends, real-time data enhances your ability to react quickly to market developments and make well-informed investment choices.

This heightened level of data transparency can significantly impact your trading decisions, helping you to identify emerging opportunities, mitigate risks, and improve the overall performance of your investment portfolio. By staying informed with real-time market data, you can gain a competitive edge in the dynamic world of trading and investing.

Limitations and Challenges of Real-Time Market Data

Cost and Accessibility

Market data providers often charge a premium for real-time data compared to delayed data. This cost can be a barrier for individual traders, especially those starting out with limited funds. Additionally, accessing real-time market data may require specialized software or connections, which can further add to the expenses.

Information Overload

Real-time market data can overwhelm you with a continuous stream of information, making it challenging to filter out the noise and focus on what truly matters. With price quotes, market news, and various indicators constantly updating, it’s easy to get distracted or make rushed trading decisions based on short-term fluctuations rather than long-term trends.

Overload of information can lead to analysis paralysis, where you become so inundated with data that you struggle to make clear, rational trading choices. It’s vital to develop a strategy that helps you filter out irrelevant information and stay focused on your trading goals.

Technical Requirements

Challenges may arise with real-time market data due to the technical requirements involved in processing and interpreting the data. You need a stable internet connection, reliable hardware, and software that can handle the constant flow of data without lagging or crashing. Moreover, interpreting real-time data requires a certain level of expertise to avoid misinterpreting signals and making costly mistakes.

A solid understanding of the technology and tools used to access real-time market data is crucial for effectively utilizing this information in your trading strategy. It’s vital to stay updated on the latest developments in trading software and technology to ensure you can capitalize on the benefits of real-time data while navigating its challenges.

Summing up

On the whole, understanding the difference between real-time and delayed market data in trading tools is crucial for making informed decisions in the financial markets. Real-time data provides up-to-the-second information on price movements, while delayed data can lag behind by several minutes. This distinction can have a significant impact on the accuracy of your trading strategies and the timing of your trades.

By utilizing real-time data, you can react swiftly to market changes and capitalize on opportunities before they disappear. Alternatively, delayed data may lead to missed opportunities or inaccurate assessments of market conditions. Therefore, it is crucial to choose the right data feed for your trading needs to stay ahead of the curve and maximize your investment potential.

FAQ

Q: What is real-time market data in trading tools?

A: Real-time market data in trading tools refers to the instantaneous and live updating of stock prices, market depth, and other relevant trading information. This data is crucial for making split-second trading decisions based on the most current market conditions.

Q: What is delayed market data in trading tools?

A: Delayed market data in trading tools is information that is not updated in real-time. There is a short delay (usually around 15 minutes) between when the data is generated and when it is displayed to the trader. This can impact the accuracy of the information, especially for highly volatile markets.

Q: What are the differences between real-time and delayed market data in trading tools?

A: The main difference between real-time and delayed market data is the timing of the updates. Real-time data provides up-to-the-second information, allowing traders to react quickly to market changes. On the other hand, delayed data has a lag, which can result in missed trading opportunities or inaccurate decision-making due to outdated information.