Mining is the process by which new cryptocurrency transactions are verified and added to the blockchain. If you’re interested in understanding how this complex system works, you’re in the right place. In this post, you’ll learn about the different types of mining, the technology involved, and the potential benefits and risks that come with it. For a deeper understanding, you can explore What Is Crypto Mining? Overview, Benefits, & Risks to broaden your knowledge.

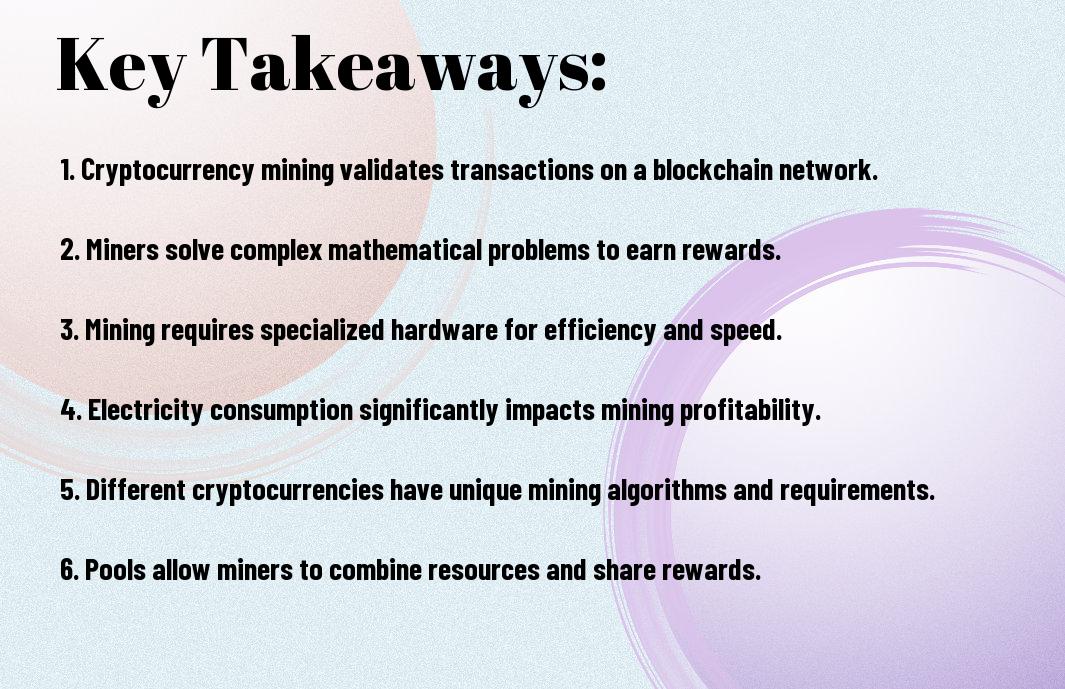

Key Takeaways:

- Cryptocurrency Mining is the process of validating transactions on a blockchain network and adding them to the public ledger.

- Mining Hardware can range from standard CPUs to advanced GPUs and specialized ASIC miners, each offering different levels of efficiency and power.

- Proof of Work is a common consensus mechanism used in mining, requiring miners to solve complex mathematical problems to secure the network.

- Rewards for mining typically include newly minted coins and transaction fees, incentivizing miners to contribute their computational power.

- Mining Difficulty adjusts over time based on network activity, influencing the competitiveness and profitability of mining efforts.

What is Cryptocurrency Mining?

As you explore the world of cryptocurrencies, you’ll encounter the term ‘mining,’ which refers to the process of validating and recording transactions on a blockchain. This decentralized activity is necessary for maintaining the integrity and security of various digital currencies, ensuring that the network remains operational and trustworthy. By engaging in mining, you not only help support the cryptocurrency’s infrastructure but also have the potential to earn rewards in the form of new coins or transaction fees.

Definition and Purpose

Against the backdrop of digital finance, cryptocurrency mining is the method by which new coins are created and transaction data is verified on the blockchain. This process involves solving complex mathematical problems, which ultimately secures the network and adds verified blocks of transactions to the public ledger.

Importance in the Blockchain Ecosystem

Purpose of cryptocurrency mining extends beyond merely generating new coins; it plays a significant role in maintaining the overall stability and security of the blockchain ecosystem. By participating in this decentralized process, you contribute to the network’s resilience against fraud and attacks, ensuring the accuracy of the transaction history.

The decentralized nature of mining means that it distributes power among various participants, preventing any single entity from gaining control. This diversity enhances security, as multiple miners work to validate transactions without relying on a central authority. By supporting the ecosystem through mining, you help preserve the core principles of cryptocurrency: decentralization, transparency, and security.

Types of Cryptocurrency Mining

One of the first things you should know about cryptocurrency mining is that there are several types to consider. Here are the most popular methods:

- Proof of Work (PoW)

- Proof of Stake (PoS)

- Delegated Proof of Stake (DPoS)

- Hash Time-Locked Contracts (HTLC)

- Leased Proof of Stake (LPoS)

After exploring these types, you can choose the method that fits your needs and goals.

| Type | Description |

|---|---|

| Proof of Work | Mining through computational power. |

| Proof of Stake | Mining based on the amount of cryptocurrency owned. |

| Delegated Proof of Stake | Voting system for block producers. |

| Hash Time-Locked Contracts | Conditional contracts on blockchain. |

| Leased Proof of Stake | Leasing your coins to earn rewards. |

Proof of Work

After understanding mining, you will notice that Proof of Work (PoW) is the original consensus mechanism that cryptocurrencies like Bitcoin employ. It requires miners to solve intricate mathematical problems using computational resources. This process not only helps to secure the network but also validates transactions. You will need specialized hardware and significant power consumption to be competitive in PoW mining.

Proof of Stake

To contrast PoW, Proof of Stake (PoS) offers a more energy-efficient alternative. In this system, you can validate transactions and create new blocks based on the number of coins you hold and are willing to “stake” or lock up. Essentially, the more you hold, the greater your chances of being selected for mining blocks, which can lead to rewards.

Plus, PoS can often lead to faster transaction times and lower energy costs compared to PoW. It encourages long-term holding of coins, as staking your assets can earn you passive income. As a miner using PoS, you participate in the network’s security while contributing to its efficiency and sustainability. This could potentially make PoS a more attractive option for many in the cryptocurrency community.

Mining Hardware

Keep in mind that the choice of mining hardware significantly impacts your mining efficiency and profitability. Selecting the right equipment tailored to the cryptocurrency you want to mine is necessary, as different coins require different types of hardware. Whether you go for CPUs, GPUs, or specialized ASIC miners will determine your mining success and energy consumption.

CPU vs. GPU Mining

For newcomers, it’s vital to understand the primary difference between CPU and GPU mining. While CPUs can handle multiple tasks, GPUs are specifically designed for parallel processing, making them more effective for mining complex algorithms found in various cryptocurrencies. This distinction can greatly affect your mining output and overall performance.

ASIC Miners

One of the most powerful options available for cryptocurrency mining is the use of ASIC miners. These Application-Specific Integrated Circuits are designed specifically for mining, offering unmatched speed and efficiency compared to traditional CPUs and GPUs.

Hardware used in ASIC miners is optimized for specific hashing algorithms utilized by certain cryptocurrencies, allowing you to mine at significantly higher rates. While the initial investment in ASIC miners can be substantial, their superior hashing power can lead to increased profitability over time, especially for Bitcoin and other major coins. Understanding their functionality and suitability for your mining strategy will help you make informed decisions in your crypto mining journey.

Mining Software

For successful cryptocurrency mining, having the right mining software is vital. Mining software connects your hardware to the blockchain network, allowing you to mine effectively. It processes the mining algorithms, providing you with the necessary tools to monitor your mining operations and manage your earnings. Choosing the appropriate software can significantly impact your mining efficiency and overall profitability.

Overview of Popular Mining Software

Mining software options vary widely, with popular choices including CGMiner, BFGMiner, and EasyMiner. Each has its unique features, from user-friendly interfaces to advanced customization and performance optimization. As you explore your options, consider what aligns best with your mining hardware and preferred cryptocurrencies.

Choosing the Right Software

To select the right mining software, consider factors such as ease of use, compatibility with your hardware, and supported cryptocurrencies. You may also want to evaluate the software’s features, such as performance analytics and mining pool integration, to ensure it meets your needs.

Software performance can directly affect your mining success, so it’s vital to do your research. Look for user reviews and community feedback, as these insights can help you identify which software delegates effectively to your chosen hardware setup. Additionally, consider the level of support the software offers, as this can be invaluable, especially as you navigate the early stages of your mining journey.

Mining Pools

Not every individual miner can successfully mine cryptocurrency alone due to the high difficulty levels involved. This is where mining pools come into play, allowing miners to combine their computational power and increase their chances of earning rewards. To learn more about this collaborative approach, check out Bitcoin Mining: Everything You Need to Know!.

Advantages of Joining a Pool

An obvious advantage of joining a mining pool is the steady income it can provide through collective rewards. By pooling resources, you can minimize variance in earnings, allowing you to earn more consistently over time, rather than relying solely on the luck of solo mining. This makes it a more appealing option for many miners.

How to Choose a Mining Pool

Mining pools vary in size, fee structures, and payout methods. Analyze these factors to find one that aligns with your goals. An ideal pool will also have a good reputation in the community, offering reliable payouts and efficient server operations, which can significantly affect your profitability.

Advantages of selecting the right mining pool include access to shared resources, which can lower the barrier to entry for smaller miners. You’ll want to consider factors like the pool’s fees, payout methods, and the level of support they provide. Additionally, verify their uptime and security features, as these impacts your overall mining experience. Keep an eye on community reviews and discussions to gauge reliability and performance, ensuring your efforts yield the best possible returns.

Cryptocurrency Mining Economics

Once again, understanding the economics of cryptocurrency mining is vital for anyone considering entering this space. Factors like the cost of electricity, hardware efficiency, and cryptocurrency price fluctuations all play important roles in determining your profitability. For a deeper probe the inner workings, check out How Does Bitcoin Mining Work? A Beginner’s Guide.

Costs Involved

Along with the initial investment in mining hardware, you need to factor in ongoing expenses such as electricity, cooling, and potentially even rent for your mining space. Efficient mining machines can minimize these costs, but high electricity rates can still significantly affect your bottom line.

Potential Profitability

For investors, potential profitability hinges on various elements including the value of the mined cryptocurrency, your operating costs, and network difficulty. As these factors fluctuate, your earnings can vary dramatically, making it necessary to stay informed and adapt your strategy accordingly.

At times, mining may yield higher returns, particularly during bullish market trends or when mining rewards are substantial. However, be wary of the risks associated with market volatility; profits can diminish rapidly if the cryptocurrency prices drop or if mining difficulty increases. Knowing when to mine or hold can ultimately shape your overall success in the cryptocurrency mining realm.

Final Words

On the whole, understanding the basics of cryptocurrency mining equips you with the knowledge to navigate the ever-evolving digital landscape. By grasping the fundamentals—from the technology behind blockchain to the steps involved in mining—you gain insight into an necessary component of the cryptocurrency ecosystem. Whether you’re considering investing time or resources into mining or simply wish to stay informed, having a solid foundational understanding will empower you to make informed decisions in your cryptocurrency journey.

Q: What is cryptocurrency mining and how does it work?

A: Cryptocurrency mining is the process by which new digital coins are generated and transactions are verified and added to the blockchain. Miners use powerful computers to solve complex mathematical problems that validate transactions. Once a problem is solved, a new block is added to the blockchain, and the miner is rewarded with newly created coins as well as transaction fees from the validated transactions.

Q: What equipment do I need for cryptocurrency mining?

A: To mine cryptocurrency effectively, you need specialized hardware. This typically includes ASIC (Application-Specific Integrated Circuit) miners for coins like Bitcoin, or GPUs (Graphics Processing Units) for other cryptocurrencies like Ethereum. Additionally, you’ll need a stable internet connection, adequate cooling solutions for your hardware, and access to a mining pool if you choose to collaborate with others to increase your chances of earning rewards.

Q: Are there any energy costs associated with cryptocurrency mining?

A: Yes, cryptocurrency mining consumes a significant amount of electricity. The energy consumed depends on your mining equipment’s power efficiency and the difficulty of the mining process for the specific cryptocurrency. It’s important to calculate the cost of electricity in relation to the potential earnings from mining to ensure that the endeavor is financially viable. Many miners look for locations with lower electricity rates to optimize profitability.