Calculate the true value of a stock to make informed investment decisions that align with your financial goals. Understanding the worth of a stock requires analyzing various financial metrics and market conditions. By employing valuation methods such as discounted cash flow, price-to-earnings ratios, and comparable company analysis, you can gain deeper insights into whether a stock is undervalued or overvalued. This guide will walk you through each step, helping you develop confidence in assessing the potential of your investments.

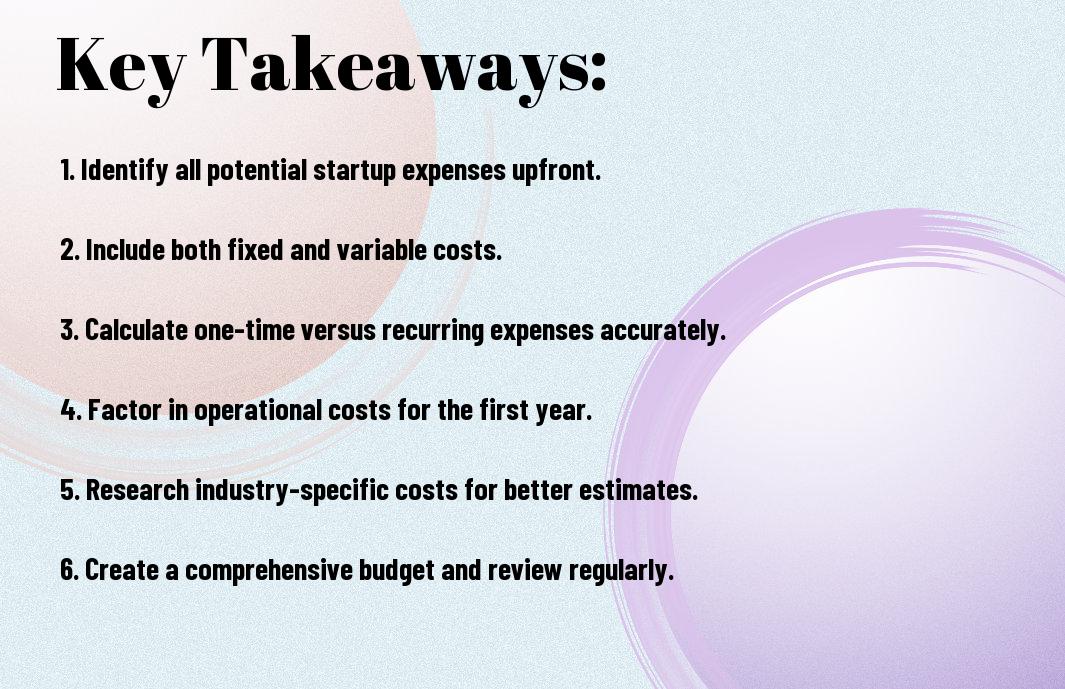

Key Takeaways:

- Discounted Cash Flow (DCF) analysis is necessary in assessing a stock’s intrinsic value by estimating its future cash flows and discounting them to present value.

- Price-to-Earnings (P/E) Ratio can provide context by comparing a company’s stock price to its earnings per share, helping to identify if a stock is undervalued or overvalued relative to its peers.

- Market Trends and economic indicators should be considered alongside financial metrics to form a comprehensive view of a stock’s potential and risks.

Understanding Stock Valuation

Before you can accurately determine the true value of a stock, it is necessary to comprehend the different methods of stock valuation. Stock valuation involves assessing a company’s worth using various models and metrics that consider financial performance, future growth potential, and market conditions. By understanding these concepts, you’ll be better equipped to make informed investment decisions that align with your financial goals.

The Concept of Intrinsic Value

One of the fundamental aspects of stock valuation is the concept of intrinsic value, which represents the true worth of a company based on its fundamental characteristics. This value is derived from factors such as earnings, dividends, and growth potential, independent of market fluctuations. By calculating intrinsic value, you can identify whether a stock is undervalued or overvalued in the market.

Market Price vs. Intrinsic Value

Any investor should recognize the difference between market price and intrinsic value. Market price is what investors are currently willing to pay for a stock, influenced by supply and demand, market sentiment, and macroeconomic factors. In contrast, intrinsic value is an objective assessment based on company fundamentals, meaning a stock can be trading above or below its true worth at any given time.

At times, the market price of a stock can diverge significantly from its intrinsic value. This discrepancy can occur due to market emotion, trends, or broader economic conditions leading to over- or underpricing. Understanding this difference helps you identify potential investment opportunities, enabling you to buy undervalued stocks or sell overvalued positions, thus enhancing your overall investment strategy.

Key Methods for Valuing Stocks

Even though there are numerous approaches to valuing stocks, selecting the right method depends on your investment strategy and the specific characteristics of the company. In this section, you’ll explore the most effective techniques, including Discounted Cash Flow (DCF) Analysis and the Price-to-Earnings (P/E) Ratio, which can help you assess a stock’s true worth and make informed investment decisions.

Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) analysis is a powerful valuation method that estimates a stock’s intrinsic value based on its expected future cash flows. By forecasting these cash flows and discounting them to their present value, you can identify whether a stock is undervalued or overvalued relative to its current market price.

Price-to-Earnings (P/E) Ratio

Below the surface of valuation metrics, the Price-to-Earnings (P/E) ratio stands out as a fundamental indicator of a company’s profitability relative to its stock price. This ratio can help you compare a company’s valuation against its peers and gauge investor sentiment.

This ratio is calculated by dividing the current share price by its earnings per share (EPS), providing a straightforward way to assess whether a stock is overvalued or undervalued. A high P/E ratio may indicate that the market expects future growth, while a low ratio might suggest undervaluation or declining earnings. It’s imperative to compare the P/E ratio with industry averages and historical values for a comprehensive understanding of the stock’s performance.

Assessing Company Fundamentals

Now that you’re ready to evaluate a stock, assessing company fundamentals plays a vital role in determining its true value. This process involves diving deep into financial performance metrics, understanding the business model, and evaluating management effectiveness. By analyzing these factors, you can make informed investment decisions that align with your financial goals and risk tolerance.

Analyzing Financial Statements

An important part of assessing fundamentals is analyzing financial statements, including the income statement, balance sheet, and cash flow statement. These documents provide insight into the company’s profitability, liquidity, and overall financial health. Focus on key ratios such as the price-to-earnings ratio and debt-to-equity ratio to gain a clearer picture of how well the company is performing.

Evaluating Management and Business Model

Besides financial statements, evaluating management and the business model is equally important. This involves examining the leadership team’s track record and how effectively they adapt to market changes. Assess the company’s unique value proposition, competitive advantages, and potential for growth in your analysis to better understand its long-term viability.

With a keen eye on both management and the business model, you can gain insights into how strategic decisions impact overall performance. Assess the experience and background of key executives while considering their vision for the company. An effective team generally leads to a strong business model that can withstand economic fluctuations and competition, offering you a more compelling investment opportunity.

Market Conditions and Their Impact

After understanding the fundamentals of stock valuation, you need to analyze the broader market conditions. Factors such as economic cycles, geopolitical events, and consumer sentiment can significantly influence stock prices. By assessing these external elements, you can better predict market movements and their potential effects on the stocks you are evaluating.

Economic Indicators

Behind every sound investment decision, there are imperative economic indicators that provide insight into market health. You should pay attention to metrics like GDP growth rates, unemployment figures, and inflation levels, as they reflect the overall economic environment and can help you gauge the potential performance of your stocks.

Industry Trends

To effectively analyze your stock, you must stay informed about the trends within the industry in which the company operates. These trends can reveal shifts in consumer behavior, technological advancements, or regulatory changes that could impact a company’s growth potential and profitability.

Hence, monitoring industry trends allows you to align your investment strategy with market trajectories. By focusing on emerging technologies, consumer preferences, and competitive dynamics, you can identify sectors that are poised for growth or decline. This knowledge helps you make more informed decisions about which stocks to include in your portfolio, ultimately enhancing your investment outcomes.

Behavioral Finance and Stock Valuation

Keep in mind that behavioral finance plays a significant role in stock valuation, as it addresses how psychological factors affect investor decisions. Emotional responses and cognitive biases can lead to mispricing in the stock market. Understanding these nuances can help you make more informed decisions. For more insights, check out How To Determine The True Value Of A Stock?

Investor Sentiment

On the other hand, investor sentiment can greatly influence market trends. When investors exhibit extreme optimism or pessimism, it can lead to significant fluctuations in stock prices that do not align with a company’s fundamentals. Being aware of these trends helps you navigate the market more effectively.

Market Anomalies

Behavioral finance also highlights market anomalies, which occur when stock prices deviate from their expected values based on traditional financial theories. These irregularities often arise from investor behavior, such as overreaction to news or trends, leading to potential profit opportunities if you can identify and act upon them.

Market anomalies can often lead to inefficiencies, creating situations where a stock may be undervalued or overvalued. This means that, despite strong fundamentals, a company’s stock price may not reflect its true worth due to market psychology. By recognizing these anomalies, you can exploit pricing inefficiencies to enhance your investment strategy and maximize returns.

Practical Steps for Valuation

Many investors find value in following a structured approach to stock valuation. By breaking down the process into clear steps, you can gain a better understanding of a stock’s worth and make informed decisions. Start by gathering pertinent data, performing necessary calculations, and analyzing the results to arrive at a well-rounded valuation.

Gathering Information

About valuation, the first step is collecting relevant information about the stock you are analyzing. This includes financial statements, recent earnings reports, industry benchmarks, and market trends. Utilize reliable sources such as company filings, financial news websites, and stock analysis platforms to gather comprehensive data that will support your valuation process.

Performing Calculations

Among the necessary steps in valuing a stock is performing various calculations, such as determining earnings per share (EPS), price-to-earnings (P/E) ratio, and discounted cash flow (DCF) analysis. Each of these metrics provides valuable insights into the stock’s performance and future potential. A diligent approach to these calculations will help you quantify the stock’s current worth accurately.

Gathering the necessary financial data and inputting it into the formulas will allow you to assess the company’s profitability and growth potential. Ensure that you are using the most recent and accurate figures, as they will significantly impact your calculations. Familiarizing yourself with valuation models like DCF will enable you to project future cash flows and adjust their present value, solidifying your overall analysis.

To Wrap Up

Taking this into account, understanding how to calculate the true value of a stock involves assessing various metrics such as earnings, dividends, and growth potential. You’ll want to evaluate both qualitative and quantitative factors to arrive at a well-rounded assessment of a stock’s worth. By employing methods like discounted cash flow analysis and comparing historical performance, you empower yourself to make more informed investment decisions. Ultimately, applying these techniques will help you identify undervalued stocks and refine your overall investment strategy.

FAQ

Q: What are the primary methods to calculate the true value of a stock?

A: There are several key methods used to calculate the true value of a stock. The most common include the Discounted Cash Flow (DCF) analysis, which estimates the present value of future cash flows; the Price-to-Earnings (P/E) ratio, which compares a company’s current share price to its earnings per share; and the Dividend Discount Model (DDM), which calculates the present value of expected future dividends. Each of these methods can provide insights into whether a stock is overvalued, undervalued, or fairly priced, but it’s important to use multiple methods for a comprehensive analysis.

Q: How does the Discounted Cash Flow (DCF) analysis work?

A: The Discounted Cash Flow (DCF) analysis works by projecting the future cash flows of a company and discounting them back to their present value using a discount rate, which typically reflects the risk associated with the investment. The formula involves estimating future cash flows, determining the appropriate discount rate, and summing the present values of those cash flows. Ultimately, this analysis provides an estimate of the intrinsic value of a stock, allowing investors to assess whether the current market price is justified.

Q: What role do market conditions play in determining a stock’s true value?

A: Market conditions play a significant role in determining a stock’s true value. Factors such as economic indicators, market trends, interest rates, and investor sentiment can greatly influence stock prices. When market conditions are favorable, investors may be willing to pay a premium for stocks, potentially leading to overvaluation. Conversely, during economic downturns, stocks may be undervalued due to pessimism. Therefore, it’s vital for investors to consider both the intrinsic value derived from calculations and the prevailing market conditions when assessing a stock’s true value.