Downturns in the economy can catch even the most prepared businesses off guard, making it vital for you to have a solid strategy in place. Understanding how to navigate these challenging times can mean the difference between survival and closure. In this post, you will learn actionable steps to fortify your business against potential economic hardship, from cost management to strengthening customer relationships. By preparing proactively, you can position your business to withstand fluctuations and emerge stronger when the economy rebounds.

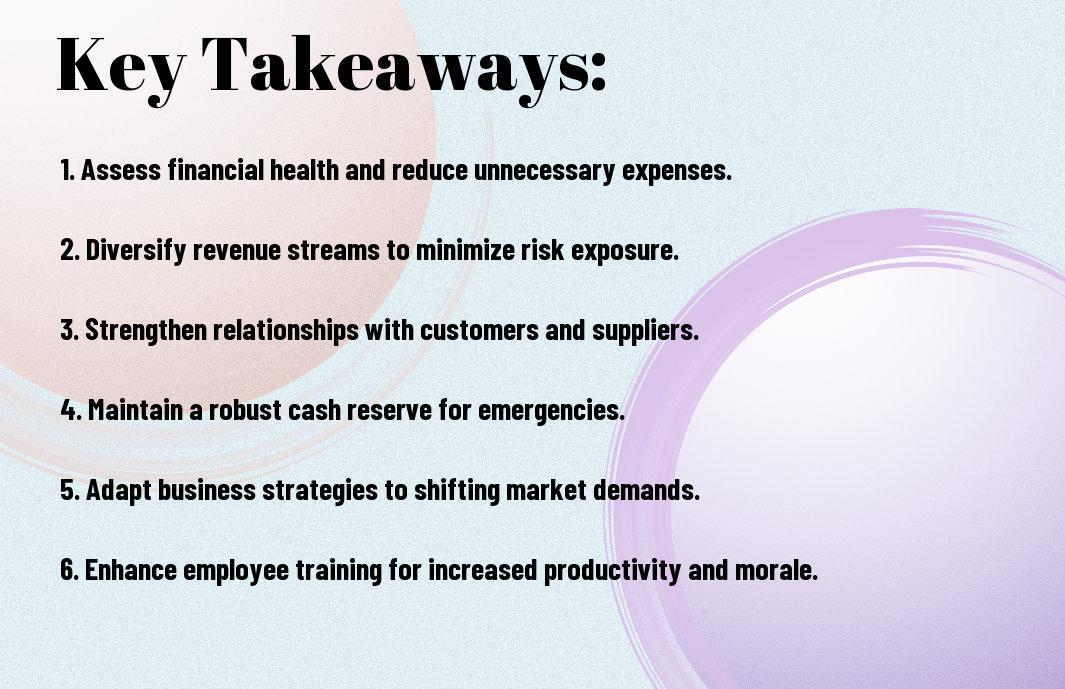

Key Takeaways:

- Diversify Revenue Streams: Explore new markets or products to minimize dependency on a single source of income.

- Optimize Cash Flow: Implement strict budgeting and monitor expenses more closely to ensure liquidity during tough times.

- Strengthen Customer Relationships: Enhance communication and engagement with clients to foster loyalty and retain business during downturns.

Understanding Economic Downturns

A business owner must grasp the concept of economic downturns to effectively navigate the challenges they pose. These periods of economic contraction can impact consumer spending, investment, and overall business performance, leading to decreased revenues and potential layoffs. Understanding the drivers behind such downturns can better inform your strategy for resilience and recovery.

Definition and Causes

About economic downturns, they are temporary periods of economic decline, typically characterized by decreased gross domestic product (GDP), increased unemployment, and reduced consumer spending. Various factors can trigger these downturns, including financial crises, changes in consumer confidence, or global events disrupting markets or supply chains.

Historical Perspectives

The analysis of past economic downturns provides valuable insights into their cyclical nature and the patterns that emerge during such times. Historical events like the Great Depression of the 1930s, the 2008 financial crisis, and the COVID-19 pandemic all demonstrate how sudden economic shocks can affect businesses differently, often leading to widespread innovation and adaptation. By studying these occurrences, you can identify potential warning signs and enhance your preparedness for future downturns.

Further exploration into historical economic downturns reveals that businesses that pivoted quickly or adopted new business models often emerged stronger. Analyzing the strategies employed by successful companies during tough times helps you learn how to mitigate risks and leverage opportunities when similar challenges arise in the future. This knowledge allows you to build a more resilient business that can weather economic fluctuations effectively.

Assessing Your Current Business Situation

Assuming you want to prepare your business for an economic downturn, the first step is to assess your current situation thoroughly. This involves taking stock of your overall performance, operational efficiency, and market positioning. Gathering as much data as possible will allow you to recognize your strengths and weaknesses, enabling you to make informed decisions for future resilience. Conducting a comprehensive assessment will help you identify the necessary adjustments required to weather potential economic challenges.

Financial Health Evaluation

Assessing your financial health is vital to understanding your business’s resilience. Begin by reviewing your profit margins, cash flow, and debt levels to gauge your overall stability. Analyze your financial statements and key performance indicators to identify trends and areas for improvement. By painting a clear picture of your financial standing, you can better prepare for unexpected downturns.

Identifying Vulnerabilities

For your business to thrive during uncertain times, you need to identify vulnerabilities that may put you at risk. Recognizing weak points in your operations, supply chain, or customer base can help you focus on mitigating those risks. By doing so, you can develop strategies that enhance your business’s stability and longevity.

Understanding your vulnerabilities requires a comprehensive analysis of different factors that could impact your business. Evaluate areas such as dependency on specific suppliers or customers, reliance on limited product lines, and potential gaps in your operational processes. By pinpointing these risks, you can devise contingency plans, diversify your offerings, and strengthen your relationships within your industry. This proactive approach will not only safeguard your business during downturns but also enhance your overall resilience against future challenges.

Strategic Planning for Resilience

Not every business is equipped to weather financial storms, which is why strategic planning for resilience is vital. You should assess your strengths, weaknesses, opportunities, and threats to ensure you can adapt to changing conditions. For more insights on adapting your business, check out How To Prepare Your Company for a Recession or ….

Diversifying Revenue Streams

Below diversifying your revenue streams can help you stabilize your income during economic fluctuations. Consider introducing complementary products or services that appeal to your existing customer base or explore new markets that align with your business’s expertise.

Adjusting Operational Expenses

To maintain financial stability, you must regularly assess and adjust operational expenses. This can involve reevaluating vendor contracts, streamlining processes, and identifying non-vital expenditures that can be trimmed.

Adjusting your operational expenses requires a thorough review of your budget and spending patterns. Look for areas where costs can be cut without sacrificing quality or efficiency. Engaging your team in brainstorming sessions can uncover innovative ways to save money, including leveraging technology and optimizing resource allocation. By doing so, you can create a leaner business model that effectively sustains you through economic challenges.

Strengthening Customer Relationships

To navigate an economic downturn effectively, strengthening your customer relationships is imperative. Engaging with your customers regularly will not only enhance their loyalty but also position your business as a reliable partner during tough times. By focusing on personalized experiences and addressing your customers’ needs, you can cultivate long-lasting connections that contribute to your business’s resilience.

Enhancing Communication

Besides improving your products or services, enhancing communication with your customers fosters trust and transparency. Regular updates, feedback requests, and active engagement through social media can help you understand their concerns while reinforcing your commitment to their satisfaction.

Adapting to Changing Needs

Along with maintaining strong communication, adapting to your customers’ changing needs is vital in an uncertain economy. Being responsive to shifts in preferences or challenges allows your business to remain relevant and build loyalty among clientele.

This adaptability involves actively monitoring market trends and gathering customer feedback. By recognizing and anticipating shifts in consumer behavior, you can modify your offerings and approaches accordingly. This might include introducing new products or services based on emerging demands or adjusting pricing structures to accommodate tighter budgets. Your willingness to evolve demonstrates that you genuinely care about your customers, fostering deeper connections that endure through economic fluctuations.

Building an Emergency Fund

Now is the time to prioritize building an emergency fund for your business. This fund acts as a financial cushion in times of economic uncertainty, helping you navigate unexpected expenses or downturns. Aim to set aside three to six months’ worth of operating expenses to provide you with the necessary liquidity to sustain your business while you adjust to changing market conditions.

Importance of Liquidity

Across varied industries, having liquidity is important for maintaining operational stability. It allows you to cover day-to-day expenses and respond to unexpected challenges, such as a sudden decrease in revenue or increased costs. A business with sufficient liquid assets is better equipped to seize opportunities that may arise, ensuring longevity and resilience.

Strategies for Savings

Strategies for savings can significantly enhance your emergency fund. Start by conducting a thorough review of your budget and identifying areas where expenses can be reduced. Consider allocating a specific percentage of your monthly profits to your emergency fund, treating it as a non-negotiable expense. Additionally, exploring high-yield savings accounts can help grow your fund while keeping it accessible.

Consequently, establishing a dedicated savings plan can reinforce your financial security. When you automate transfers into your emergency fund, you eliminate the temptation to spend that money elsewhere. This allows you to build your fund consistently. Consider setting financial milestones to motivate you as you watch your savings grow. By being disciplined in your approach, you’ll foster an environment where your business can thrive, even in challenging economic climates.

Monitoring Economic Indicators

Unlike prosperous times, monitoring economic indicators during a downturn is vital for assessing your business’s position in the market. Staying informed about economic trends helps you make informed decisions that can bolster your resilience against challenges. By keeping an eye on shifts in the economy, you can anticipate changes, strategize appropriately, and navigate your business through uncertain waters.

Key Economic Metrics

An understanding of key economic metrics can provide valuable insights into market conditions. Focus on indicators such as GDP growth rates, unemployment rates, and consumer spending patterns. These metrics can help you gauge overall economic health and make necessary adjustments to your business strategy in response to shifts in the economic landscape.

Tools for Analysis

Along with monitoring economic metrics, utilizing tools for analysis can enhance your understanding of economic trends. Data visualization software, economic forecasting models, and financial analytics platforms are instrumental in interpreting complex data, allowing you to make informed decisions for your business. These tools enable you to track changes over time and spot potential opportunities even during downturns.

With a multitude of tools for analysis at your disposal, you can effectively leverage technology to analyze economic data and trends. Incorporating software solutions that aggregate data from a variety of sources allows you to create detailed reports and visual representations, simplifying complex information. By using these tools, you can gain actionable insights that empower you to adjust your business strategy proactively and maintain a competitive edge in a challenging economy.

To Wrap Up

The key to preparing your business for an economic downturn lies in proactive planning and strategic adjustments. You should focus on strengthening your cash reserves, diversifying your revenue streams, and closely monitoring your expenses. Additionally, consider investing in customer relationships and improving operational efficiency. For a comprehensive guide on how to prepare your business during challenging times, explore this resource on How to Prepare Your Business for a Recession, which offers valuable insights and actionable advice.

FAQ

Q: What are the first steps a business should take to prepare for an economic downturn?

A: To prepare for an economic downturn, businesses should start by conducting a thorough financial analysis. This includes reviewing cash flow, profit margins, and overall financial health. Establishing a budget that accounts for potential decreased revenues can help. Additionally, businesses should consider diversifying revenue streams to reduce dependency on a single source. Streamlining operations and cutting unnecessary expenses can also strengthen the business’s financial position. Implementing a strong contingency plan will allow the business to respond quickly if the downturn occurs.

Q: How can businesses maintain customer loyalty during an economic downturn?

A: Maintaining customer loyalty during challenging economic times involves clear communication and providing value. Businesses should keep customers informed about any changes in operations, products, or services. Offering promotions or discounts can also help retain customers who might be looking to cut back on spending. Focusing on exceptional customer service, being attentive to customer feedback, and personalizing experiences can further reinforce customer relationships. By showing empathy and understanding towards customers’ needs, businesses can foster loyalty even in tough economic conditions.

Q: What strategies can businesses implement to safeguard employees during an economic downturn?

A: To safeguard employees during an economic downturn, businesses should prioritize transparent communication about the state of the company and any necessary changes. Providing additional training and upskilling opportunities can also prepare employees for evolving roles as the market changes. Instead of layoffs, exploring options like flexible working arrangements, reduced hours, or voluntary time off can help retain staff. Offering support services such as counseling or financial advice can also assist employees in managing their personal challenges during economic difficulties, thereby strengthening the overall workforce morale.