Management of your business finances requires a strategic approach to maintain sustainability and growth. You need to understand your cash flow, track your expenses, and implement efficient budgeting techniques. By leveraging tools and resources, you can streamline your finance processes for better decision-making. For more insights, explore these 12 unique money management tips for your business to enhance your financial management skills. Effective financial practices will equip you with the knowledge to navigate challenges and seize opportunities.

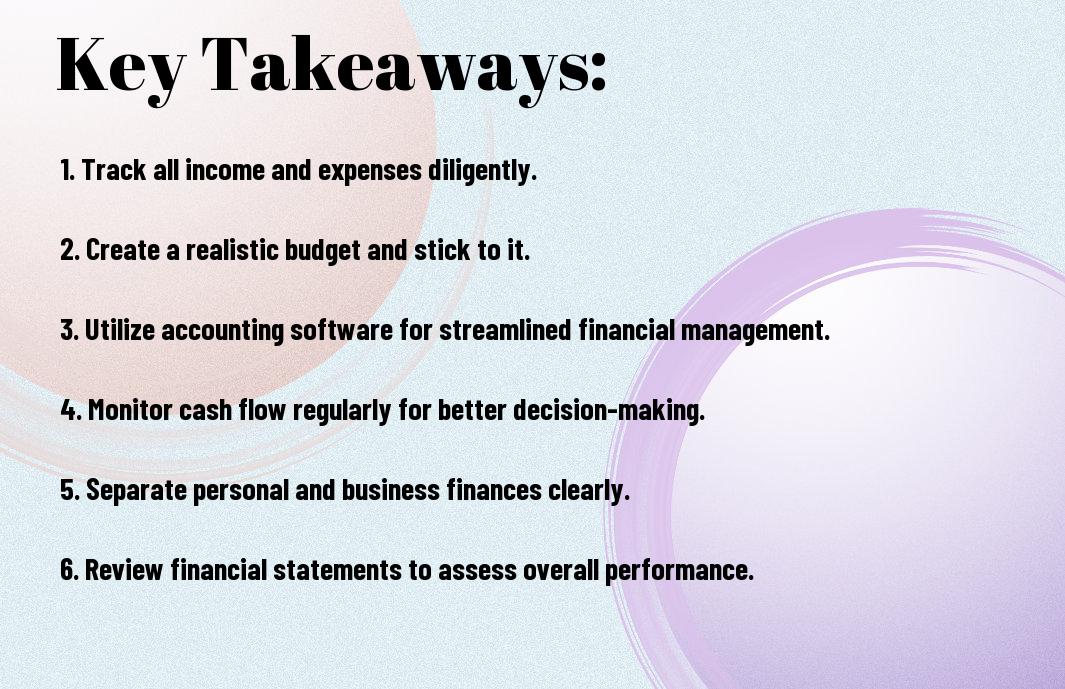

Key Takeaways:

- Budgeting: Create a detailed budget to track your income and expenses, ensuring you allocate funds appropriately across various business needs.

- Cash Flow Management: Monitor your cash flow closely to understand the inflows and outflows of cash, preventing potential shortfalls and aiding in timely payments.

- Financial Reporting: Regularly generate financial statements, such as profit and loss statements and balance sheets, to evaluate your business’s financial health.

- Cost Control: Identify areas where costs can be reduced without compromising quality, enhancing overall profitability.

- Seek Professional Guidance: Consult with financial advisors or accountants to gain insights into tax optimization and long-term financial planning.

Understanding Business Finances

To effectively manage your business finances, you first need a solid understanding of the financial landscape you operate in. Familiarize yourself with key elements such as cash flow, profitability, and the factors that influence these components. For a deeper dive, check out A Complete Guide to Managing Small Business Finances, as it offers comprehensive insights to enhance your financial literacy.

Importance of Financial Management

After establishing your understanding of business finances, it’s crucial to recognize the significance of financial management in achieving long-term success. Efficient financial management allows you to make informed decisions, allocate resources wisely, and navigate potential financial challenges with confidence.

Key Financial Statements

Beside understanding the importance of managing finances effectively, you should familiarize yourself with key financial statements that offer valuable insights into your business’s performance. These include the income statement, balance sheet, and cash flow statement, which together provide an overview of your financial health and operational efficiency.

Plus, each key financial statement serves a distinct purpose: the income statement shows your revenues and expenses over a period, the balance sheet illustrates your assets, liabilities, and equity at a specific point in time, and the cash flow statement tracks the movement of cash in and out of your business. This comprehensive view enables you to identify trends, make accurate forecasts, and strategize for growth, ensuring that you manage your finances effectively.

Budgeting for Success

While creating a budget may seem daunting, it is an vital tool for managing your business finances effectively. A well-planned budget allows you to allocate resources wisely, track expenses, and identify areas for improvement, ensuring your business stays on a path to success. By setting realistic financial goals and monitoring progress, you’ll gain greater control over your business’s economic situation and create a roadmap for future growth.

Creating a Realistic Budget

Among the steps to create a realistic budget is gathering historical financial data, analyzing past trends, and understanding your business needs. This foundation enables you to set achievable revenue targets and estimate monthly expenses accurately. Consider involving your team in this process to gain insights and foster accountability. A well-rounded approach will help create a budget that aligns with your business objectives and adapts to changing circumstances.

Monitoring and Adjusting Your Budget

Budget monitoring is vital to ensure your financial plans remain on track and aligned with your business goals. Regularly comparing your actual expenditures and revenues to your budgeted figures allows you to identify variances and make necessary adjustments. This practice ensures you are not just adhering to your budget but also adapting to any unexpected changes in your business environment.

In fact, staying proactive in monitoring your budget helps you make informed decisions about reallocating resources or cutting costs when needed. By continually assessing your financial performance, you can identify trends and respond to challenges with agility. This ongoing process will ultimately enhance your financial stability and support sustainable growth for your business.

Cash Flow Management

Despite the importance of maintaining healthy cash flow, many businesses struggle with it. Effective cash flow management allows you to ensure that your business can meet its financial obligations while also funding growth opportunities. By understanding your cash flow dynamics, you can make informed decisions that safeguard your business’s financial health and support long-term sustainability.

Tracking Cash Flow

Against typical assumptions, tracking cash flow goes beyond simply noting income and expenses. It involves monitoring the timing of cash inflows and outflows to identify patterns that can inform your business strategy. Utilizing cash flow statements and forecasting tools can give you a clearer picture of your liquidity and help you preempt potential challenges.

Strategies for Improving Cash Flow

Around common practices, improving your cash flow requires a proactive approach. Start by reviewing your payment terms, optimizing inventory levels, and tightening accounts receivable processes to ensure you receive payments on time. These simple adjustments can create a more predictable cash flow, allowing your business to operate smoothly and invest in future growth.

Indeed, incorporating strategies such as diversifying your income streams can significantly impact cash flow stability. Consider offering subscriptions or recurring services to create a steady revenue source. Additionally, negotiating better payment terms with suppliers can give you more time to collect payments from your clients, further enhancing your cash position. By consistently analyzing and adjusting your strategies, you can foster a more resilient cash flow for your business.

Investment Strategies

Unlike personal finances, managing your business investments requires a strategic approach that aligns with your overall goals. To grow your business sustainably, it’s imperative to explore diverse investment avenues that can provide both stability and growth. Developing a well-defined investment strategy ensures that you focus your resources efficiently and adapt to changing market conditions.

Identifying Investment Opportunities

After assessing your business’s financial health, you should actively seek out investment opportunities that align with your long-term objectives. This can include exploring emerging markets, new technology, or partnerships that can enhance your product offerings. Staying informed about industry trends and networking can also uncover potential avenues for profitable investments.

Evaluating Risk and Return

Investment decisions are always accompanied by potential risks and returns. Assessing these factors can help you make informed choices that protect your business while aiming for growth. You should consider the volatility of the investments, time horizon, and the correlation with your existing portfolio before making any commitments.

Identifying the right balance between risk and return involves understanding not only the potential gains from an investment but also assessing how much loss your business can withstand. This analysis requires detailed financial projections and a clear grasp of market conditions. Tailoring your investments to align with your risk tolerance will ensure you remain on track towards achieving your financial goals while maintaining the flexibility to adjust as necessary.

Financial Tools and Software

Your understanding of financial tools and software can significantly enhance your business’s financial acumen. Utilizing the right resources will streamline your financial management processes and provide insights that guide better decision-making. For expert insights, check out 9 Tips to Manage Your Business Finances, which offers valuable advice tailored to your needs.

Selecting the Right Tools

On your journey toward efficient financial management, selecting the right tools is vital. Assess your specific business needs and evaluate different software options based on features, user-friendliness, and integration capabilities. This thoughtful approach ensures you adopt solutions that support your unique financial requirements.

Maximizing Efficiency with Technology

Financial technology can help streamline your operations and reduce manual tasks. By automating processes like invoicing, expense tracking, and reporting, you can easily save time and minimize errors. These tools not only enhance accuracy but also free you up to focus on strategic growth initiatives.

Indeed, implementing technology for financial management goes beyond simple task automation. These solutions can offer real-time data analytics, helping you track trends and forecast potential financial challenges. This proactive approach allows you to make informed decisions quickly, ensuring your business remains agile in a competitive landscape. Further, many platforms offer cloud-based access, enabling collaboration with your team and financial advisors regardless of location, thus enhancing your overall operational efficiency.

Working with Financial Professionals

All business owners can benefit from the insights and experience of financial professionals. Engaging with accountants, financial advisors, and consultants can provide you with the specialized knowledge you need to make informed decisions, optimize cash flow, and prepare for future growth. By collaborating with experts, you can ensure your financial strategies align with your overall business goals and comply with regulations, freeing you to focus on running your company effectively.

When to Hire an Accountant

Above all, knowing when to hire an accountant can save you time and stress. Consider bringing in a professional if your business is expanding, if you are facing complex financial situations, or if tax season starts to become overwhelming. An accountant can help you manage your finances efficiently and provide valuable advice tailored to your business needs.

Benefits of Financial Advisory Services

Working with financial advisory services can significantly enhance your business operations. These professionals can help you manage risks, optimize investments, and develop strategies that align with your long-term financial goals. They bring expertise that can help you navigate complex financial landscapes, allowing for smarter decision-making.

It is imperative to understand that engaging a financial advisor can provide you with a fresh perspective on your financial matters. They can help analyze your financial statements, streamline your budgeting processes, and identify potential areas for improvement. Furthermore, their customized strategies can lead to increased profitability, ensuring that your business remains competitive and adaptable in a rapidly changing market.

Summing up

Summing up, effectively managing your business finances requires a combination of strategic planning, diligent tracking, and informed decision-making. By establishing a clear budget, maintaining accurate records, and regularly reviewing your financial health, you position your business for sustained growth. Utilize tools and resources that keep you organized, and don’t hesitate to seek professional guidance when needed. This proactive approach will empower you to make sound financial choices that support your business objectives and enable long-term success.

FAQ

Q: What are the key components of managing business finances?

A: Effective management of business finances includes several key components such as budgeting, cash flow management, bookkeeping, and financial reporting. Budgeting involves creating a financial plan that outlines expected income and expenses over a specific period. Cash flow management ensures that the business has enough liquidity to meet its obligations by monitoring the timing of income and expenditures. Bookkeeping is the systematic recording of financial transactions, while financial reporting provides insights into the business’s financial health through profit and loss statements, balance sheets, and cash flow statements.

Q: How can I improve cash flow in my business?

A: Improving cash flow can be achieved by optimizing accounts receivable and payable processes. To enhance accounts receivable, consider implementing more efficient invoicing practices, such as sending invoices promptly and offering discounts for early payments. For accounts payable, manage payment schedules effectively to take advantage of payment terms while avoiding late fees. Additionally, regularly review your cash flow forecast to anticipate any shortfalls and adjust your spending plans accordingly. Evaluating inventory levels and streamlining operations can also free up additional cash.

Q: What tools or software can assist in managing business finances?

A: There are numerous tools and software options available that can greatly streamline financial management. Accounting software, such as QuickBooks or Xero, can help with bookkeeping, invoicing, and financial reporting. Budgeting tools like Mint or YNAB (You Need A Budget) can assist in tracking expenses and managing budgets effectively. Additionally, cash flow management tools like Float and Pulse can provide real-time cash flow forecasts and insights. Consider using project management software that includes financial tools, as this can help integrate financial tracking with other aspects of your business operations.