Many business owners face the challenge of managing debt, which can significantly impact your overall financial health and growth potential. With the right strategies, you can regain control and ensure your company remains resilient. This post will guide you through imperative steps and best practices to manage your business debt effectively. For additional insights, explore these Effective Ways of Managing Business Debt.

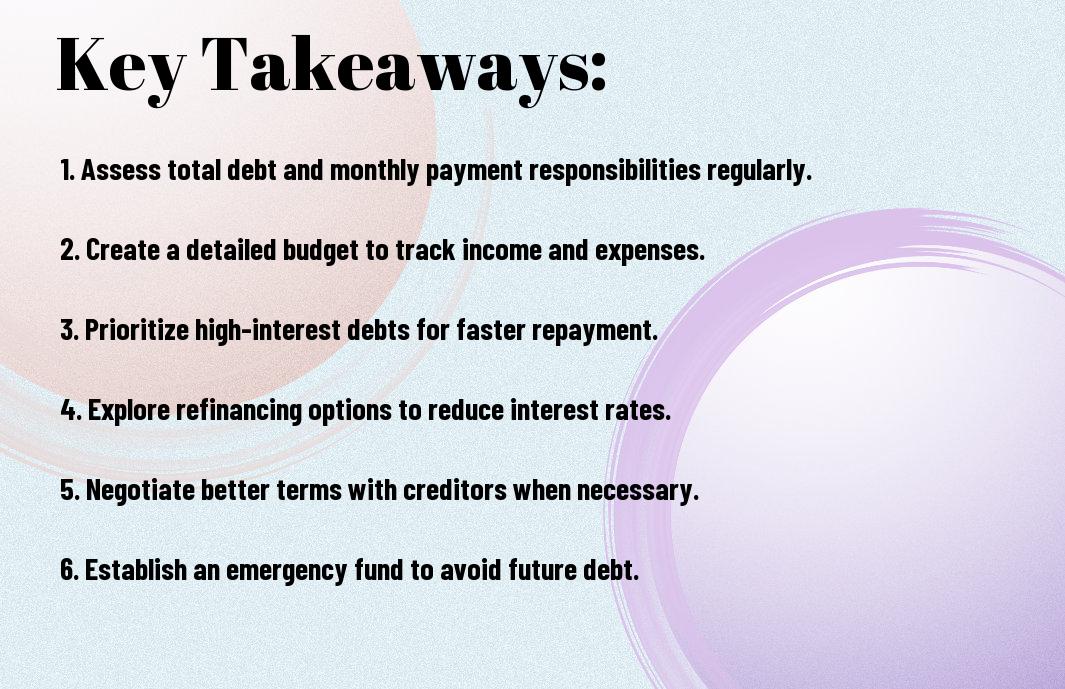

Key Takeaways:

- Budgeting: Establish a comprehensive budget to track income and expenses, helping to identify areas where costs can be reduced to facilitate debt repayment.

- Debt Prioritization: Organize debts by interest rates and payment deadlines; focus on paying off high-interest debts first to minimize overall costs.

- Communication: Maintain open lines of communication with creditors to negotiate payment terms or explore refinancing options that may offer more favorable conditions.

Understanding Business Debt

Before plunging into solutions, it’s vital to grasp what business debt entails. Business debt consists of the financial obligations your company incurs through loans, credit, or other financial instruments. Managing this debt effectively can significantly impact your company’s financial health and operational stability.

Types of Business Debt

Before undertaking debt management, you should recognize the various types of business debt. Each type serves different purposes and comes with its own set of characteristics:

- Term Loans

- Lines of Credit

- Invoice Financing

- Business Credit Cards

- Equipment Financing

Perceiving these categories clearly can help you make informed borrowing decisions.

| Type of Debt | Description |

| Term Loans | Fixed amount borrowed for a specific term. |

| Lines of Credit | Flexible borrowing against a credit limit. |

| Invoice Financing | Borrowing against outstanding invoices. |

| Business Credit Cards | Short-term revolving credit for purchases. |

| Equipment Financing | Loans specifically for purchasing equipment. |

Causes of Business Debt

After assessing your financial situation, it’s crucial to understand the reasons behind business debt accumulation. Various factors can lead to increased borrowing, impacting your business’s sustainability.

And, many businesses may find themselves in debt due to unforeseen circumstances such as market fluctuations, increased operating costs, or the need for investment to grow or adapt to changes. Poor cash flow management can exacerbate these issues, leading you to rely more on debt than intended. Additionally, if you’re starting a new venture, initial investments often require external financing, creating a debt burden that can take time to manage effectively.

Assessing Your Current Debt Situation

Now that you are looking to manage your business debt effectively, it’s important to assess your current debt situation. Start by gathering all relevant information regarding your outstanding balances, interest rates, and payment schedules. This awareness will provide you with a clear picture of what you owe and help you identify the most pressing financial challenges that require your attention.

Debt Inventory

Debt inventory involves compiling a comprehensive list of all your business debts, including loans, credit lines, and supplier invoices. This systematic approach allows you to visualize the total amount owed and categorize debts by type, interest rate, and maturity dates, making it easier to prioritize repayments and strategize your next steps.

Cash Flow Analysis

Across your business operations, understanding your cash flow is vital. By analyzing your inflows and outflows, you can identify patterns that affect your ability to meet debt obligations. This insight enables you to allocate resources efficiently, ensuring that you maintain a positive cash flow that can support your repayment plans.

Even a small improvement in cash flow can significantly impact your debt management strategy. You should regularly track your revenue against expenses to identify any seasonal fluctuations or trends. This enables you to anticipate periods of tighter cash flow and allows you to strategize for those times, ensuring you can meet your payment obligations while maintaining the operational health of your business.

Strategies for Debt Management

Once again, effective strategies are key to managing your business debt. By implementing a structured plan, you can not only stay on top of repayments but also ensure the longevity of your business. Utilize tools such as budgeting and cash flow management to create a clear picture of your financial obligations. This allows you to make informed decisions that can help alleviate the stress of debt while paving the way for potential growth.

Debt Reduction Techniques

Reduction in debt can be achieved through various techniques tailored to your situation. Start by prioritizing high-interest debts, paying them off first to save on future interest payments. Consider consolidating multiple debts into one with a lower interest rate, or explore options like the snowball method, where you focus on small debts first to build momentum and confidence. Each of these methods can streamline your approach, making it easier to regain control over your finances.

Negotiating with Creditors

At times, reaching out to creditors for negotiation can lead to more favorable repayment terms. Inform them of your current financial situation and express your willingness to pay off the debt. Many creditors are open to restructuring payments, reducing interest rates, or even settling for a lesser amount than originally owed. Your proactive communication can foster goodwill and improve your relationship with those lenders.

Indeed, negotiating with creditors can serve as a turning point in your debt management plan. Taking the initiative to discuss your financial challenges often leads to solutions that may not have been available initially. Creditors generally prefer to receive partial payments rather than risk losing everything if your business fails. By engaging in open dialogue and proposing realistic repayment options, you can often secure adjustments that make your debt more manageable, ultimately easing the strain on your business’s finances.

Creating a Debt Repayment Plan

Unlike managing personal debt, business debt requires a strategic approach to repayment. You need a clear plan that outlines how to tackle your obligations effectively, ensuring you stay focused on your financial goals. By creating a comprehensive repayment plan, you can mitigate risks and boost your business’s cash flow, setting yourself up for long-term stability and success.

Setting Priorities

Against the backdrop of multiple debts, it’s vital to prioritize your payments. Identify which debts carry the highest interest rates or the most severe consequences for late payment. By focusing on these, you can minimize overall costs and avoid potential penalties that could hinder your operations.

Establishing a Payment Schedule

Schedule your payments to align with your cash flow, ensuring that you meet your obligations without jeopardizing your business operations. This organized approach allows you to allocate funds more effectively and can help you stay disciplined in your repayment efforts.

In fact, establishing a consistent payment schedule not only helps you manage your debts more effectively but also reinforces your financial discipline. Aim to review your cash flow regularly to adjust payment amounts if necessary, ensuring that your repayment plan remains viable amidst fluctuations in your business revenue. This proactive strategy can lead to a healthier financial position in the long run.

Monitoring and Adjusting Your Plan

Many business owners overlook the importance of regularly monitoring and adjusting their debt management plan. Consistent evaluation allows you to identify potential issues early, ensuring that your financial strategy remains effective in changing circumstances. By staying proactive, you can maintain healthier financial practices, adapt to new challenges, and ultimately steer your business toward stability and growth.

Regular Reviews

Reviews of your debt management plan should occur at regular intervals, allowing you to assess your progress and make necessary changes. Scheduling these reviews ensures that you remain aware of your financial standing and can quickly address discrepancies. Analyzing key performance indicators will also help to keep your debt levels in check while you work towards your financial goals.

Adapting to Changes in Business Conditions

Your ability to adapt your debt management strategy to shifts in the market or your business environment is crucial for long-term success. Staying attuned to economic trends and emerging industry challenges will enable you to make informed decisions about your financial commitments. Regularly adjusting your approach ensures that you can manage your debt effectively, regardless of external pressures or unforeseen circumstances.

Monitoring your business landscape is vital for identifying the changes that may impact your debt management approach. You should keep an eye on indicators such as market fluctuations, regulatory adjustments, and shifts in consumer behavior. By responding promptly to these developments, you can recalibrate your financial strategies, explore alternative financing options, or restructure existing debt to better align with your current business model and growth objectives.

Seeking Professional Help

Keep in mind that managing business debt can be overwhelming, and seeking professional help can provide you with the guidance and expertise needed to navigate your financial challenges. By consulting with a financial advisor or credit counselor, you can gain insights into effective debt management strategies tailored to your unique situation.

When to Consult an Expert

Around the time you realize your business debt is becoming unmanageable, or if you’re feeling stressed about meeting payments, it’s wise to consult an expert. Early intervention can prevent complications and offer you solutions that you might not have considered on your own.

Choosing the Right Advisor

Seeking the right advisor is crucial for effective debt management. You should look for someone with a solid track record in business finance and significant experience dealing with debt restructuring and management. Their expertise can provide you with tailored strategies that align with your business goals.

For instance, when searching for an advisor, consider checking their credentials, client reviews, and areas of specialization. A professional who understands your industry can offer personalized insights and strategies that can make a real difference in your debt management efforts. Take your time to interview potential advisors to find someone who not only has the right qualifications but also resonates with you and your business philosophy.

Summing up

Now that you understand the vitals of managing business debt effectively, you can take actionable steps to ensure your financial stability. Focus on creating a clear budget, prioritizing your debts, and maintaining open communication with creditors. By regularly assessing your financial situation and adjusting your strategies, you will enable your business to thrive even in challenging economic conditions. Stay disciplined, seek professional advice when needed, and always keep your long-term goals in mind as you navigate your way through debt management.

Q: What are the most effective strategies for managing business debt?

A: Effective strategies for managing business debt include creating a detailed budget to monitor cash flow, prioritizing high-interest debts to pay off first, and exploring refinancing options to lower interest rates. Additionally, maintaining open communication with creditors can lead to more manageable repayment plans. It is also beneficial to build an emergency fund to handle unexpected expenses, ensuring that debt obligations remain manageable during financial fluctuations.

Q: How can a business assess whether to take on new debt?

A: Assessing the decision to take on new debt involves conducting a thorough analysis of the business’s current financial health. This includes evaluating existing debt levels, cash flow projections, and the ability to make future repayments. Companies should calculate the debt-to-equity ratio and perform a break-even analysis to determine how the new debt may impact overall performance. Furthermore, considering the purpose of the debt and how it aligns with long-term goals is vital, as investing in growth opportunities can ultimately lead to improved financial stability.

Q: What role does financial forecasting play in managing business debt?

A: Financial forecasting plays a significant role in managing business debt by providing insights into future revenue streams and expenses. This allows a business to anticipate potential cash flow challenges and plan accordingly. By creating realistic forecasts, a business can identify when it will have sufficient resources to meet debt obligations and make informed decisions about new borrowing. Additionally, incorporating various scenarios such as best-case and worst-case can help in preparing for uncertainties, ensuring that the business remains on track with its debt management strategy.