It’s important for every business owner to establish an emergency fund to safeguard against unexpected financial challenges. By setting aside a portion of your profits, you can create a financial buffer that offers peace of mind and ensures your operations can continue even in tough times. This guide will provide you with practical steps to build your emergency fund effectively, empowering you to take control of your business’s financial resilience and focus on growth.

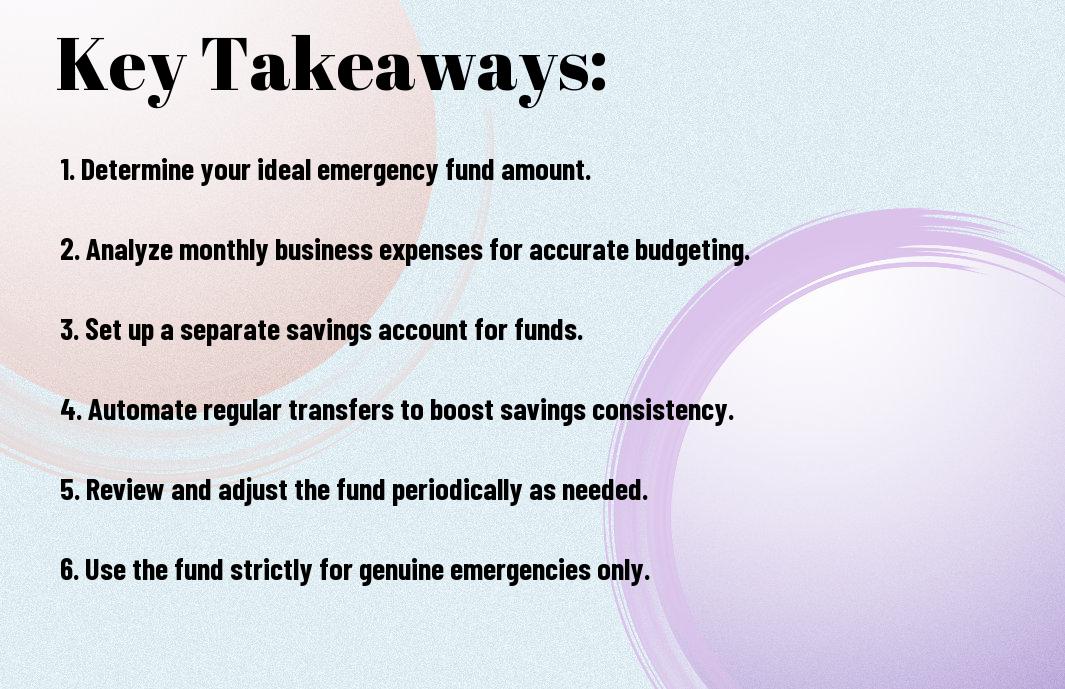

Key Takeaways:

- Set a Target Amount: Determine how much money you need to cover unexpected expenses or a downturn in revenue.

- Establish a Separate Account: Open a dedicated savings account solely for your emergency fund to keep it distinct from operational funds.

- Automate Savings: Set up automatic transfers to your emergency fund to consistently build it over time without needing to think about it.

- Review and Adjust: Regularly assess your fund’s adequacy based on business changes and adjust your savings goals accordingly.

- Use Windfalls Wisely: Allocate any unexpected income or bonuses to your emergency fund to grow it more quickly.

Understanding the Importance of an Emergency Fund

Before you probe creating an emergency fund for your business, it’s necessary to grasp why it matters. An emergency fund acts as a financial safety net, ensuring that unexpected challenges don’t derail your operations. By setting aside a dedicated pool of resources, you empower your business to handle unforeseen circumstances with resilience, ultimately safeguarding your long-term stability and growth.

Definition of an Emergency Fund

On a fundamental level, an emergency fund is a savings account specifically designated for unexpected expenses or financial downturns. In the context of your business, it provides immediate cash flow support to help you navigate crises without resorting to debt or impacting your operational budget.

Benefits for Businesses

One significant advantage of maintaining an emergency fund is the peace of mind it offers. When you know you have financial reserves, you can make decisions more confidently and focus on growing your business rather than worrying about unforeseen expenses.

Another compelling benefit is that an emergency fund enables you to respond swiftly to opportunities or challenges, whether it’s a sudden market shift or the chance to invest in new technology. With these funds available, you can make choices that enhance your business’s competitiveness without the stress of immediate financial constraints. Ultimately, this proactive approach not only helps in crisis management but also fosters a culture of financial preparedness within your organization.

Assessing Your Business Financial Needs

There’s no denying that understanding your financial needs is imperative for building an emergency fund for your business. To determine how much you should save, start by evaluating your monthly expenses and potential disruptions by reviewing your cash flow. This will help you create a tailored financial safety net. For more insights, check out How to Build a Small Business Emergency Fund.

Identifying Potential Emergencies

Identifying the types of emergencies your business may face is vital for effective preparation. Consider scenarios such as economic downturns, natural disasters, or unexpected equipment failures. By recognizing these potential challenges, you can better forecast the financial impact they may have on your operations.

Determining Funding Objectives

Around 30% of small businesses encounter cash flow issues, making it necessary to set clear funding objectives for your emergency fund. Establishing how much money you’ll need for various emergencies will guide you in setting a target for your savings. Consider variables like operational costs and the duration for which your business can sustain itself during downturns.

Due to the unpredictable nature of business challenges, setting realistic funding objectives will empower you to respond effectively when emergencies arise. Assess your monthly operational costs and determine a safety net, ideally covering three to six months of expenses. This targeted approach not only ensures you maintain business continuity but also provides peace of mind, enabling you to make strategic decisions during uncertain times.

Establishing a Savings Goal

Once again, setting a savings goal for your business is a foundational step in creating an emergency fund. This goal should be based on your specific business needs, operational costs, and potential unforeseen circumstances. By determining how much you need to save, you can create a targeted approach that ensures you build a financial cushion that supports your business during lean times.

Calculating Recommended Fund Size

Around three to six months’ worth of operating expenses is a common benchmark when calculating the recommended fund size. This figure should reflect all critical expenses that your business incurs, such as rent, utilities, payroll, and inventory costs. Taking the time to assess your financial obligations will guide you in establishing a realistic savings target that can help buffer against unexpected challenges.

Setting Realistic Timeframes

Against your financial goals, it’s important to establish realistic timeframes for your savings plan. Break down your overall savings target into achievable monthly or quarterly milestones to better track your progress. By setting specific deadlines, you can maintain motivation and ensure that you’re consistently contributing toward your emergency fund.

Establishing a timeline for your savings not only helps in managing your financial goals but also allows you to allocate resources efficiently. Assess your income fluctuations and expenses to tailor your timeframe, making it more manageable. Consistency is key; by committing to regular deposits into your emergency fund, you’ll build financial stability that can weather potential storms without compromising your business operations.

Choosing the Right Savings Account

Now that you understand the importance of an emergency fund, selecting the right savings account is vital. A high-yield savings account or a money market account can offer better interest rates, helping your business grow its funds. For more guidance, check out these 5 steps to build an emergency fund.

Types of Accounts for Emergency Funds

Behind each savings strategy, you’ll find different types of accounts that suit your needs:

| Account Type | Advantages |

| High-Yield Savings | Higher interest rates. |

| Money Market Account | Check-writing privileges. |

| Certificate of Deposit (CD) | Fixed rates for terms. |

| Regular Savings Account | Easy access to funds. |

| Brokerage Account | Potential for higher returns. |

After evaluating these options, you can choose what aligns best with your business needs.

Factors to Consider When Selecting an Account

Consider the following when choosing your ideal emergency fund account:

- Interest rates

- Fees and minimum balance requirements

- Accessibility and withdrawal limits

- Account features (like online banking)

- Financial institution reputation

Recognizing these factors will ensure you find the best account for your emergency fund.

At your business level, selecting the right type of account depends on your unique financial circumstances:

- Interest rates impact your fund’s growth

- Fees can eat into your savings

- Accessibility is vital during emergencies

- Account features can enhance your experience

- Reputation gives you confidence in your choice

Recognizing these elements will guide you in making an informed decision for your emergency fund account.

Strategies for Building Your Emergency Fund

All businesses should prioritize building an emergency fund to safeguard against unforeseen expenses. Effective strategies include setting clear savings goals, regularly reviewing your financial situation, and implementing smart budgeting practices. For more insights, check out this Small Business Emergency Fund: What It Is & Why You Need It.

Budgeting for Savings

After establishing your business’ income and expenses, dedicate a specific line item in your budget for savings. This will help you allocate funds regularly toward your emergency fund without impacting your operational costs. By prioritizing savings in your budget, you solidify your commitment to building a financial safety net.

Automating Contributions

Savings become more manageable when you automate your contributions. By setting up automatic transfers from your business account to your emergency fund, you ensure consistent growth without having to think about it each month.

Consequently, automating your savings allows you to build your emergency fund without the risk of overspending. You can set up transactions aligned with your cash flow, making it easier to reach your savings goals. This proactive approach helps you accumulate funds steadily, reinforcing your financial stability for the unexpected moments that may arise in your business journey.

Maintaining and Evaluating Your Fund

After establishing your emergency fund, it’s vital to maintain and evaluate it regularly. You should track your financial health to ensure your fund remains adequate against unforeseen circumstances or business fluctuations. Routine assessments allow you to identify any gaps and make informed adjustments, keeping your business resilient and prepared for any challenges that may arise.

Regular Reviews of Financial Health

On a scheduled basis, review your business’s financial health to gain insights into your ongoing needs. This process involves examining your cash flow, expenses, and any potential risks that could impact your operations. Regularly updating this information will ensure your emergency fund remains aligned with your business’s current situation.

Adjusting Your Fund as Your Business Grows

Above all, as your business evolves, you must adjust your emergency fund to reflect your changing financial landscape. Increased revenue or expanded operations were to align your savings with your new responsibilities, ensuring you remain prepared for unexpected expenses.

Further evaluation of your fund can include factoring in new expenses related to growth, such as additional employees, equipment, or larger operational costs. As your revenue increases or your business model shifts, recalculating the ideal amount for your emergency fund is key to shielding your enterprise against downturns. Consistently doing so will empower you to take calculated risks while ensuring you have a financial safety net in place.

Conclusion

Presently, establishing an emergency fund for your business is important for navigating unexpected challenges. You should assess your monthly expenses, set a realistic savings target, and develop a consistent savings strategy to build this financial cushion. Additionally, consider designating a separate account specifically for your emergency fund to minimize the temptation of using these savings for day-to-day operations. By taking these steps, you can enhance your business’s resilience and ensure it’s better equipped to weather any financial storm that comes your way.

Q: What is an emergency fund for a business and why is it important?

A: An emergency fund for a business is a reserve of financial resources set aside to cover unexpected expenses or financial distress. This might include sudden drops in sales, unplanned repairs, or cash flow shortages. Having an emergency fund is important because it helps ensure the business can continue operating during tough times without resorting to high-interest loans or cutting vital expenses.

Q: How much money should I set aside for an emergency fund?

A: The amount you should reserve for an emergency fund typically depends on your business’s size, operating expenses, and revenue volatility. A common guideline is to aim for three to six months’ worth of operating expenses. This gives you a financial safety net to draw from when unexpected challenges arise, allowing you to maintain operations and navigate through difficult periods without significant stress.

Q: What are the best strategies for building an emergency fund for my business?

A: Building an emergency fund can be achieved through several strategies. Start by setting a specific savings goal and timeline, allowing you to track your progress. Consider redirecting a portion of monthly profits or setting up a separate savings account designated solely for the fund. Automating transfers to this account can help you save consistently without thinking about it. Additionally, during times of higher income, consider allocating larger amounts to this fund to reach your target sooner.