Growth investing can yield substantial returns if you know how to target the right opportunities effectively. You need to evaluate companies not just on their current earnings, but on their potential for future growth. This post will guide you through the important factors to consider when searching for the best growth stocks, including performance metrics, industry trends, and market conditions. By applying these strategies, you can enhance your investment portfolio and maximize your chances of success.

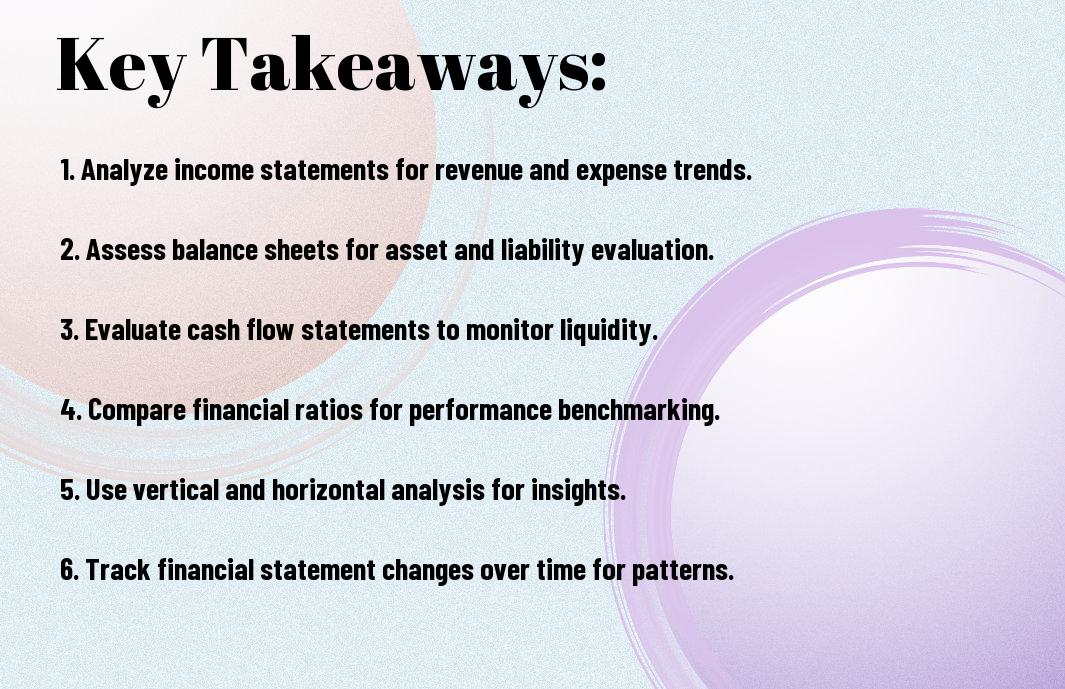

Key Takeaways:

- Research potential companies thoroughly, analyzing financial health, performance history, and market trends to understand their growth potential.

- Industry Trends play a significant role; focus on sectors that are emerging or showing consistent growth to identify strong candidates.

- Management Quality is vital; assess the leadership team’s experience and track record in driving company success.

- Valuation Metrics should be considered, such as price-to-earnings and price-to-sales ratios, to avoid overpaying for growth.

- Long-Term Horizon is necessary for growth investing; be prepared to hold stocks through volatility to realize their full potential.

Understanding Growth Stocks

Before submerging into investment opportunities, it’s crucial to comprehend what growth stocks are. These stocks represent companies expected to increase their earnings at an above-average rate compared to their industry or the overall market. Investors often look for these stocks to maximize their returns, as they promise impending growth through innovation, expansion, or increasing demand for their products.

Definition of Growth Stocks

Definition: Growth stocks are shares in companies that demonstrate the potential for above-average financial growth. Unlike value stocks, which may be undervalued, growth stocks often trade at higher price-to-earnings ratios due to their anticipated growth trajectory.

Characteristics of High-Quality Growth Stocks

With high-quality growth stocks, you should look for several key characteristics. These companies typically exhibit strong revenue growth, competitive advantages, and robust profit margins. Additionally, they often invest heavily in innovation and have a solid management team focused on long-term strategies.

To identify high-quality growth stocks, assess the company’s historical performance and its potential for future expansion. Look for a consistent history of revenue and earnings growth, as well as a healthy balance sheet with minimal debt. Companies that invest in research and development often have the edge necessary to maintain their growth trajectory. Understanding the company’s market position, industry trends, and economic factors can further enhance your decision-making process when selecting growth stocks.

Key Metrics to Evaluate Growth Stocks

Assuming you want to invest in growth stocks, it’s important to focus on key metrics that indicate strong performance potential. These metrics offer valuable insights into a company’s ability to expand rapidly and generate returns on your investment. Values like earnings growth, price-to-earnings ratio, and revenue growth rate should be closely analyzed to select the best candidates for your portfolio.

Earnings Growth Rate

One of the most significant indicators of a growth stock is its earnings growth rate. This metric shows how much a company’s earnings have increased over a specific period, typically expressed as a percentage. Higher earnings growth rates suggest that the company is successfully expanding its operations and driving profits, making it an appealing choice for your investment strategy.

Price-to-Earnings Ratio

Around valuation, the price-to-earnings (P/E) ratio is a vital metric that helps you assess whether a growth stock is fairly priced relative to its earnings. This ratio compares a company’s current share price to its earnings per share (EPS), reflecting investor perceptions of future growth. A higher P/E may indicate that you’re paying a premium for expected earnings growth.

At the same time, evaluating the P/E ratio requires context—comparing it against industry peers can provide a clearer perspective. A high P/E ratio might not be concerning if justified by strong earnings growth, while a low P/E could signal undervaluation or poor performance. Thus, understanding the underlying reasons for the P/E level is imperative for informed investment decisions.

Analyzing Industry Trends

All successful growth stock investors understand the importance of analyzing industry trends. By recognizing the sectors poised for expansion, you can identify opportunities that may lead to significant returns. Stay informed on emerging technologies, changes in consumer behavior, and shifts in regulations that impact various industries. This knowledge enables you to make informed decisions and invest in companies that are likely to experience strong growth in the future.

Identifying Growth Sectors

An effective approach to pinpointing growth sectors involves researching industries that are experiencing rapid change or innovation. Pay attention to sectors like technology, renewable energy, and healthcare, where you can find companies driven by advancements and evolving consumer demands. By focusing on these industries, you enhance your chances of finding stocks with substantial growth potential.

Evaluating Market Potential

Across different industries, assessing market potential is fundamental to identifying promising growth stocks. You should analyze factors such as market size, competitive landscape, and customer demand to gauge the overall health and future growth prospects of an industry.

Also, consider the scalability of the businesses operating within those sectors. Are they positioned to capture an increasing market share? Look for companies that demonstrate strategic advantages such as innovation, strong management teams, and a solid track record. By evaluating these elements, you can better determine which growth stocks may thrive in the face of evolving market conditions.

Conducting Fundamental Analysis

To successfully identify the best growth stocks, you need to conduct thorough fundamental analysis. This process involves examining a company’s financial health, market position, and industry dynamics. Utilizing resources like How to Find the Best Growth Stocks can guide you in evaluating imperative metrics to determine whether the stock makes a good investment.

Reviewing Financial Statements

Among the first steps in your analysis should be a close look at the company’s financial statements. Scrutinize key components like the income statement, balance sheet, and cash flow statement to assess profitability, debt levels, and liquidity. These factors will provide you with insight into the company’s overall financial health and its potential for growth.

Assessing Management Effectiveness

Fundamental analysis also involves assessing management effectiveness. Look into the experience and track records of the company’s leadership team. Their ability to make sound strategic decisions and navigate market challenges can significantly impact the company’s growth trajectory.

Also, consider how management’s decisions align with shareholder interests. Pay attention to their communication style, transparency, and responsiveness to market conditions. Evaluating these aspects can help you gauge whether the management team is equipped to drive the company forward and deliver sustainable growth over time.

Tools and Resources for Stock Research

Your journey to identifying the best growth stocks can be significantly enhanced by utilizing various tools and resources. Websites like 10 Best Growth Stocks to Buy for the Long Term offer valuable insights and recommendations to streamline your research process.

Online Platforms and Screeners

Before venturing into the stock market, it’s beneficial to familiarize yourself with online platforms and stock screeners. These tools allow you to filter stocks based on specific growth metrics, making it easier to identify opportunities that align with your investment strategy.

Investment Research Services

Online investment research services provide in-depth analyses and expert opinions on potential growth stocks. These resources often include detailed reports, financial metrics, and market trends that can help you make more informed investment decisions.

Stock research services frequently come with access to proprietary databases and tools that allow you to track companies’ performance over time. Leveraging these services can give you a competitive edge, as you gain insights from analysts who specialize in identifying promising growth stocks. With access to comprehensive data, you can refine your search for the best investment opportunities more effectively.

Building a Diversified Growth Stock Portfolio

Once again, assembling a diversified growth stock portfolio involves strategically selecting a mix of stocks across different sectors, ensuring that you spread risk while harnessing opportunities for growth. To gain insights on selecting and researching quality growth stocks, you can refer to this conversation on How do you pick and research good growth stocks?

Importance of Diversification

Any successful investor understands that diversification is important to mitigate risk. By investing in a variety of growth stocks, you protect your portfolio against downturns in any single company or sector, thereby increasing your chances of achieving sustainable long-term growth.

Strategies for Portfolio Management

Diversification can be implemented through various strategies, such as sector allocation, market capitalization balance, and geographical diversification. This approach allows you to capture growth across different areas of the economy while reducing the impact of volatility.

And as you manage your portfolio, consider the use of rebalancing techniques to maintain your desired level of diversification over time. Regularly reviewing your investments will help you identify underperforming stocks and make informed decisions about when to buy or sell, ensuring that your portfolio aligns with your growth objectives.

To wrap up

From above, you can effectively find the best growth stocks by doing thorough research, analyzing financial metrics, and staying updated on industry trends. Focus on companies with strong revenue growth, a solid competitive position, and innovative products or services. Utilize resources like research reports and expert opinions to enhance your decision-making process. By taking a systematic approach and being patient, you can identify potential high-growth opportunities that align with your investment goals.

FAQ

Q: What characteristics should I look for in a growth stock?

A: When searching for the best growth stocks, focus on companies that demonstrate strong revenue and earnings growth potential. Look for characteristics such as a healthy profit margin, a solid return on equity, and a history of consistent earnings growth rates. Additionally, consider companies with innovative products or services that have a competitive edge in their industry. Pay attention to their market position and evaluate their ability to scale operations effectively.

Q: How important are analyst ratings when selecting growth stocks?

A: Analyst ratings can provide valuable insights when selecting growth stocks, but they should not be the sole basis for your decision. Ratings from financial analysts often reflect market sentiment and can indicate potential buying opportunities or red flags. However, it’s vital to conduct your own research and analysis. Look at the underlying financials of the company, industry trends, and macroeconomic factors before making any investment choices. Analyst ratings should serve as one of several tools in your evaluation process.

Q: What role does valuation play in finding growth stocks?

A: Valuation is a vital factor when identifying growth stocks, as it helps determine whether a stock is fairly priced relative to its growth prospects. Common valuation metrics include the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Forward P/E ratio. While growth stocks generally trade at higher valuations due to their earnings potential, it’s important to avoid overpaying. Compare valuations with industry peers and historical averages to gauge whether a stock’s price reflects its growth potential accurately.