Most aspiring entrepreneurs find themselves questioning the financial requirements of launching their venture. Understanding how to calculate the cost of starting a business is imperative for laying a solid foundation. You’ll need to consider various expenses, from initial investments to ongoing operational costs. To assist you in this process, you can explore Business Startup Costs: How To Calculate And Budget, which provides detailed insights and strategies for accurate budgeting. With the right approach, you can effectively assess your financial needs and plan accordingly.

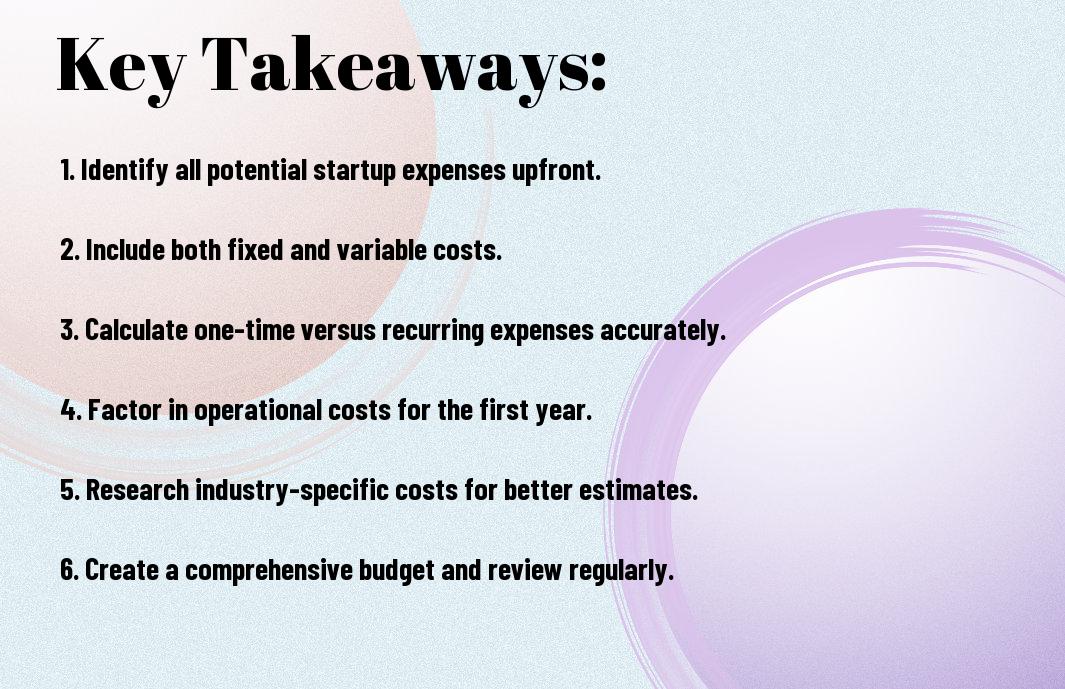

Key Takeaways:

- Estimate Expenses: Identify and categorize all potential costs, including startup costs, operating expenses, and unexpected expenses to develop a comprehensive budget.

- Research Funding Options: Explore various funding sources such as personal savings, loans, investors, or grants to support your business financially.

- Regularly Review Projections: Continuously monitor financial projections and adjust your forecasts as needed to ensure your business remains on track to profitability.

Understanding Startup Costs

To accurately determine the financial requirements of launching your business, you must understand startup costs. These expenses are typically divided into two main categories: fixed costs and variable costs. Recognizing and estimating these costs will enable you to create a well-informed budget, ensuring your business is on solid financial footing from the beginning.

Fixed Costs

One of the primary components of your startup costs will be fixed costs, which do not fluctuate based on your level of production or sales. These include expenses like rent, salaries, and insurance premiums that you will incur regardless of your business activity. Understanding these costs is vital since they represent ongoing commitments that you must plan for.

Variable Costs

Variable costs refer to expenses that change in direct proportion to your business operations. As your sales increase or decrease, these costs will adapt accordingly. Common examples include raw materials, utilities, and shipping fees. Estimating variable costs accurately can help you forecast your cash flow more effectively.

This variability requires you to be proactive in monitoring and adjusting your budget, especially as your business grows. By understanding your pricing strategies and the demand for your products or services, you can better control these expenses. Keeping a close eye on your variable costs will ultimately support your financial health and sustainability as your business evolves.

Estimating One-Time Expenses

If you want to accurately calculate the cost of starting your business, estimating one-time expenses is vital. These expenses usually cover initial costs that are not recurring, and can significantly vary depending on your industry. Be sure to include everything from legal fees to equipment, as these initial investments will shape the financial foundation of your venture.

Legal Fees

Along with other one-time costs, legal fees should be factored into your budget. These can include expenses for business registration, licenses, permits, and the services of an attorney for contract reviews or trademark registrations. Engaging a legal expert can provide guidance and help ensure that you meet all regulatory requirements.

Equipment and Supplies

Before launching your business, it’s vital to assess the equipment and supplies you will need. This could range from office furniture and computers to specialty tools particular to your trade. Each item contributes to your startup’s functionality and productivity.

Hence, creating a detailed list of necessary equipment and supplies will help you avoid unexpected costs later. Consider not only the initial purchase price but also ongoing maintenance and potential upgrades. Investing in quality items can enhance efficiency and lifecycle, which could save you money in the long run and ensure your business operates smoothly from the start.

Projecting Ongoing Expenses

Many entrepreneurs overlook the significance of ongoing expenses when setting up their business. These costs play a pivotal role in your overall financial planning, impacting your cash flow and profitability. It’s vital to project these expenses accurately to create a sustainable business model and ensure you’re well-prepared for any financial challenges ahead.

Rent and Utilities

By evaluating your potential location, you can better estimate your rent and utility expenses. Consider factors like square footage, lease terms, and utility costs in your area. This helps you understand how much you will need to allocate monthly to maintain a functional workspace that meets your business needs.

Salaries and Wages

Across various industries, salaries and wages represent a significant portion of your ongoing expenses. Knowing how much to pay your employees not only affects staff retention but also influences your budget planning. You’ll need to assess local salary benchmarks and consider additional costs like benefits and payroll taxes.

And as your business grows, so will your payroll responsibilities. It’s important to factor in potential raises, bonuses, and employee turnover as part of your ongoing salary expenses. You may also want to allocate funds for hiring specialized roles as your business evolves, ensuring you have the right talent to drive your business forward.

Additional Financial Considerations

Keep in mind that starting a business involves various financial elements beyond initial setup costs. You should factor in ongoing expenses and emergency funds to ensure stability as your operations begin. Understanding these additional financial considerations will help you create a more accurate budget and prepare for unforeseen challenges.

Marketing and Advertising

Marketing isn’t just an afterthought; it’s an necessary expense for launching your business successfully. You’ll need to allocate funds for branding, promotional materials, and online advertising to reach your target audience effectively. A well-planned marketing strategy will not only create awareness but also attract customers and drive sales.

Insurance Costs

One important aspect of your startup’s budget is insurance costs. Protecting your business against potential risks can prevent significant financial losses down the line.

For instance, different types of insurance such as general liability, property, and workers’ compensation will vary based on your industry and specific operations. By researching and obtaining the appropriate insurance policies, you ensure that you are safeguarded against unforeseen events, thus maximizing your long-term financial stability.

Funding Your Business

Now that you’ve outlined your startup costs, the next step is determining how to fund your business. Various options are available, including personal savings, loans, and investments. Each method has its own pros and cons, so you’ll need to evaluate which approach aligns best with your financial situation and business goals.

Personal Savings

About funding your business through personal savings, it’s often considered one of the most straightforward methods. Using your own money allows you to avoid debt and maintain full control over your business. However, ensure that you have enough savings to support both your business needs and personal financial security.

Loans and Investments

After assessing your personal savings, you might consider loans and investments as options to fund your business. Financing through loans often requires a solid business plan, while investors may seek equity or a stake in your company.

In fact, when looking for loans, it’s important to explore different lending institutions and understand the terms and interest rates. If you consider attracting investors, be prepared to pitch your business idea compellingly, as they will want to see potential for growth and return on investment. Balancing these options will help you secure the funding that best meets your needs.

Creating a Budget

For entrepreneurs, creating a budget is vital for managing financial resources effectively. A well-structured budget helps you plan for expenses, allocate funds for various business activities, and identify potential financial challenges. By understanding your fixed and variable costs, you can make informed decisions regarding pricing and resource allocation, ensuring that your business stays on track financially.

Developing a Financial Plan

The development of a comprehensive financial plan is key to your business’s success. This plan should outline projected revenues, operating costs, and anticipated cash flow. By having a clear financial roadmap, you can set realistic goals, prepare for unexpected expenses, and evaluate the overall financial health of your business over time.

Tracking Expenses

By diligently tracking your expenses, you gain valuable insights into your business’s financial performance. This practice allows you to identify spending patterns, assess budget variances, and adjust your financial strategies accordingly to avoid overspending.

Understanding your expenses in detail is vital for maintaining your business’s profitability. Regularly reviewing your spending enables you to pinpoint areas where you might cut costs or invest more strategically. Utilizing expense tracking tools can streamline the process, making it easier to categorize and analyze your financial data. This proactive approach not only aids in managing your current expenses but also informs future budgeting decisions and helps you stay aligned with your financial goals.

To wrap up

The process of calculating the cost of starting a business involves evaluating various factors such as initial investments, operating expenses, and potential unforeseen costs. By creating a comprehensive budget and accounting for both fixed and variable expenses, you can gain a clearer understanding of your financial needs. This proactive approach enables you to make informed decisions, secure funding, and set your business on a path to success. Being thorough in your calculations will not only prepare you for challenges but also enhance your confidence in launching your venture.

FAQ

Q: What are the main costs to consider when starting a business?

A: When starting a business, several main costs need to be taken into account. These include:

- Startup Costs: These are one-time expenses incurred before the business begins operations, such as legal fees, permits, and equipment purchases.

- Operating Costs: These ongoing expenses include rent, utilities, salaries, and marketing. It’s important to project these costs for at least the first year.

- Inventory Costs: If your business sells products, you’ll need to estimate the cost of purchasing initial inventory.

- Insurance: This includes various types of insurance such as liability, property, or health insurance, which are necessary to protect your business.

Q: How can I accurately estimate my startup costs?

A: To estimate startup costs accurately, follow these steps:

- Research: Look into the industry standards and consult with others who have started similar businesses to gauge typical costs.

- Create a Detailed Business Plan: Include a section that outlines all potential costs categorized into fixed and variable expenses.

- Compile a Checklist: Develop a checklist outlining every item and service you might need, from office furniture to marketing materials, then assign costs to each.

- Consult Professionals: Engage with accountants or business advisors for insights into hidden costs that you may not consider initially.

Q: Should I include contingencies in my financial calculations?

A: Yes, incorporating contingencies in your financial calculations is advisable. Here’s how you can approach it:

- Add a Contingency Percentage: A common practice is to allocate an additional 10-20% of your total estimated costs to cover unexpected expenses.

- Identify Potential Risks: Assess risks specific to your business or industry, such as economic fluctuations, and account for potential fallout.

- Adjust Regularly: As you progress through the startup phase and gather more information, it may be wise to reassess and adjust your contingency plans to ensure you’re still covered.