Most investors seek stability and long-term growth in their portfolios, and blue chip stocks can offer just that. These shares belong to well-established companies known for their reliability, making them a safer option compared to more volatile investments. By investing in blue chip stocks, you position yourself for consistent dividends and the potential for capital appreciation. Additionally, their strong track records often reflect solid management and a steady performance during economic downturns, making them a worthy consideration for your investment strategy.

Key Takeaways:

- Stability: Blue chip stocks are known for their reliability and steady performance, providing a stable investment option even during market fluctuations.

- Dividends: Many blue chip companies offer attractive dividend yields, rewarding investors with regular income in addition to potential capital appreciation.

- Growth Potential: These established firms often have a strong track record of growth, making them a valuable addition to a long-term investment portfolio.

- Market Leadership: Blue chip stocks typically belong to industry leaders with strong competitive advantages, positioning them well in the market.

- Lower Risk: Investing in blue chip stocks generally involves lower risk compared to more volatile options, appealing to conservative investors.

Understanding Blue Chip Stocks

Your investment journey can be greatly enhanced by understanding blue chip stocks, which represent shares in large, well-established companies with a history of financial stability and strong performance. These companies typically operate on a global scale, are leaders in their industry, and have reliable revenue streams, making them a favored choice among investors seeking long-term growth.

Definition and Characteristics

Among the key traits of blue chip stocks are their proven track record of profitability, consistent dividend payments, and low volatility compared to other types of stocks. These companies often have a solid market capitalization, reflecting their stability and reputation, which adds to their appeal for conservative investors looking for reliability in their portfolios.

Historical Performance

Along with their solid characteristics, blue chip stocks have exhibited impressive historical performance, often outperforming other stock categories over the long term. This consistency allows you to feel more secure when investing, as the stability of these companies contributes to steady appreciation in share value.

With blue chip stocks, you can see trends of resilience even during economic downturns, as these companies have a history of weathering financial storms. Their strong fundamentals and ability to generate revenue in various market conditions provide you with confidence in your investment choice. Thus, incorporating blue chip stocks into your portfolio can enhance its overall performance, giving you a sense of both security and growth potential.

Advantages of Blue Chip Stocks

While many investments come with risk, blue chip stocks often provide a safe harbor for your portfolio. These established companies are known for their solid track record and consistent performance, making them a popular choice for investors seeking long-term growth and stability. By investing in blue chip stocks, you can benefit from ongoing market demand and enjoy the peace of mind that comes with reliability.

Stability and Reliability

Chip stocks are renowned for their stability and reliability, making them an attractive choice for discerning investors. These companies typically have strong balance sheets, strong earnings history, and a proven ability to navigate economic downturns. As a result, investing in blue chip stocks can help mitigate risk in your portfolio, providing a more secure investment option.

Dividend Payments

Above all, blue chip stocks often come with the bonus of regular dividend payments. These dividends serve as a form of income that you can reinvest or use as cash flow, enhancing your overall returns while you hold these investments.

Considering the financial strength of blue chip companies, they tend to have the resources to support consistent dividend payments. Over time, many blue chip stocks not only maintain but also increase their dividends, providing you with an opportunity for both income and capital appreciation. This reliable stream of passive income can be particularly beneficial, especially in volatile markets, allowing you to build wealth more steadily.

Risk Management

Many investors worry about the potential risks associated with stock market investments. However, by choosing blue chip stocks, you can enhance your risk management strategy. These stable companies typically withstand economic downturns, providing a degree of security that less established firms cannot offer. Investing in blue chip stocks allows you to balance your portfolio effectively while pursuing growth with greater confidence.

Lower Volatility Compared to Smaller Stocks

One of the advantages of blue chip stocks is their lower volatility. This attribute can be summarized as follows:

| Blue Chip Stocks | Smaller Stocks |

|---|---|

| Stable price movements | Higher price fluctuations |

| Less affected by market sentiment | More sensitive to news and trends |

| Consistent dividends | Irregular dividends |

Economic Resilience

On the other hand, blue chip stocks exhibit remarkable economic resilience. These firms often have established market positions, diversified products, and strong financials that allow them to weather economic volatility better than smaller companies.

And, their ability to adapt to changing market conditions enables blue chip stocks to maintain stable revenues and earnings even in challenging environments. Investing in these stocks provides you with a reliable foundation for your portfolio and enhances your overall financial peace of mind.

Long-Term Investment Strategy

Unlike shorter-term trading strategies, investing in blue chip stocks is a commitment to the long game. By focusing on well-established companies with a history of strong performance, you can build wealth over time while benefiting from the potential for price appreciation and dividend income. This approach not only minimizes the impact of market volatility but also aligns with your goal of achieving financial stability and growth in the long run.

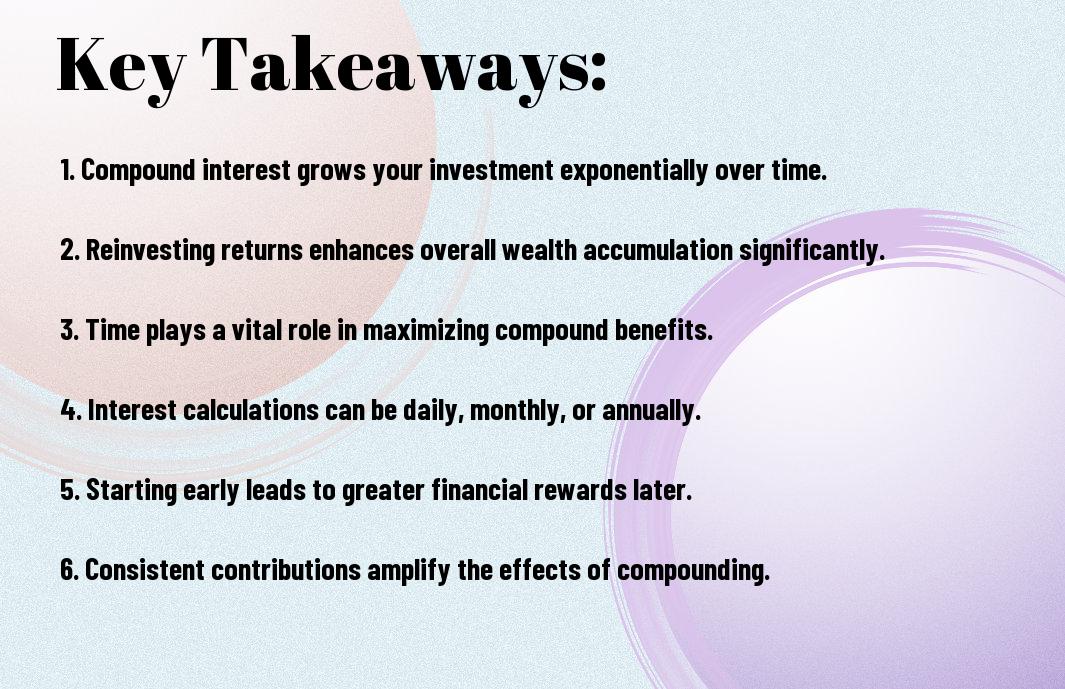

Compounding Growth

Behind every successful investment is the power of compounding growth. When you invest in blue chip stocks, your returns are reinvested, allowing your wealth to grow exponentially over time. As your investments generate income through dividends and price appreciation, you can leverage this growth potential to accelerate your financial journey. This means that the longer you hold these stocks, the more pronounced the benefits of compounding become, providing a significant advantage in your investment portfolio.

Diversification Benefits

Around blue chip stocks lies an inherent advantage in diversification. By investing in these established companies from various sectors, you can spread your risk and minimize the impact of any single market downturn. This diversified approach not only stabilizes your investment portfolio but also enhances your potential for steady returns, as these companies often have a proven track record to weather economic fluctuations.

Indeed, diversification plays a vital role in safeguarding your investments. By incorporating a mix of blue chip stocks across different industries, you ensure that your portfolio is well-rounded and less vulnerable to isolated market shocks. This strategy allows you to tap into the stability that blue chip companies offer while still capturing growth potential, striking the perfect balance between risk and reward in your long-term investment strategy.

Market Trends and Blue Chip Stocks

All market trends significantly impact blue chip stocks, making them vital for your investment portfolio. As established companies, blue chip stocks often outperform other market segments during both bullish and bearish trends. Staying informed about market dynamics allows you to make well-timed decisions, maximizing your returns while minimizing risks associated with economic fluctuations.

Identifying Growth Opportunities

By analyzing market trends, you can spot growth opportunities in blue chip stocks. These companies often adapt to changing market conditions, positioning themselves for long-term success. Keeping your eyes on industry developments enables you to identify which blue chips might experience substantial growth and help you build a more robust investment strategy.

Navigating Economic Cycles

With the right approach, blue chip stocks can be a safe haven during economic downturns. They often have stable earnings and dividends, making them a reliable choice when the market is volatile. Understanding economic cycles allows you to adjust your investment strategy, ensuring that you maintain steady growth and performance even in challenging times.

And while blue chip stocks provide a sense of security during economic cycles, it’s imperative to evaluate each company’s fundamentals. Changes in company management, industry competition, or regulatory environments can impact their performance. By staying informed and adjusting your portfolio accordingly, you can navigate through various economic landscapes, ensuring that your investments continue to work for you, no matter the market conditions.

How to Build a Portfolio with Blue Chip Stocks

Not all blue chip stocks are created equal, so diversifying your investments is vital. Start by identifying leading companies in various industries to mitigate risks while enhancing growth potential. Allocate a certain percentage of your investment to each stock based on your risk tolerance and investment goals, ensuring you maintain a balanced exposure to different sectors.

Selection Criteria

With blue chip stocks, you should consider factors such as a company’s market capitalization, dividend history, consistent earnings growth, and overall financial health. These attributes typically signify a company’s stability and capacity to weather economic downturns, making them strong candidates for your portfolio.

Monitoring and Rebalancing

Between periodic economic assessments and company performance reviews, it’s important to keep an eye on your blue chip stocks. This vigilance ensures you stay aware of market changes and enables you to react effectively, optimizing your investments.

Rebalancing your portfolio is an ongoing process that involves adjusting your holdings to maintain desired asset allocation. As stock prices fluctuate, your portfolio may become unbalanced, potentially leading to increased risk or reduced returns. Regularly evaluate the performance of your blue chip stocks, and if certain holdings deviate significantly from your original allocation, consider selling or reinvesting to restore balance. Doing so not only protects your investment but can also enhance overall returns in the long run.

Summing up

Drawing together the advantages of investing in blue chip stocks, you can benefit from their stability, proven track record, and potential for consistent dividends. These investments can balance your portfolio and reduce volatility, making them a wise choice for long-term growth. By focusing on established companies, you position yourself in a realm of reliability and opportunity. To explore further, check out What Are Blue Chip Stocks? A Good Investment? to enhance your understanding and strategy in the stock market.

FAQ

Q: What are blue chip stocks and why are they considered a safe investment?

A: Blue chip stocks are shares of established companies that have a long history of financial stability, strong performance, and reliable dividends. These companies typically have a solid track record of profitability, a robust market presence, and a reputation for quality and reliability. Because of these characteristics, blue chip stocks are often seen as a safer investment option, particularly during market volatility. Investors rely on these stocks for lower risk and consistent returns, making them a cornerstone in a diversified investment portfolio.

Q: How do dividends contribute to the advantages of investing in blue chip stocks?

A: Dividends are a significant attraction for investors in blue chip stocks. These companies often have a history of paying regular and increasing dividends, which provides investors with a stream of income in addition to potential capital gains from stock appreciation. The stability of dividend payments can be especially appealing during economic downturns, as they can help offset any potential losses in stock value. Furthermore, reinvesting dividends can compound returns over time, enhancing the growth potential of an investment in blue chip stocks.

Q: What is the long-term growth potential of blue chip stocks compared to other investment options?

A: Blue chip stocks generally provide a good balance of stability and growth potential over the long term. While they may not offer explosive growth like smaller, speculative stocks, their consistent performance allows investors to benefit from gradual appreciation. Historically, blue chip stocks have delivered competitive returns, often outperforming asset classes such as bonds and real estate during extended periods. This makes them suitable for investors seeking to build wealth through a more stable investment strategy that capitalizes on the proven growth and resilience of established companies.