Just as a great tree takes time to grow strong and resilient, building wealth requires your patience and commitment. You may be tempted to seek quick fixes or instant results, but understanding that wealth accumulation is a long-term journey can profoundly impact your financial success. Cultivating patience allows you to make informed decisions, stay the course during market fluctuations, and ultimately, achieve your financial goals. Embracing this virtue will enhance your ability to navigate the complexities of investing and saving, leading to a prosperous future.

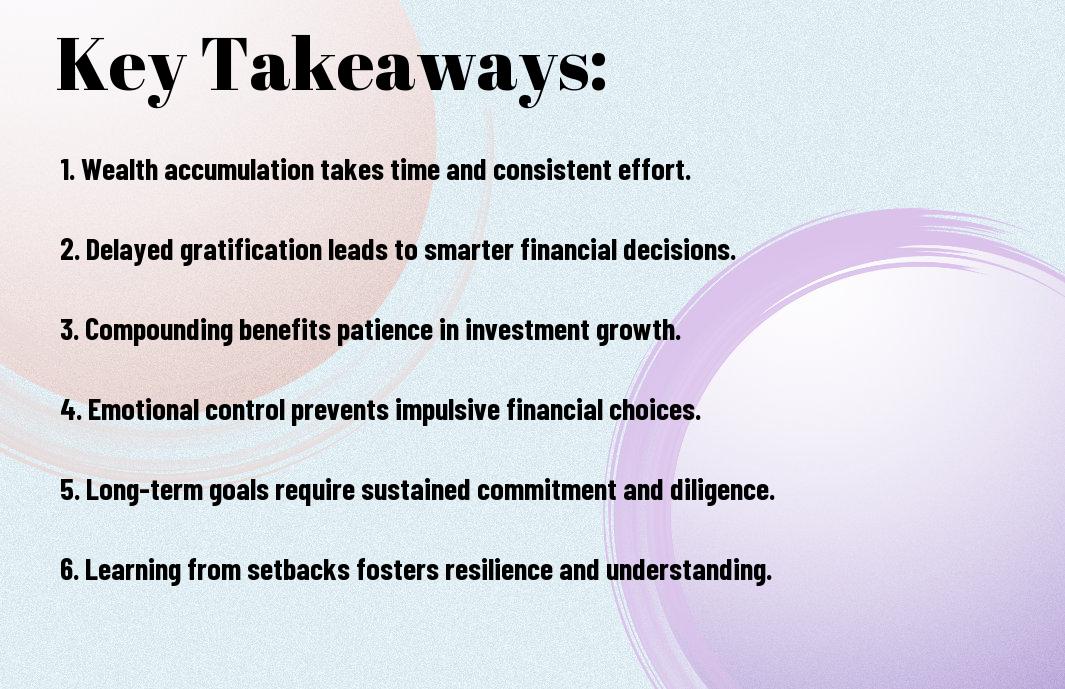

Key Takeaways:

- Long-term Vision: Building wealth requires a strategic approach and a focus on long-term goals rather than quick fixes.

- Compound Interest: The power of compounding demonstrates how patience can significantly increase wealth over time through investment returns.

- Market Fluctuations: Understanding that markets will fluctuate means staying invested during downturns rather than reacting impulsively.

- Discipline in Spending: Developing a habit of disciplined saving helps individuals accumulate wealth steadily, avoiding rash purchases.

- Learning Opportunities: Patience allows for continuous learning, which is vital for making informed financial decisions and adapting to change.

Understanding Patience in Wealth Building

The journey to building wealth requires a deep understanding of patience. It involves recognizing that sustainable growth often takes time and consistent effort rather than quick wins. Embracing this mindset allows you to cultivate resilience, make informed decisions, and stay committed to your financial goals despite the inevitable ups and downs of the market.

The Psychology of Patience

Beside the tactical aspects of wealth building, the psychology of patience plays a pivotal role in your financial success. Developing a patient mindset enables you to be more reflective and less reactive in your approach to investments and savings. This mental fortitude can help you weather market fluctuations and avoid the impulse to make hasty decisions driven by fear or excitement.

Patience vs. Impulsivity in Financial Decisions

Before making any financial decision, it’s imperative to distinguish between patience and impulsivity. Impulsive decisions often arise from emotional triggers or the fear of missing out (FOMO), leading you away from your long-term goals. Understanding this difference empowers you to take a step back and assess situations critically, ensuring your choices align with your wealth-building strategy rather than fleeting emotions.

Considering the impact of impulsivity on your financial objectives is vital. Quick, emotional decisions can derail your progress and lead to unnecessary losses, while adopting a patient approach allows you to evaluate your options thoroughly. This thoughtful decision-making process not only aids in minimizing risks but also enhances your ability to stick to long-term strategies, ultimately empowering you to reach your wealth-building goals more effectively.

The Role of Time in Wealth Accumulation

You may often overlook the impact that time has on wealth accumulation. The longer you allow your investments to grow, the more substantial your wealth can become. By harnessing The Power of Patience in Wealth Building, you can create a financial portfolio that flourishes over the years, revealing the significant benefits of patience alongside persistence.

Compound Interest and Its Effects

To truly appreciate the power of time in wealth building, you need to understand compound interest. This financial phenomenon allows you to earn interest not only on your initial investment but also on the accumulated interest over time. As your wealth compounds, it accelerates your path to financial independence, showcasing the long-term benefits of patience in investment strategies.

Long-Term Investments vs. Short-Term Gains

With a focus on building wealth, it’s necessary to distinguish between long-term investments and short-term gains. Opting for long-term investments generally provides greater rewards as they tend to ride out market fluctuations, accumulating value over time. Short-term gains, while enticing, often come with increased risks and taxes, making them less favorable for sustainable wealth generation.

Wealth accumulation is often best achieved through a strategic focus on long-term investments rather than seeking quick returns. By committing to a well-diversified portfolio that prioritizes sustained growth, you can leverage the power of time to enhance your financial situation. This approach not only minimizes risks associated with market volatility but also fosters a disciplined mindset that aligns with your overarching financial goals.

Strategies for Cultivating Patience

After recognizing the value of patience in building wealth, you can implement specific strategies to cultivate it in your financial journey. Begin by engaging in practices that promote mindfulness and self-control, such as meditation, journaling, or simply pausing before making impulsive financial decisions. By fostering a greater awareness of your thoughts and emotions, you can develop the ability to evaluate situations calmly and rationally, ensuring your wealth-building strategies are sustainable and effective.

Setting Realistic Financial Goals

Realistic financial goals act as a roadmap for your wealth-building journey, helping you maintain perspective and patience. Set achievable short-term and long-term goals by evaluating your current financial situation and planning steps necessary to achieve those goals. This structured approach allows you to track progress, celebrate small victories, and remain motivated without feeling overwhelmed, giving you the confidence to stay the course.

Developing a Growth Mindset

Around the journey of wealth-building, developing a growth mindset is important for nurturing patience. This mindset encourages you to view challenges as opportunities for learning and growth rather than setbacks. By embracing the belief that your skills and abilities can be developed over time, you’ll remain focused on progress rather than immediate results. This perspective allows you to appreciate the journey and fosters resilience during moments of uncertainty.

Even when faced with financial setbacks, a growth mindset helps you see these moments as temporary hurdles rather than insurmountable obstacles. By analyzing what went wrong and identifying lessons learned, you reinforce your commitment to long-term financial goals. This approach builds your patience, enabling you to weather short-term difficulties while staying aligned with your broader vision of wealth accumulation. As you adapt and grow, you’ll find that maintaining patience becomes second nature.

Case Studies of Patience Leading to Wealth

Not only does patience play an important role in wealth building, but numerous case studies illustrate its impact on financial success. Here are some compelling examples:

- Warren Buffett: Maintained a $1 million investment in Coca-Cola for over 25 years, yielding a return of 1,200%.

- Peter Lynch: Held onto the Fidelity Magellan Fund for over a decade, growing it from $18 million to $14 billion.

- John Bogle: Advocated for long-term investing in index funds, resulting in average annual returns of 10% over 40 years.

- Jeff Bezos: Focused on Amazon’s growth for over two decades, resulting in a company worth over $1 trillion.

Success Stories from Notable Investors

With many investors, patience has been the key differentiator between fleeting gains and sustained wealth. Figures like Warren Buffett exemplify how sticking to a solid investment strategy over time can reap monumental rewards. They took calculated risks and stayed the course, even during market downturns, leading to impressive long-term results that can inspire your investment journey.

Lessons from Wealth Building Failures

Among the lessons etched in the minds of investors are those derived from wealth building failures. Iconic figures, like Enron executives, learned harsh truths about the perils of impatience and short-lived decisions that ultimately led to significant financial ruin.

Failures in wealth building often stem from the allure of quick returns. You may observe that many who pursued rapid profits through risky investments faced devastating losses. Learning from these failures can be instrumental in shaping your own strategies, steering you toward more prudent, patient approaches that yield long-term benefits rather than chasing ephemeral gains.

The Impact of Market Fluctuations on Patience

Despite the unpredictability of market fluctuations, maintaining patience is necessary for long-term wealth building. Market ups and downs can test your resolve, but understanding that these fluctuations are part of the investment journey can help you stay the course. As discussed in The Art of Patience: How Delayed Gratification Builds Wealth, exercising patience often leads to greater rewards in the long run.

Navigating Economic Downturns

Impact of economic downturns can be daunting, yet they often present opportunities for disciplined investors like you. Market corrections can lead to lower prices on quality assets, allowing you to purchase investments at a discount. By staying informed and focused on your long-term goals, you can turn downturns into advantageous situations.

Staying Committed During Market Volatility

Any deviation in market performance can evoke anxiety and impulsive reactions. It’s easy to feel overwhelmed when the market experiences rapid changes, but staying committed to your strategy will bolster your financial health. Focus on your long-term objectives and avoid letting short-term fluctuations dictate your decisions.

Committed investors understand that volatility is not an enemy but a natural part of the market. By keeping your emotions in check, you can make rational choices that align with your financial goals. Embrace a long-term perspective and remind yourself that true wealth building takes time; by adhering to your plan, you position yourself for future success.

Final Words

The journey to building wealth is often a marathon, not a sprint, and patience plays a vital role in your success. As you navigate the complexities of investing, saving, and financial planning, understanding that results take time can keep you focused and resilient. By adopting a patient mindset, you allow your investments to mature and compound, ultimately leading to greater financial stability and growth. Embrace the process, stay committed to your long-term goals, and trust that, with patience, your financial aspirations can indeed become a reality.

FAQ

Q: Why is patience necessary when it comes to building wealth?

A: Patience is vital in wealth accumulation as it allows individuals to make informed decisions without succumbing to fear or impulsiveness. Often, wealth building is a long-term journey that includes market fluctuations, investment adjustments, and personal growth. Those who maintain a patient approach can weather financial storms and capitalize on compounding interest, which significantly grows investments over time. This steadfastness ensures that individuals are less likely to react rashly to short-term changes and can stick to their financial plans, facilitating sustained growth.

Q: How does patience benefit investment strategies?

A: Implementing an investment strategy that emphasizes patience can lead to more stable returns. Investors who are not easily swayed by market noise are more likely to adhere to their investment allocations and avoid panic selling during market downturns. Such an approach fosters a discipline of continuous investment, allowing for dollar-cost averaging, which can mitigate the impact of volatility over time. Moreover, with a long-term perspective, investors can take advantage of opportunities that others might overlook due to a focus on immediate results.

Q: Can developing patience improve financial decision-making?

A: Developing patience can significantly enhance financial decision-making by encouraging thoughtful analysis and research before acting. Without the pressure of immediate returns, individuals are more likely to explore diverse investment options, seek advice, and understand their risk tolerance before committing their resources. This thoroughness reduces the likelihood of costly financial mistakes made out of haste. Over time, individuals who practice patience in their financial dealings tend to build a more robust and well-rounded portfolio, leading to greater wealth accumulation and financial security in the long run.