Over time, understanding financial literacy can significantly impact your investing journey and overall financial health. By equipping yourself with the necessary knowledge, you can make informed decisions that align with your goals. Whether you are a beginner or an experienced investor, enhancing your financial skills will empower you to navigate the complexities of the market effectively. Explore additional resources and strategies through Investing in your Future – Financial Literacy to further boost your confidence in investing.

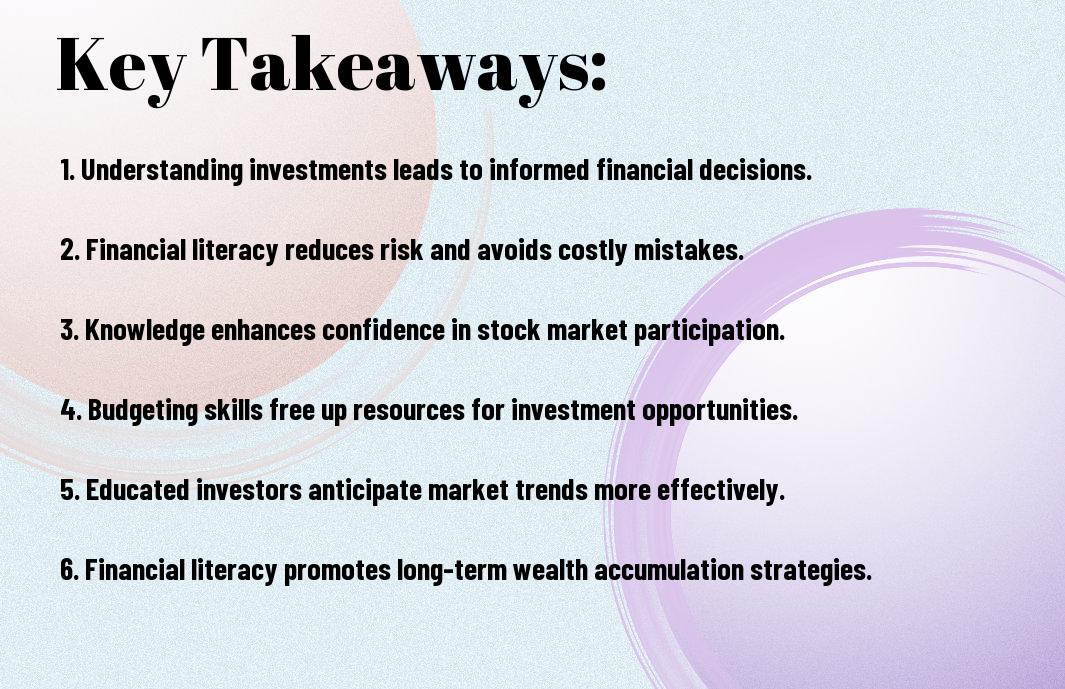

Key Takeaways:

- Understanding Investments: Financial literacy enables individuals to comprehend different types of investments, reducing the risk of poor choices.

- Risk Assessment: Being financially literate allows investors to evaluate risks associated with various investment options and align them with their risk tolerance.

- Informed Decision-Making: Knowledge of financial principles empowers investors to make informed decisions rather than relying solely on trends or advice from others.

- Long-term Strategy: Financial literacy encourages the development of a long-term investment strategy, promoting sustained growth and wealth accumulation.

- Budgeting Skills: It enhances budgeting abilities, ensuring that investors allocate funds effectively between expenditures and investments.

Understanding Financial Literacy

Before you can make informed investment decisions, it’s important to grasp the concept of financial literacy. This encompasses the knowledge and skills needed to manage your financial resources effectively. By understanding how to read financial statements, assess risk, and create a budget, you position yourself to not only invest wisely but also to secure your financial future.

Definition and Key Concepts

By developing financial literacy, you begin to comprehend fundamental concepts such as budgeting, saving, investing, and debt management. With these definitions in hand, you can create a strong financial foundation that aids in achieving your long-term goals.

The Role of Financial Literacy in Personal Finance

The ability to manage your personal finances greatly depends on your financial literacy. It equips you with the understanding necessary to make smart decisions about spending, saving, and investing your money.

Role of financial literacy extends to all areas of your personal finance. It helps you identify the best ways to allocate your resources, avoid unnecessary pitfalls, and recognize opportunities that align with your financial goals. By being financially literate, you can evaluate options more critically and build a strategy that ensures your investments serve your best interests over time.

The Relationship Between Financial Literacy and Investing

If you aim to excel in investing, understanding the intricate relationship between financial literacy and investment success is imperative. Financial literacy equips you with the knowledge necessary to navigate complex investment landscapes, allowing you to make empowered decisions. A solid grasp of financial principles enhances your ability to analyze opportunities and assess potential pitfalls, ultimately leading to greater investment outcomes.

Informed Investment Decisions

Informed investment decisions stem from a deep understanding of financial concepts, enabling you to evaluate various investment vehicles effectively. When you’re financially literate, you are more likely to discern between fact and fiction in investment advice, enhancing your capacity to choose strategies that align with your goals and risk tolerance.

Risk Assessment and Management

On the other hand, effective risk assessment and management are integral to successful investing. With financial literacy, you gain the ability to identify, evaluate, and mitigate potential risks associated with your investments, ensuring you can maintain a balanced portfolio that aligns with your financial objectives.

And this proactive approach toward risk not only minimizes potential losses but also enhances your overall investment strategy. By understanding different types of risks—such as market risk, credit risk, and liquidity risk—you can develop a tailored risk management plan. This enables you to make informed choices that help safeguard your investments while positioning you for greater returns. Investing without proper risk assessment can lead to unforeseen consequences, making financial literacy imperative for every investor.

Barriers to Financial Literacy

Your journey towards financial literacy can be obstructed by various barriers that hinder your understanding of investing principles. These barriers often stem from educational gaps and socioeconomic factors, making it challenging to gain the knowledge needed to succeed in the financial world. Addressing these issues is imperative for fostering a more informed and confident approach to investing.

Educational Gaps

Between formal education systems and personal finance resources, significant gaps often exist that prevent you from acquiring imperative investing knowledge. Many schools do not prioritize financial education, leaving you without a strong foundation in critical financial concepts.

Socioeconomic Factors

Besides educational gaps, socioeconomic factors also play a significant role in your financial literacy. Limited access to resources, financial institutions, and informative materials can create substantial barriers. These factors may include:

- Lack of access to quality financial education programs

- Limited exposure to investment opportunities

- Financial instability or debt that hinders your ability to invest

Knowing how these factors affect your financial knowledge can empower you to seek out opportunities for improvement.

In addition, socioeconomic status influences your network and the information available to you. Those from higher socioeconomic backgrounds may benefit from family support and mentorship in financial matters, while others may struggle to even find basic resources. Recognizing these disparities is vital for understanding your situation and the potential hurdles you may face. Consider the following:

- Access to financial advisors or mentorship networks

- Community resources for financial education

- Opportunities to engage with investment platforms

Knowing how socioeconomic factors shape your financial literacy can motivate you to seek alternative resources and strategies for improving your understanding of investing.

Strategies to Improve Financial Literacy

All individuals seeking to enhance their financial literacy should consider multiple strategies. Engaging with educational materials, such as books and online courses, can provide foundational knowledge. You can also explore academic insights like The Economic Importance of Financial Literacy. Furthermore, practical experience through budgeting or investing simulations can deepen your understanding. Implementing these strategies can greatly improve your confidence and decision-making in financial matters.

Education and Resources

Resources are abundant for those looking to increase their financial savvy. Websites offering free online courses, workshops, and webinars can serve as valuable tools. Recognizing your learning preferences can help you choose the best format, whether it’s reading articles, watching videos, or participating in interactive classes. Take the initiative to access these educational opportunities and broaden your understanding of personal finance and investing.

Community Initiatives

Across various communities, initiatives are emerging to promote financial literacy. Local organizations and institutions often offer workshops, seminars, and mentorship programs to help individuals improve their financial skills. Engaging with these programs allows you to network and learn from others who share similar financial goals while benefiting from expert guidance in a supportive environment.

But getting involved in community initiatives can significantly enhance your financial literacy journey. These programs often cater to diverse audiences, ensuring that everyone from beginners to more experienced individuals can find relevant information. Additionally, having access to local resources allows you to ask questions and receive personalized assistance, fostering a deeper understanding of finances and investments that online sources may not provide. Embrace these opportunities to cultivate your financial knowledge within your community.

The Impact of Financial Literacy on Investment Success

Despite the overwhelming evidence that financial literacy significantly enhances investment success, many investors still underestimate its importance. When you equip yourself with financial knowledge, you are better positioned to make sound investment decisions, assess risks accurately, and choose opportunities that align with your financial goals. Enhanced financial literacy empowers you to navigate complex markets, ensuring better long-term outcomes for your portfolio and personal wealth.

Case Studies and Statistics

Above all, various case studies and statistics highlight the powerful influence of financial literacy on investment performance:

- Investors with financial education had a 50% higher annual return compared to those without.

- Over 70% of financially literate individuals reported feeling confident in their investment choices.

- Households that underwent financial literacy training increased their savings rate by 30% within one year.

- A nationwide survey found that financially literate individuals are 40% less likely to make impulsive investment decisions.

- In states with mandatory financial education, the average investment return was 25% higher than states without such programs.

Long-term Benefits of Financial Knowledge

Beside immediate advantages, having a strong foundation in financial knowledge lays the groundwork for long-term gains. Understanding the principles of finance enables you to build better wealth management strategies, prepare for retirement, and make informed decisions regarding major financial commitments. By continually investing in your financial education, you cultivate not only better investment habits but also sustainable practices that promote financial growth throughout your life.

At its core, the long-term benefits of financial knowledge extend beyond mere investments. When you gain insights into financial concepts, you empower yourself to plan for life’s milestones, such as buying a house or funding your children’s education. This strategic foresight allows you to build a resilient financial future, diversify your assets, and create a legacy that extends to future generations. Ultimately, this knowledge ensures that your financial endeavors yield enduring results that enhance your overall quality of life.

Future Trends in Financial Literacy and Investing

For you to stay ahead in the dynamic world of investing, understanding future trends in financial literacy is vital. The integration of technological advancements and innovative educational tools will significantly shape how individuals engage with their finances, providing accessible resources to improve your investment acumen. As markets evolve, you will need to adapt your knowledge to navigate these changes effectively.

Technology and Education

The emergence of smart technology and digital platforms is transforming the way financial literacy is imparted. You can now access interactive courses, webinars, and mobile applications designed to enhance your understanding of investing. This technological wave not only makes learning convenient but also personalized, allowing you to learn at your own pace while honing your investment strategy.

Evolving Investment Markets

For you to thrive in today’s investment landscape, it’s vital to grasp the shifts within evolving markets. The rise of alternative investments, including cryptocurrencies and ESG-focused assets, requires an updated understanding of various strategies. Additionally, the growing trend towards decentralized finance means you must familiarize yourself with how technology is reshaping traditional investment paradigms.

In fact, the transition towards digital marketplaces and automated investment tools is altering the way you can invest and manage your portfolio. You need to stay informed about these emerging markets as they not only present new opportunities but also come with distinct risks. Understanding these factors will empower you to make informed decisions while adapting your strategy to fit an ever-changing financial landscape.

To wrap up

From above, it’s clear that enhancing your financial literacy is fundamental to making informed investment decisions. Understanding the principles of finance empowers you to assess risks, identify opportunities, and develop strategies that align with your financial goals. By investing time in educating yourself, you’ll not only enhance your confidence but also increase your chances of achieving long-term success in investing. Your financial future is in your hands, and gaining knowledge in this area is a vital step towards securing it.

Q: Why is financial literacy necessary for successful investing?

A: Financial literacy provides individuals with the knowledge and understanding necessary to make informed investment decisions. It encompasses the awareness of basic financial concepts such as risk management, asset allocation, and investment strategies. By being financially literate, investors can evaluate their options more effectively, recognize when a promotion may be too good to be true, and understand how market fluctuations can affect their portfolios. This foundation enables them to navigate the investment landscape confidently and develop a strategy that aligns with their financial goals.

Q: How does understanding financial principles impact investment outcomes?

A: When investors have a solid grasp of financial principles, they are better equipped to assess the potential returns and risks associated with various investment opportunities. This understanding aids in developing realistic expectations about growth, informed timing of asset purchases or sales, and recognizing the importance of long-term versus short-term investments. Knowledge of concepts such as compounding interest and diversification allows individuals to optimize their portfolios, minimize losses, and enhance overall performance, thereby improving their investment outcomes significantly.

Q: What resources are available for enhancing financial literacy in relation to investing?

A: There are numerous resources available to help individuals improve their financial literacy regarding investing. Online courses and workshops are offered by various educational platforms and institutions that cover fundamental and advanced financial concepts. Additionally, books on personal finance and investing, as well as reputable financial blogs and podcasts, can provide valuable insights. Many investing firms also produce educational materials and webinars aimed at demystifying investment practices. Utilizing these resources can greatly enhance understanding and empower individuals to make more informed investment decisions.